With residential prices rising at breakneck speed, it is becoming even harder to find the next up-and-coming area of London to invest in. Graham Shone looks at some alternative areas

If you’re looking for traditional ‘alternative’ locations to exploit in London’s thriving residential market, you might have already been beaten to the prize.

Previous analyses within London Investor Guides have looked at areas set to benefit from London’s improving transport network, as well as those aided by the capital’s burgeoning artistic communities.

All of those areas would, once upon a time, have been described as alternative, but with those districts now maturing at an ever-accelerating rate, where can the ahead-of-the-curve investor look for residential returns?

There are a few postcode areas where developers look to be showing increased interest, but which seldom get mentioned as potential residential hotspots.

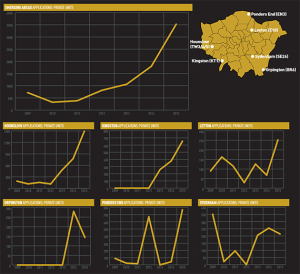

Looking in pure market share terms (for private units only); the areas shown on this map (below) have between them contributed just 1.8% of all unit completions over the last seven years – and a snapshot at the end of 2015 told us that just 2.1% of all units under development in London were being built in these villages.

However, the last 1-2 years indicate how these spaces may begin to contribute significantly more to London’s housing market. The last biannual period (2014-15) has seen a 184% increase in private unit applications compared to the previous two years – far outstripping the average for London overall in that period, at 47%.

Taken in isolation, 2015 saw just over 3,500 private units applied for across these six villages (see graphs), which represents 5% of the total proposed across London.

This is a substantial jump from that traditional 2% ‘ceiling’ and doubtless an indicator that these markets will grow in influence in the delivery of new private stock over the medium term.

Perhaps a good name for these locations would be ‘emerging’ markets – being, as they are, relatively immature in overall private residential development terms. This notion is reflected by the fact that our data indicates just 120 out of the 50,000 units listed as ‘opportunity sites’ appear in these six locations.

Opportunity sites largely come about through refusals, withdrawals, or lapsed consents. While a smattering appear across these emerging markets, the paucity of overall units available through such sites indicates how untouched they have been on the applications front until now.

There are doubtless other locations one might think of first when attempting to branch beyond the traditional hotspots of residential development, but these might be the ones at the earliest stage of development into becoming genuine alternative locations.

Going back further, the last two years have, remarkably, seen over 2,000 more units proposed in these postcode areas than in the previous five years combined – such has been their meteoric ascent in the eyes of London’s residential developers.

Individually, the areas reflect various stories – Orpington and Kingston were largely areas in which social units were planned over the last few years, but only to a very small extent.

Ponders End saw a spike in unit applications in 2012, in isolation against much smaller numbers either side, while Hounslow has seen nearly 1,500 units proposed over the last 12 months compared with traditional figures of between 100 and 400 annually.

Leyton and Sydenham have seen gradual increases in developer activity as the areas continue to emerge as viable commuter locations for those priced out of central (and central-adjacent) areas.