Retailing has shifted from the high street to the web. Property investors have had to adapt, as rents in shopping centres stagnate and supermarkets lose their appeal for the weekly shop.

But one company has adapted to the changing retail environment: LondonMetric.

The company is the product of the merger of London & Stamford Property and Metric Property Investments in January 2013.

The two companies’ investment models complemented each other: London & Stamford invested in residential, office and industrial properties, while Metric focused on retail.

The combined companies created an entity with net assets of around £800m. In the two years since, the size of its portfolio has increased by 75% to £1.4bn.

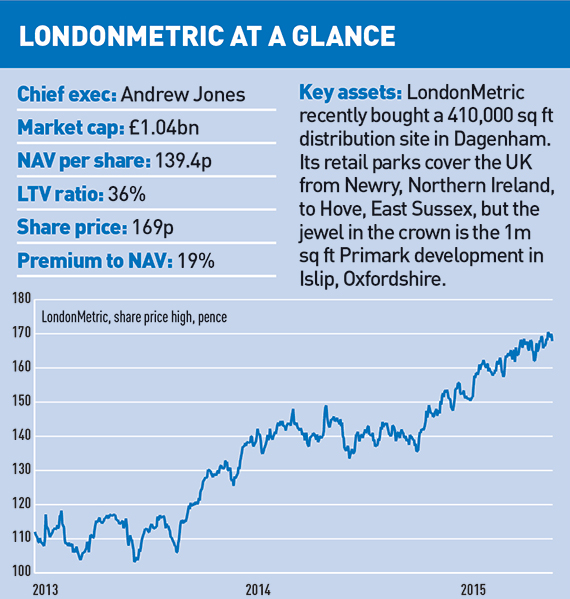

Headed by chief executive Andrew Jones, who was formerly head of retail at British Land, the company has built a core portfolio of retail parks that has been augmented by distribution centres as it adapts to the changing retail environment.

The model has allowed the company to increase not just its portfolio value but also its earnings, which were up by 55% in the 2014-15 financial year to £41m.

LondonMetric spent just under £309m in the year to the end of March on the retail distribution sector, which now comprises 47% of the company’s portfolio.

Jones says the focus on distribution assets was a response to changing consumer habits and the “right-sizing” that many retail park users, such as Tesco and B&Q, were undergoing.

And because quality assets in the distribution and convenience sectors are scarce, the company has begun to take on development risk.

Jones believes taking on development is not a risk. “We are creating good buildings as well as an avenue of future development profit,” he says. “Two years ago we didn’t do any development.”

The firm has more than 2m sq ft under development, with a further 1m sq ft in the pipeline, and of the developments already started, 90% are prelet.

One project alone accounts for a third of its total development pipeline – the Primark distribution centre at Islip, Oxfordshire. It covers more than 1m sq ft and is expected to return a yield of 6.8% and £5.3m in rent on completion in September.

As the trend to more frequent, lower-volume shopping continues, convenience outlets have also become a focus for the company, which has bought and developed a number of such assets in the past year.

These sites can also act as click-and collect hubs for online retailers, providing an additional source of income and a bonus for tenants, which know that collection customers tend to spend once on site.

LondonMetric is looking at replicating the trend in the US for major online retailers to open large retail outlets to act as click-and-collect hubs for major urban centres.

Not only would the strategy fit in with the way retail is heading, but also with the mid-size urban convenience shop and distribution centre model the company is working with.

Market adaptability pushed LondonMetric’s rental income up by 21% to £70.9m across all investments in the 2014-15 financial year from £58.5m a year earlier. Some 2.9% of the uplift came from asset management work.

More than a third of the 2015 portfolio valuation uplift of £118m is also the result of asset management work undertaken throughout the year.

It is figures such as these that have prompted the City to see LondonMetric as a good place to put its money. CanaccordGenuity, for one, has rated the company as a buy, owing to its ability to outperform expectations over the past year – it has upped its target price from 181p to 189p in June.

A 20p rise in share price from the 2 June trading price of 169p seems achievable when it is considered that the company traded at 117p at the time of the merger less than three years ago.

If the firm continues to adapt to the retail industry’s needs, it could even exceed this level in the coming year.