Loan-to-value ratios have increased in the past six months across the core European cities of London, Paris and Frankfurt, with loans now typically above 60%, according to the latest DTZ European Lending Trends report.

Loan-to-value ratios have increased in the past six months across the core European cities of London, Paris and Frankfurt, with loans now typically above 60%, according to the latest DTZ European Lending Trends report.

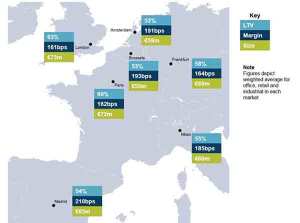

The survey also found that margins for those cities were being driven down over the same period, with the cost of a loan over the benchmark Libor or Euribor rate typically 160-165bps.

Outside those locations, LTVs remained low, with Milan, Madrid, Amsterdam and Brussels averaging 50-60%, with pricing margins typically also higher than in the core.

Edward Daubeney, DTZ’s head of debt advisory EMEA, said: “Lenders’ responses to our survey highlight an appetite for greater risk in tier 1 cities, as investment markets continue to recover and the unwinding of legacy debt continues.

“Although lenders remain disciplined on risk, there has been a willingness to move up the risk curve in tier 1 cities, with increased lending on speculative developments, especially in core cities, where the availability of grade A stock remains low. However, this trend is not reflected in tier 2 and 3 cities, with lenders continuing to be risk-averse.”

Just over 90% of lenders thought activity would increase over the coming months compared with the previous six months, and 70% of those lenders said that over that period, they had seen an increase in both new loans and refinancing activity for clients.

In particular, lending activity has increased outside core countries such as France, Germany and the UK. Italy has grown the quickest, with its share of loans up from 4% to 9% over the first six months of 2015.

In line with other surveys, the report found that the lending base is now more diverse, with alternative lending filling the space left by more traditional lenders.

Potential risks to the market stem mostly from the increased weight of capital, lenders said, and the next two highest concerns are deflation and a Chinese slowdown.

The survey covered 50 active lenders across Europe and focused on recent lending and the expected trends for the next six months.