Mattress or market? Where to stash your cash? London’s office market might feel like a dead cert on paper, but it is far from one homogenous market.

For some the fringe might still feel a bit edgy, but Mayfair is hotter than hell’s waiting room.

So where is the money to be made in London’s office market and which markets are growing?

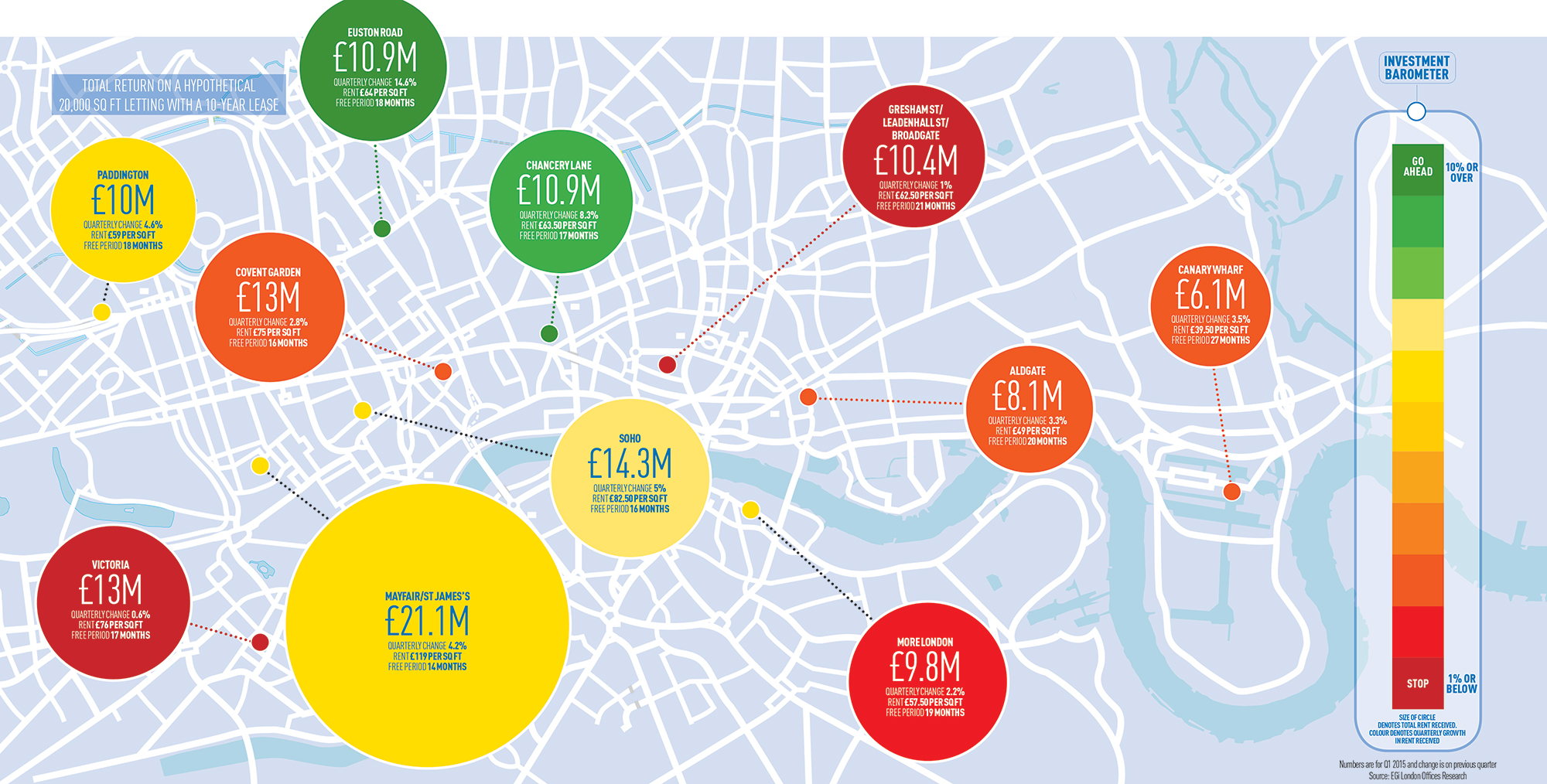

We have taken figures from EGi London Offices Research and calculated how much you would make by investing in an average hypothetical 20,000 sq ft office let on a 10-year lease, taking away the rent-frees to give you the cash you could be pocketing.

If you like your investments copper-bottomed, then the largest rent returns are in Mayfair and St James’s. Far from being a slow, plodding, dependable but unexciting market, the rate of growth in this prime corner of the West End has doubled in the past year from an average of 2% each quarter in 2014 to 4% in Q1 this year. It is pricey in the first place and, while it boasts the highest rents in London coupled with the lowest rent-free periods, stock is tight in this market and the availability rate is the lowest in London at 5%.

Stock coming on stream – 11 new developments according to Deloitte Real Estate’s latest crane survey – will help ease this, but you would be lucky to get your hands on 20,000 sq ft, with the average floorplate coming it at half that at 10,000 sq ft.

It is a long way from the stellar growth of Euston Road, which this quarter ratcheted up nearly 15%, but that has come attached to quite a rocky ride. Along with Soho, Paddington and Canary Wharf it makes Mayfair/St James’s one of the most dependable mid-range performers.

At the other end of the spectrum is Victoria. Its performance, the lowest in our listings, at 0.6%, all but flatlined. Of course, income of £13m is not to be sniffed at and some might argue the best is yet to come with a stuffed pipeline of office developments – how often do stalwarts such as Land Securities get it very wrong?

However, improvements in the area have also caught the eye of residential investors. Almost 1.5m sq ft of offices are set to be converted into residential in the next three years, according to Tuckerman, which could make winkling out the opportunities very tough.