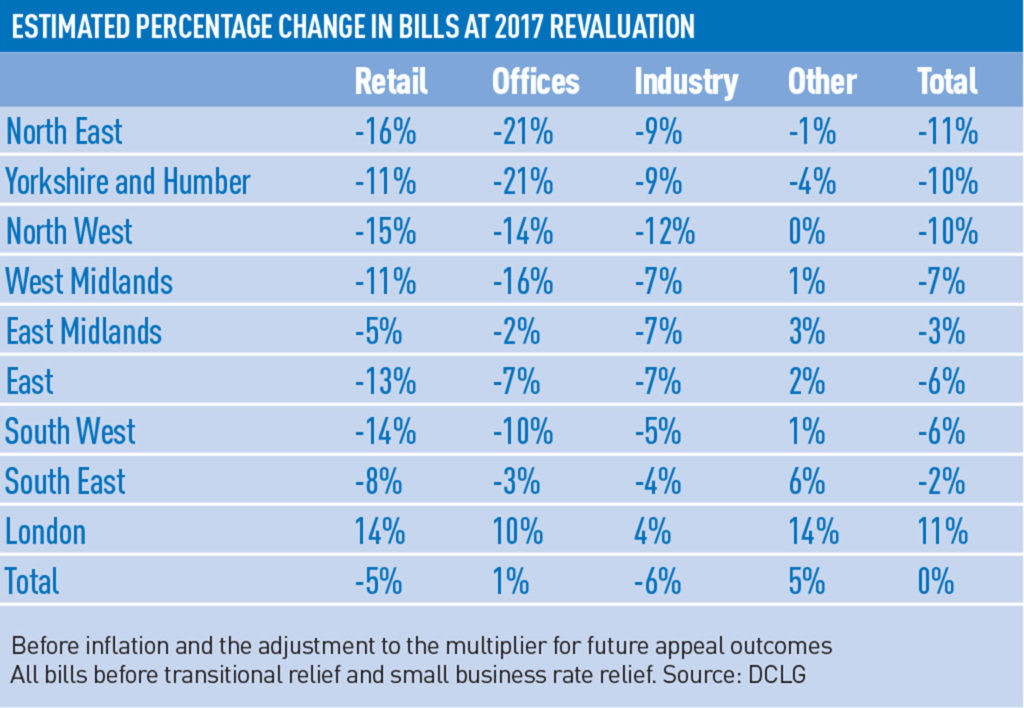

London has borne the brunt of the long-awaited rates revaluation, but many other businesses across the country expecting their tax bills to drop may have to wait years for the reality to kick in.

The capital will see an average 11% increase, valued at about £7.5bn across five years, as part of the first revaluation of rentable values since 2010.

Bills will hit doorsteps from 1 April next year. London retail and restaurants will be among the worst hit (p38).

But everywhere else in the country will see bills drop by an average of between 2% and 11% as part of an overall fall in business rates of £6.7bn over five years.

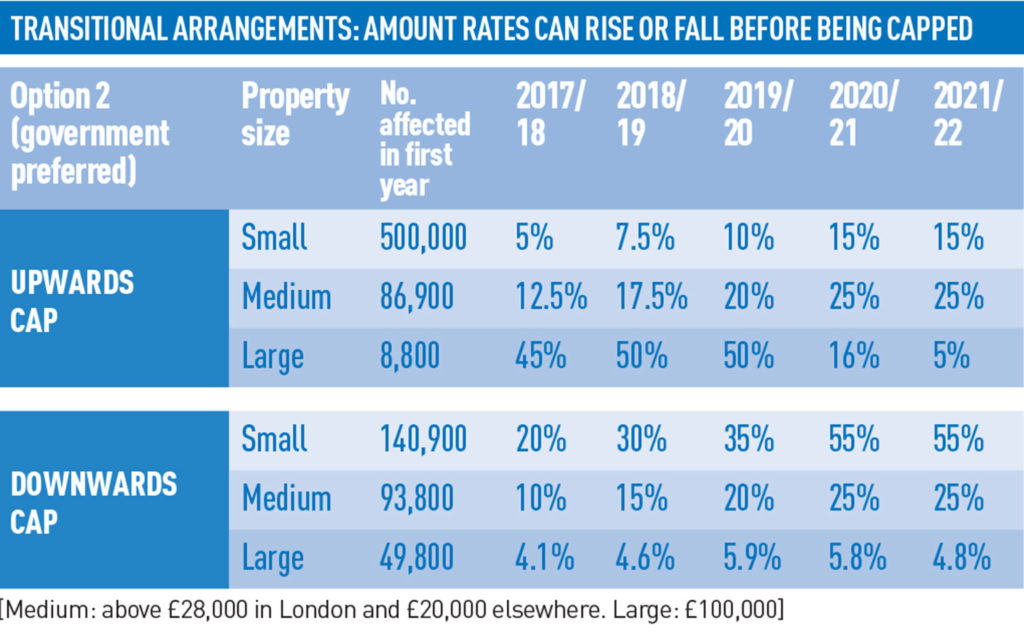

The government is consulting on two options for transitionary relief, which phase the changes slightly differently over several years.

Businesses in large properties valued at more than £100,000 will not have their rate rises capped until their bills rise by either 33% or 45% in a year (see transitional arrangements box below), compared to 12.5% in the past, leaving them having to budget for sharp and sudden increases.

Mark Rigby, chief executive of CVS, said he was staggered at the lack of a stronger cushioning effect for the properties facing hikes in the first year.

“We have never seen transitional arrangements that effectively expose larger properties to such large business rate increases. The expensive London retail locations are going to feel massive pain,” he said.

“We have never seen transitional arrangements that effectively expose larger properties to such large business rate increases. The expensive London retail locations are going to feel massive pain,” he said.

John Webber, head of rating at Colliers International, described the revaluation as a “car crash for central London”, while the New West End Company, which represents retailers and landlords around Bond Street, Oxford Street and Regent Street, said bills there could rise by an average of 80%, and called the changes ”catastrophic”.

Webber also pointed out that £100,000+ valued properties in the regions expecting huge downward bills of up to 50% could be limited to a small 4% or 5% fall in the first year by the transitionary arrangements, meaning they will have to wait for years to feel the tax relief.

Jerry Schurder, head of business rates at Gerald Eve, said: “Businesses in the hard-pressed industrial heartlands have been crying out for reduced rates bills for seven years now since the last revaluation, and at the point at which they finally see light at the end of the tunnel, the government whips the carpet from under their feet.”

Revo chief executive Ed Cooke said: “While there is clearly sympathy for those retailers with the largest rates increases, it is critical that those that have been paying too much tax since government’s ill-conceived decision to postpone the 2015 revaluation see their rates bills reduced immediately.”

Meanwhile, the value of business properties in England and Wales has gone up by 9.1% since the 2010 list, as revealed by a Valuations Office Agency document released this week.

• To take part in the consultation on transitionary relief until October 26, e-mail ndr@communities.gsi.gov.uk

• To send feedback, e-mail david.lindsell@estatesgazette.com or tweet @DavidLindsellEG or @estatesgazette

Plenty to please

Jackie Sadek, policy adviser, minister for cities

I would imagine there are a few rather pleased people around the property industry. After all, we have been nagging the government to revalue business rates.

I would imagine there are a few rather pleased people around the property industry. After all, we have been nagging the government to revalue business rates.

There is at least one person I know, who owns 40 shopping centres throughout the country, who will be feeling quietly very pleased with himself right now. Marginal retail lettings depend on the whole package of what an independent retailer needs to pay out for a unit, so decreased business rates stand to give landlords a little more wriggle room.

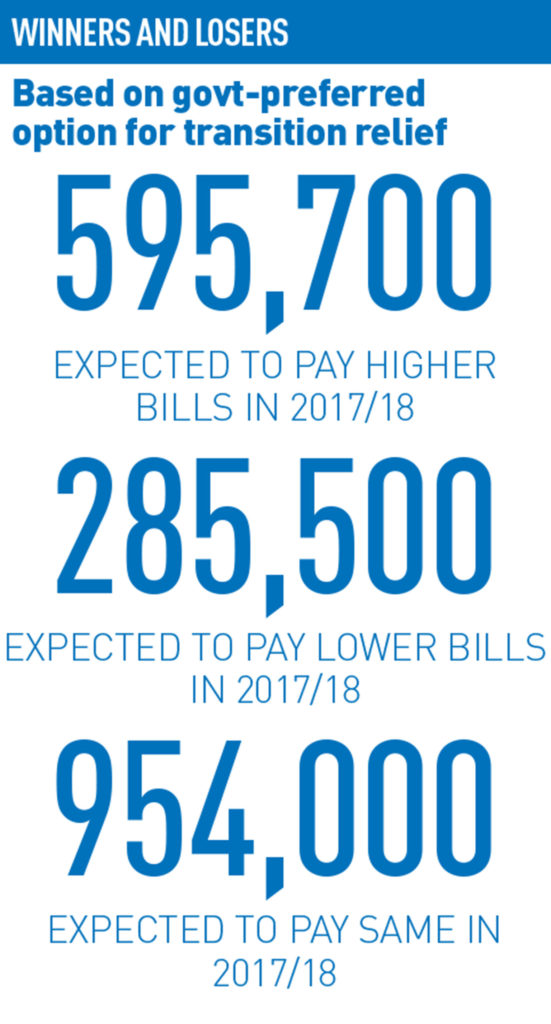

Local government minister Marcus Jones makes it clear that the majority of businesses across the country will be “unaffected or better off” by the changes, with many looking forward to their bills falling as the system is made more equitable across the whole of England. And from next April, there will be the biggest ever cut in business rates in England – worth £6.7bn over the next five years. As a result, 600,000 businesses across the country will pay no business rates at all. Nothing not to like there.

There will be a small minority who see an increase, so Jones also outlines plans for a system of transitional relief (on top of the increases in small business rate relief) to bring it in gradually over the next five years and cushion the blow. These measures are on top of wider reforms to business rates, which means that by 2020, councils will be able to keep 100% of all locally raised taxes to help fund local services, giving a stronger incentive for councils to help and support local firms to grow and prosper. This, for me anyway, is the holy grail: local authorities should be massively incentivised to promote growth.