The shortage of industrial space is most acute for units of 50,000 to 100,000 sq ft and landlords can look forward to rising rents

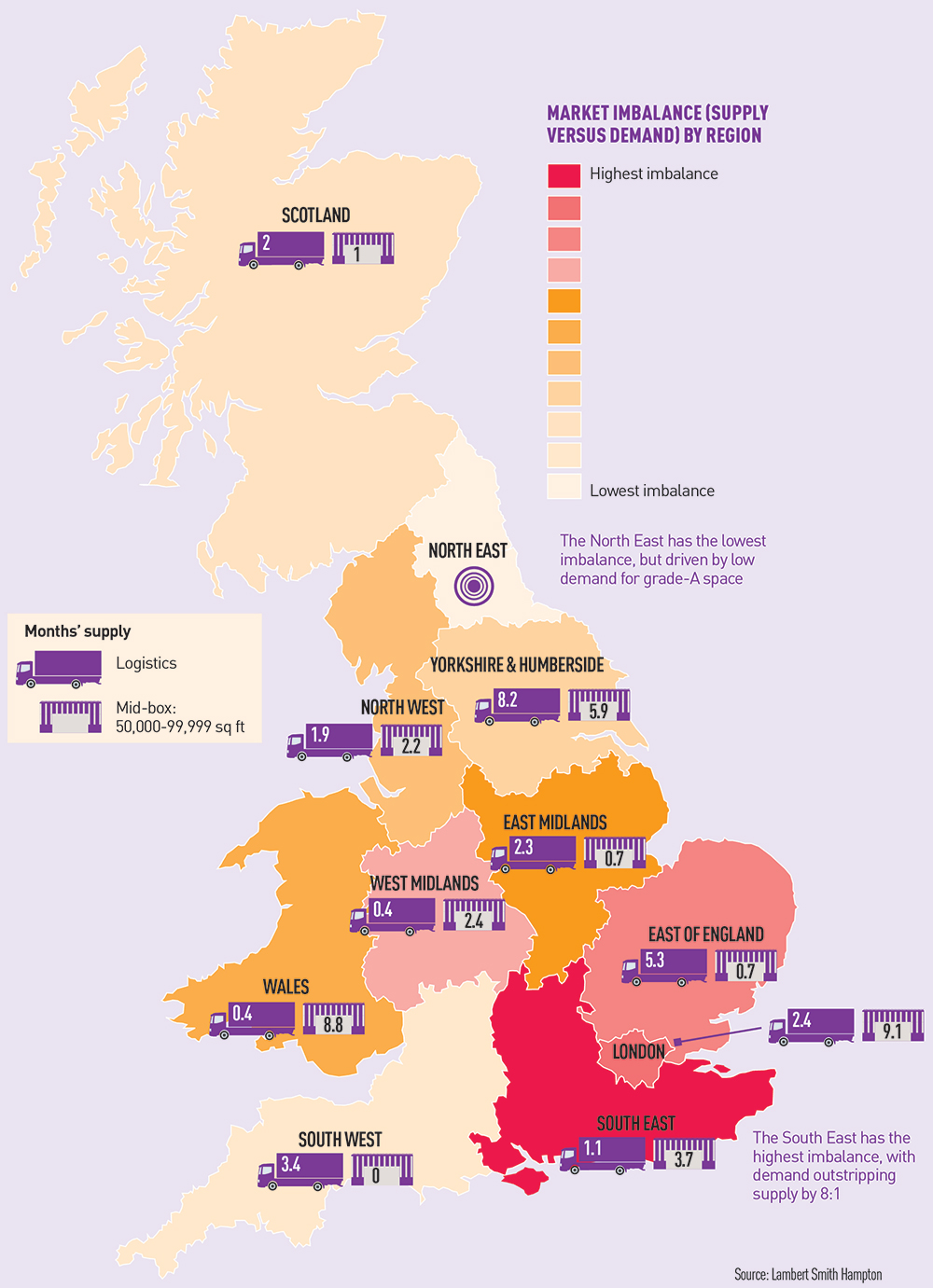

The supply of industrial space around the UK is at its lowest level since 2007, according to research from Lambert Smith Hampton.

With record take-up last year of 103m sq ft, investment of £6.6bn and speculative development doubling to 4.4m sq ft, supply has been squeezed to the point that the availability of prime space is being measured in months, not years.

While demand is high for logistics units of more than 100,000 sq ft (see p44), the greatest shortage is in “mid-box” units of 50,000 to 100,000 sq ft.

Mid-box take-up has been driven by retailers and third-party logistics operators looking for satellite and local distribution units. They accounted for 43% of mid-box take-up during 2014.

LSH predicts that now occupier demand has strengthened in line with the economy, the mid-box market will see the strongest rental growth over the coming years. The shortage of space caused prime rents to rise by 3.7% and secondary rents by 5.9% last year.

“Supply pressures have put industrial landlords in an increasingly commanding position. While speculative development is now coming forward, more meaningfully, supply shortages will continue to drive up rents over the next 12 months,” says Oliver du Sautoy, head of research at LSH.

“Well-located, secondhand units will arguably benefit most from rental growth, as occupiers compete for more space offering more flexible lease terms than new build.”