Lambert Smith Hampton’s owner Countrywide hopes to complete a strategic review of the business that may lead to a sale “later this year”, it said in its preliminary annual results.

A quick sale of the business had been anticipated when the review began late last year but it is understood that the offers received were not considered attractive enough to justify a sale. A range of other options are subsequently being explored.

The firm has considered a demerger and separate listing of LSH later this year, which could result in parts of the main Countrywide business going with LSH, most notably certain branches that could benefit from being bolstered by project management or planning expertise.

If a listing were successful, LSH could look to issue shares to merge with other privately-owned advisory firms looking for a new long-term ownership solution. LSH has long pursued Cluttons, which is battling with a £42.9m pensions deficit, while GVA, which is under the private equity ownership of EQT, has been touted as having strong synergies with the business.

Countrywide said: “As with other commercial property businesses, [LSH] was affected mid-year as the transactional and capital markets paused around the EU referendum, but finished the year strongly.”

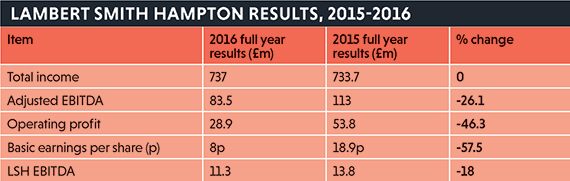

LSH’s income for 2016 was flat year-on-year but its EBITDA fell by 18% to £11.3m. Countrywide said that a decline in its transactional business was offset by an increase in consultancy revenues “but not to the extent that the costs had increased owing to the full-year impact from acquired businesses”.

Since LSH was bought by Countrywide from Sankaty in 2013, it has bought six businesses including Tushingham Moore, BTWShiells, ES Group and Douglas Newman.

A strategic review began in December with Countrywide, whose share price has fallen by 53% over the past year, looking to raise cash after a profit warning. The company has been suffering from uncertainty caused by the EU referendum and changes in stamp duty.

LSH also proposed a share placing to raise close to £43m, or just under 10% of its share capital, in order to accelerate the implementation of its online presence and pay down debt.

Oaktree Capital Management, which owns 30.1% of the company, was expected to subscribe for a proportionate number of the shares.

To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette