LISTEN: Adam Challis explains JLL’s central London development report

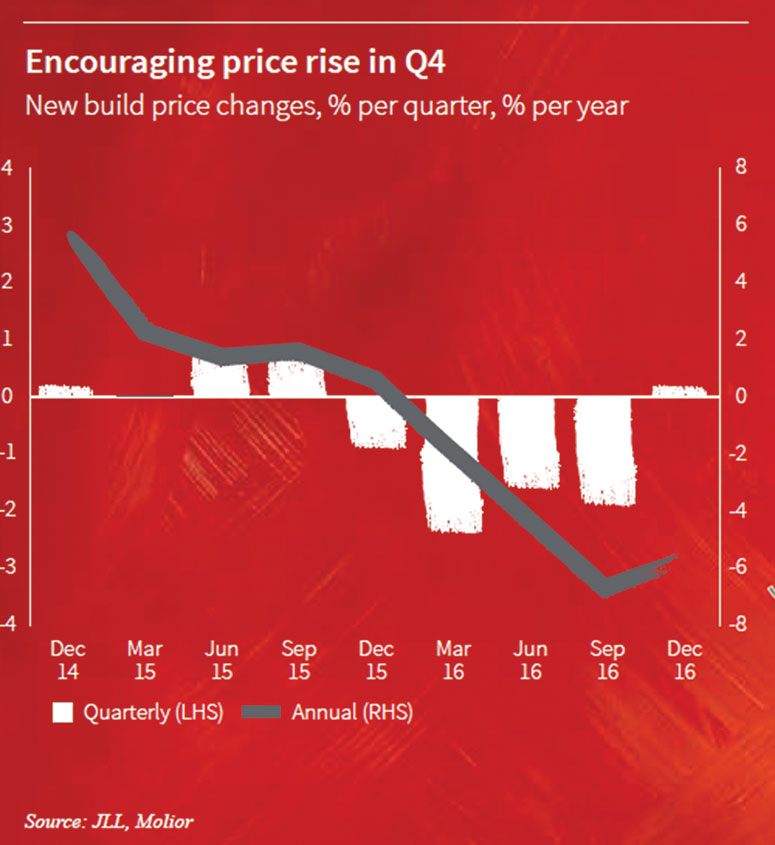

Sales prices for London new build residential stock saw their first quarterly increase in over a year in Q4 2016, as markets corrections led to buyers re-entering the market.

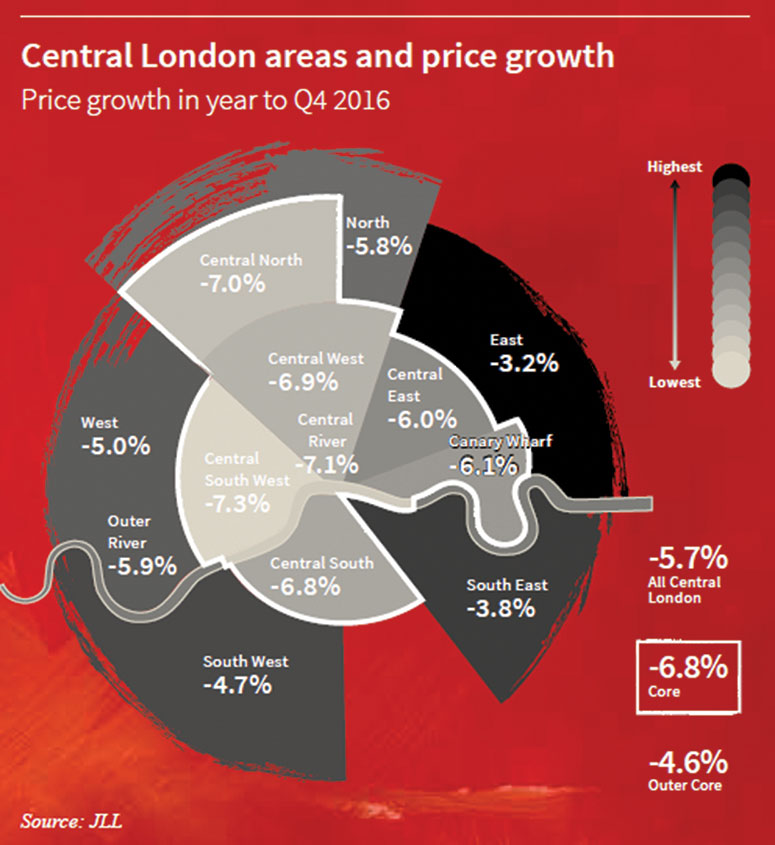

New build sales values, according to JLL’s Central London Development Monitor, fell by 5.7% on average in 2016 across central London, and by up to 7% in some areas. However, they saw a 0.2% rise in Q4.

JLL said the mood has brightened, though the market remains subdued compared to the last five years. It said that had allowed some developers to increase prices, while at other schemes the discount previously offered has been reduced.

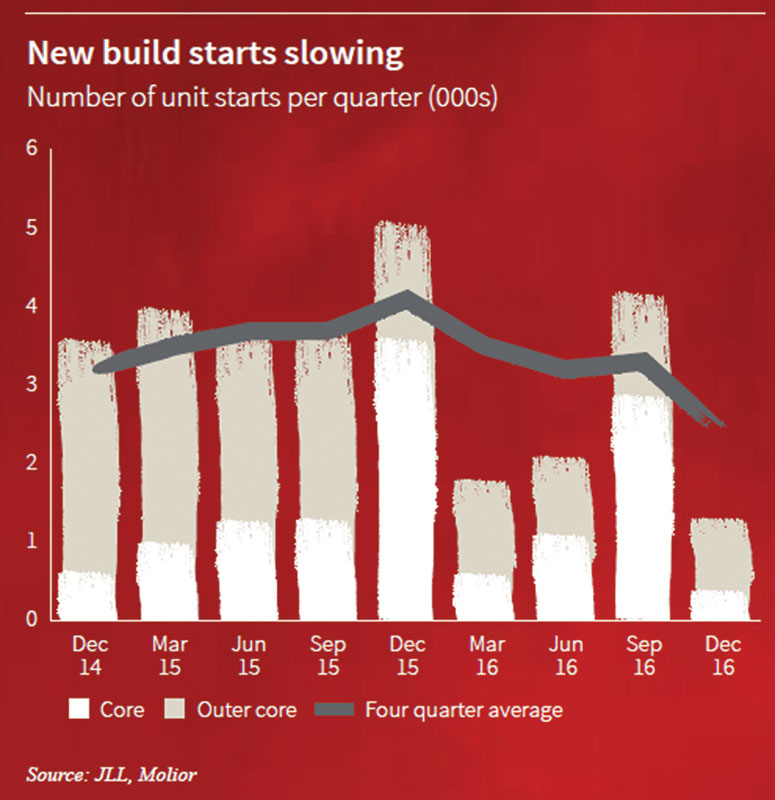

JLL says that in response to the more subdued market, developers have eased back on scheme launches – with the 48% drop between Q3 and Q4 the largest seen in the last five years.

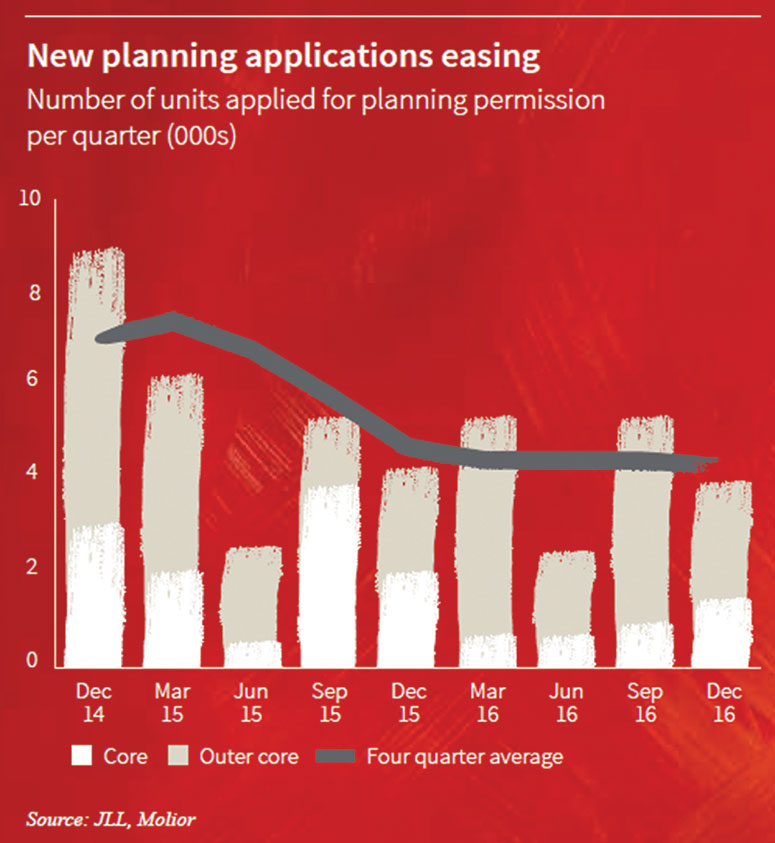

The number of planning applications has also declined: factors such as stamp duty, the Referendum, slowing demand and changes to affordable housing commitments, have all taken their toll.

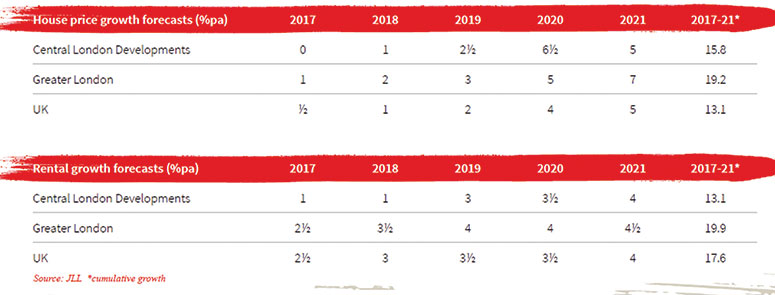

JLL says that 2017 will be another year of adjustment, though with greater upside potential. For the moment, it has not revised its residential forecasts.

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette