When Peckham’s house prices start outperforming Chelsea’s you know something is amiss.

Compared with its hot-headed cousin in the flashy core, London’s suburban residential market has been solid, dependable and ever-so-slightly boring, but that is changing.

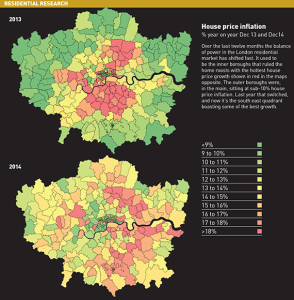

A map of the capital’s house price growth at the end of 2013 shows the core painted red, with the leafy outer boroughs bathed in green. Do the same for 2014 and it is the complete opposite, with growth in the fringe markets outstripping the core as prime markets slowed.

That the super-prime market is cooling has surprised few – experts had been predicting the steam coming out of the London market as far back as the end of last summer – but how fast it has happened has been a bit of a shock.

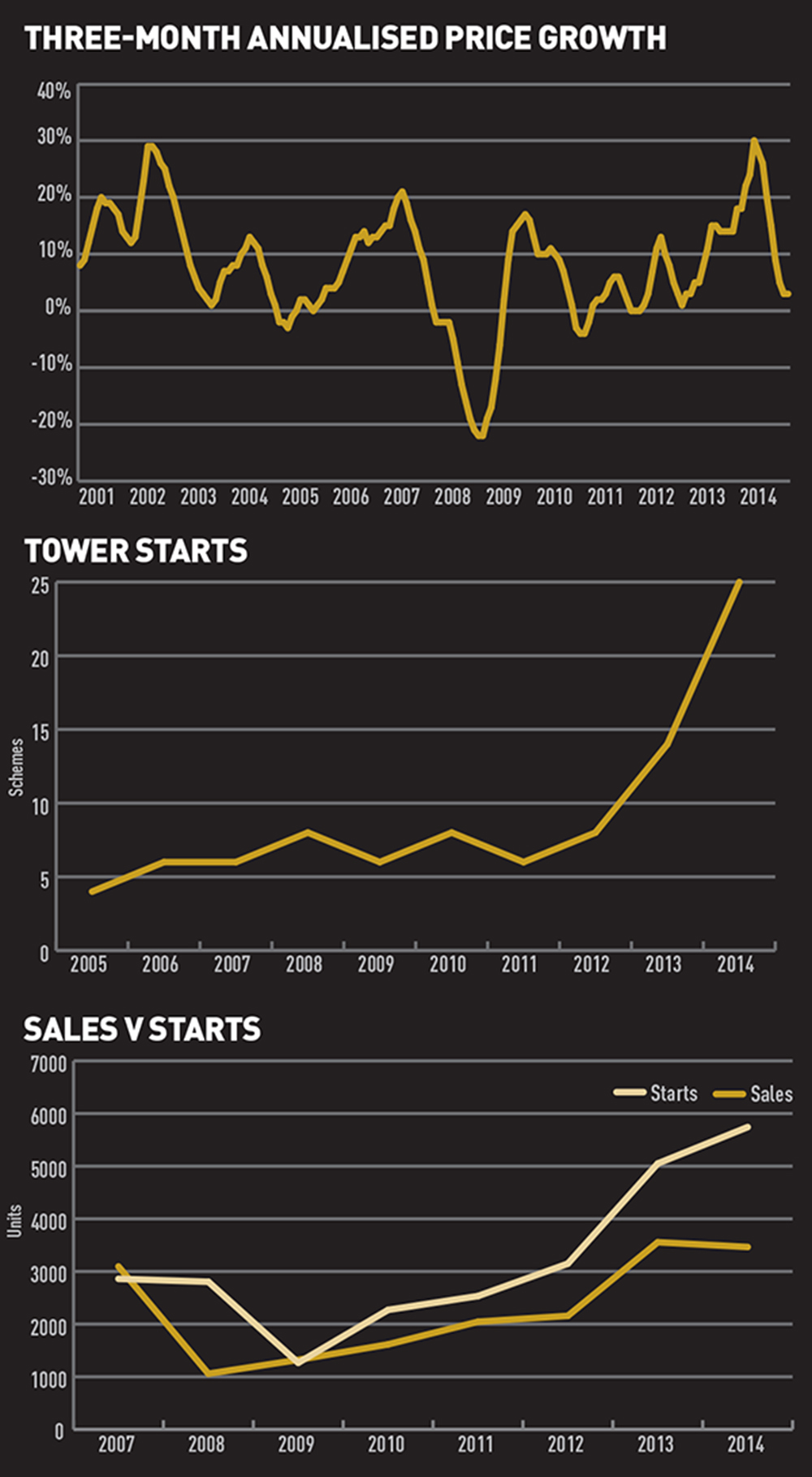

Annualised figures show that since the spring the rate of house price growth has fallen significantly. Between May and December last year the market fell from a stratospheric 30% inflation to just 3.5%, according to data commissioned by EG from Hometrack.

“Looking back to a year ago, house price inflation was really focused on inner London,” says Richard Donnell, research and insight director at Hometrack. “Now it is focused on the southern undervalued markets, the Walthamstows, north of Stratford where you get value for money, and Catford and Deptford.”

Donnell adds that the sheer level of house price growth has made liquidity in the market simply dry up. “With the banks’ new affordability tests it has caught up with the first-time buyers in the inner markets. Now to buy a property there they have to be on £100,000; whereas in the outer areas you’ve got people with not a lot of debt and lots of equity, who can move.”

For some this is a welcome maturing of the market, a slowing as things return to a more sustainable pace, but Adam Challis, head of residential research at JLL, admits: “I have been surprised at the rate of the slowdown.

“I’m not suggesting a repeat of the downturn, but the market is transitioning from growth to a more stable state and between 2015-2019 we’ll see more stable comparisons.”

His predictions are for growth to move further south as the market calms down, with the commuter belts seeing rises above the average rates.

For those reasons, developer Telford Homes has been targeting property at the under £1,000 per sq ft mark. “We had a couple of developments in the more central locations but we sold out before prices went up significantly, in my mind it pushed up and got a bit too out of people’s price ranges, and then you are talking about the sort of investors who buy without any intention of getting a rental yield,” says chief executive Jon Di-Stefano.

At that level, Di-Stefano says sales rates are still very good, pointing to The Junction scheme, E1. “It’s on the City fringe, is relatively affordable starting at around £420,000, the launch is in a couple of weeks, we’ve got 26 flats and 700 people registered, that doesn’t mean they’ll all show up wanting to buy but it shows there are still plenty of people out there.”

But sales rates aren’t booming for everyone. Figures from EG’s London Residential Research show starts grew by 25% in 2014, but sales shrank 3%,

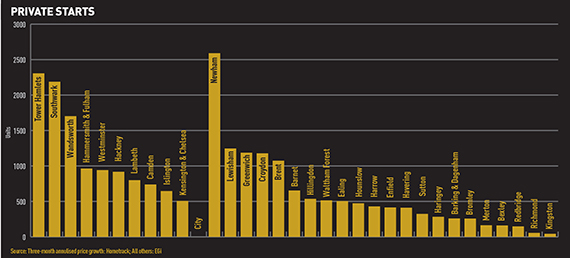

“At the end of 2013 we thought developers were at full throttle, we were wrong,” says Nigel Evans, head of EG’s London Residential Research. “In 2014 the after-burners kicked in,” he adds, pointing to total of 35,000 private units under construction in the capital at the end of 2014, split roughly equally between the inner and outer boroughs.

Supply looked set to climb steeply as starts rose above the 24,000 mark, the first time this has happened in almost two decades. Will developers be forced to take their foot off the pedal?

It might not be that clear-cut. While construction is at a two-decade high, completions are not, with tower development on the rise. Having started construction, developers are now committed to delivering regardless of what the market brings in the next couple of years and will be forced to keep building.

“We’ve had a surge in vertical rather than horizontal development,” says Evans, pointing to a 75% increase in the number of schemes starting with at least one tower over 20 storeys.

“That’s a response to the continuing demand for prestige developments by the predominantly overseas/international investor, but our health warning for 2015 remains the same: a market underpinned by the potentially volatile and unpredictable growth driver of foreign investment is one which could burst very quickly and one based on increasing levels of speculation could go down even quicker.”

Hot spots and not spots

The hottest rising areas in the capital are all in the outer ring of London. Take a map of those areas and overlay it with transport improvements and the two would directly correlate, says Richard Donnell at Hometrack.

Fastest-growing areas

| Area | Postcode | Average (last 12 months) |

|---|---|---|

| Leyton | E10 | 23.6% |

| Lewisham | SE8 | 23.3% |

| Forest Gate | E7 | 22.5% |

| West Norwood | SE27 | 21.3% |

| Manor Park | E12 | 21.3% |

| Penge | SE20 | 21.0% |

| Stratford | E15 | 20.7% |

| Clapton | E5 | 20.5% |

| Tottenham | N17 | 20.4% |

| Charlton | SE7 | 20.3% |

“Look at Herne Hill, it has seen a lot of transport improvements and that is one of the biggest swings, but a lot of people talk about Crossrail. That will be about tomorrow’s change, the effect doesn’t kick into prices until people can use it,” he says.

Areas with lowest growth

| Area | Postcode | Average (last 12 months) |

|---|---|---|

| Chelsea | SW3 | 2% |

| Belgravia | SW1 | 6.4% |

| Mayfair | W1 | 6.4% |

| Bloomsbury | WC1 | 7.1% |

| Kensington | W8 | 7.1% |

| Wapping | E1W | 7.5% |

| Camden | NW3 | 8.4% |

| Richmond upon Thames | SW14 | 9% |

| West Kensington | W14 | 9% |

| St John’s Wood | NW8 | 9% |

Fringe vs Core

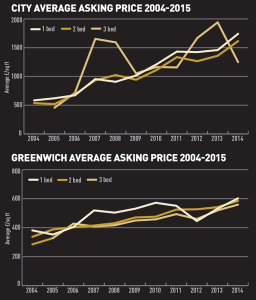

On the face of it, it looks like prices in both the inner and outer boroughs grew last year, using a snapshot of six boroughs. For example, Westminster prices reached a 10-year high.

But drill down into those markets and there are signs some of them have peaked.

In the outer boroughs average asking prices when first released to market for all properties grew. In the City the average asking price dropped by 11% last year.

What buyers were purchasing was also changing and while three-bed properties in the fringe kept pace with other homes, in the core these larger properties started to dip with a three-bed property in the Square Mile dropping from around £2,000 per sq ft to £1,250 per sq ft.

Cold front moves in on Manhattan

Cold front moves in on Manhattan

News that Manhattan’s luxury homes market is cooling has sent a shiver down the spines of London’s super-prime agents. Is the UK capital about to follow suit?

Prices for luxury co-ops and condos on the island fell on average by 11% last year according to Corcoran, a New York residential agency.

From his Park Avenue office Paul Leibowitz, executive vice president, investment properties at CBRE, says he’s yet to feel any slackening demand, with residential assets in New York still attracting interest from both domestic and foreign investors.

However, he adds: “There has been a shortage of high-quality product for sale in the market and even properties marketed as condominium conversions have been competitively bid by value-add rental buyers.”

The strong dollar could hit that. Adam Challis, head of residential research at JLL, believes a resurgent Greenback will curb some international buyers, a factor that has been important to Manhattan’s recovery.

Challis believes both London and New York markets are likely to see a similar slowing as they mature and stabilise, but for subtly different reasons. While strong currency is an amber light in the states, in London the UK’s impending general election is causing some to pause for thought he says.

Richard Barber at WA Ellis goes further, believing the UK election and its outcome to be a pivotal turning point. “If it’s the Conservatives then the confidence will be there, we’ll start to see growth edging up, if it’s not then it will be a very flat market and we won’t see a lot of growth in the first nine months.”

Barber says the spectre of the mansion tax and changes to stamp duty in December are impacting transactions at the top level of the market and in some cases have caused renegotiations.

“If it is going to cost you an extra £250,000 to buy you want to see that reflected… there is no fire under anyone to move, interest rates are low and predicted to stay low and most are saying ‘let’s wait and see what happens to government’, it’s a Mexican standoff. My prediction is that people will say ‘hang on, let’s rent it will only cost £100,000 to rent and that is a fifth of what I might be paying in stamp duty’.”