Birmingham and Nottingham have big concentrations of life sciences and medical technology firms – and they both want to have the biggest. Andy Coyne reports

The appliance of science could be the answer to the Midlands’ inward investment prayers.

The appliance of science could be the answer to the Midlands’ inward investment prayers.

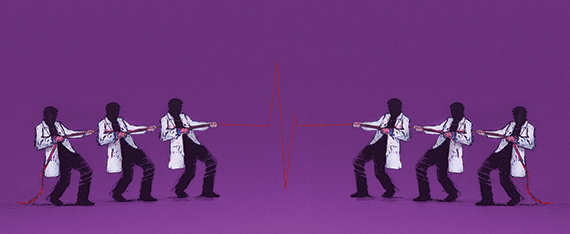

But while the Midlands Engine – the government’s new devolution delivery body for the region – will play a key part in trying to bring new businesses in, as the area’s first genuinely pan-regional economic support platform, it could find itself in the middle of a battle between Birmingham and Nottingham to become the pre-eminent location in the Midlands for the life sciences sector.

The Midlands is the UK’s medical technology heartland and although it is well known for its automotive sector (see p24) it is less well-known for being a significant producer of hospital equipment and orthopaedic devices.

Together, the West and East Midlands are home to 30% of medtech companies, compared with 27% in the South East and East and 20% in the North.

The Midlands has great strengths to offer that are distinct from much of the rest of the UK

Birmingham’s life sciences cluster is based around the Edgbaston and Selly Oak districts, the former known as the Edgbaston Medical Quarter. These have become focal points for the city’s sales pitch to potential occupiers and investors.

Statistics from Marketing Birmingham – the city’s strategic marketing partnership – reveal that the area is home to 525 medical technology companies, more than any other region, and Greater Birmingham is home to 22 life science specialisms. The sector generates annual turnover of £1.2bn in Greater Birmingham.

Its twin anchors are the £54m Queen Elizabeth hospital complex and the University of Birmingham, both of which are leading research institutions and represent a cluster of excellence.

The University of Birmingham is one of the largest centres for clinical trials in the UK, running 200 active trials at any one time, while the EMQ is home to two-thirds of the city’s healthcare economy and is linked to local family-owned property firm Calthorpe Estates, which owns a 1,500-acre swathe of Edgbaston.

Calthorpe has been behind many key initiatives in the area – including the redevelopment of the BBC’s old Pebble Mill site. That is set to continue as plans have recently been approved for a new £8m medical hub in Edgbaston in a 30,000 sq ft building on Highfield Road.

About to open its doors for the very first time is the £24m Institute of Translational Medicine, a clinical research facility located next to the Queen Elizabeth. Three city hospitals and the University of Birmingham are working together to make the ITM a centre for innovation in health sciences and diseases and 600 scientists will be conducting early-stage research there when it opens later this month.

Work on the Life Sciences Campus can now be stepped up as the Greater Birmingham and Solihull Local Enterprise Partnership has awarded a £5m grant with further funding promised from Birmingham Council. The 30-acre site has been remediated by the council and the Harvest Partnership, a joint venture between Land Securities and Sainsbury’s. One-third of the site will house the Life Sciences Campus, which is to be a centre of excellence in medical research, while the remaining 20 acres will be redeveloped as retail, leisure and student accommodation.

With so much going on, one might suspect a degree of competition between Selly Oak and Edgbaston, dominated as it is by Calthorpe’s estate. But Calthorpe chief executive Mark Lee says not.

“Rather than competing with other areas and initiatives, we are supporting the overall strategy and working with many partners, including Birmingham City Council and GBSLEP, to encourage investment,” he says.

Marketing Birmingham will launch a campaign to highlight the life sciences sector this month. Targeting businesses on the west coast of the US, it will highlight the strength of the city’s clinical trials offering.

Nicola Hewitt, commercial director at Marketing Birmingham, says: “Led by our sector specialists and using a highly targeted approach, we seek to profile the scale and range of life science facilities that exist here, and the business support on offer to potential US investors.”

One of the people Marketing Birmingham has taken soundings from is Kaleigh Haeg, a specialist surveyor working for Colliers International, who advises life science sector clients. Much of her experience was gained on the US west coast.

“The Midlands has great strengths to offer that are distinct from much of the rest of the UK. It has a catchment of 7m and such a diverse population,” she says. “Companies need access to that diverse group if they are carrying out clinical trials. That’s huge.”

On the other side of the Midlands, Nottingham will be hoping it will be the chosen destination for life science firms.

Nottingham’s area of excellence has been bioscience, based around the successful BioCity project. It is one of the largest life sciences incubators in Europe and home to more than 70 businesses.

A £30m project to extend BioCity is under way through a new 50,000 sq ft building due for completion in spring 2017. The project is being funded by Nottingham City Council and the D2N2 Local Enterprise Partnership.

Nottingham is also looking to expand its offering to a wider life sciences market via MediCity, a collaboration between high-street pharmacy and retailer Boots and BioCity on the Boots site within the Nottingham Enterprise Zone.

Plans for MediCity incubation include refurbishing an existing building to provide 65,000 sq ft of business incubation space for the health, beauty and wellbeing sectors.

Tim Garratt, who heads East Midlands property consultancy Innes England, says: “BioCity and MediCity are great stories for Nottingham.”

But with the Midlands Engine in mind, Garratt accepts that being under the same umbrella as a life sciences sector competitor in the shape of Birmingham is a novel experience.

“There will always be some tensions because they are competitors at some levels. But it could be good tension, as it makes everyone raise their game,” he says.

Victor Ktori, head of Savills’ Nottingham office, suggests that cost could be a differentiator. “Nottingham is a very attractive proposition because its fixed costs are lower,” he says.

But Haeg at Colliers International doesn’t see that as a factor. “I would be hesitant to sell the Midlands based on cost,” she says. “It’s better to talk about clinical trials, the population and the talent pool.”

Digital industries

According to Tech City UK’s Tech nation 2016 report, Birmingham’s digital cluster grew by 31% between 2010 and 2014 and now generates £1.13bn of GVA a year.

Alistair Cory, head of the Birmingham office of architectural firm Gensler, is based in Digbeth’s Custard Factory, one of the digital and creative clusters in the city’s Digbeth area (see p30). He says there has been an advance of digital across the region, as firms relocate to Birmingham.

“Access to creative staff is a key reason. It was also a key reason why we came here,” he adds.

Birmingham City Council has plans to further develop the area – and by extension the sector – as part of its HS2-related Curzon regeneration proposals.