Just one year’s worth of office supply remains in central London after a flurry of mega-deals in quarter two ate into more than 1.2m sq ft of space.

Just one year’s worth of office supply remains in central London after a flurry of mega-deals in quarter two ate into more than 1.2m sq ft of space.

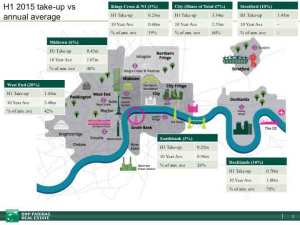

The City, West End and N1 markets all slipped below the 12-month mark at current take-up levels as the capital saw space signed for rise by 50% compared to the previous quarter, according to BNP Paribas Real Estate.

Supply in the City is down 40% on the 10-year average and down by more than a third in the West End where the vacancy rate is now below 4%. Daniel Bayley, head of central London Offices at BNP Paribas Real Estate warned: “With the levels of supply in the West End and City unlikely to improve dramatically in the foreseeable future, the move out from the core is a trend that is set to continue.”

More than a quarter of all space taken was signed outside of core markets in Q2 boosted by four mega-deals. Deutsche Bank’s 388,000 sq ft letting at Upper Bank Street in Docklands and Google’s 182,000 sq ft letting at King’s Cross helped the two markets register a four-fold increase in take-up this quarter, compared to Q1. Deals to TfL and the FCA in Stratford totalling nearly 700,000 sq ft saw the east London market grab an unprecedented 10% of total take-up.