Back in the mid-2000s, venturing off Manhattan Island and moving into a Brooklyn warehouse would most likely have raised a few eyebrows. Today the same relocation would probably raise even more, but for very different reasons.

Ten years ago, Brooklyn and Queens were dismissed as second-rate Manhattan overspill districts. In October this year, average house prices in Brooklyn hit $800,000 (£530,000), with rises in values exceeding those in Manhattan.

The market is a little further behind in Queens, where the average house price is hovering at $450,000. But this has not deterred overseas investors – particularly Chinese buyers, which are swooping in to buy up the sort of large development sites that simply do not exist in Manhattan, where space commands a prohibitive premium.

But any investor looking to snap up a good deal around Williamsburg or Dumbo (Down Under Manhattan Bridge Overpass) will have their work cut out. The time has come to start looking further afield – to the outer boroughs’ outer boroughs.

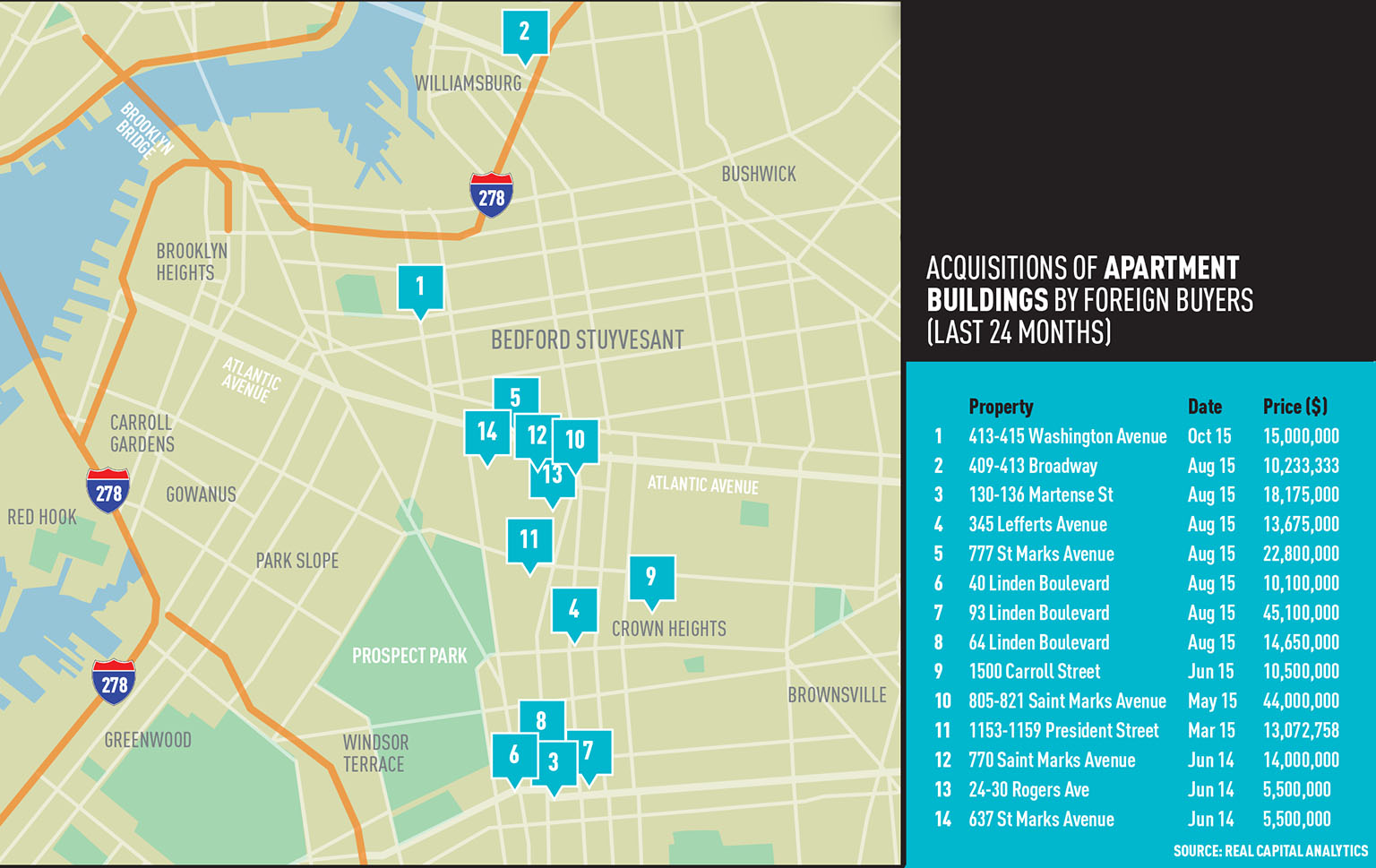

“Over the last 24 months, foreign buyers have been moving further and further out,” says Real Capital Analytics senior vice president Jim Costello. “They are following the consumers. You can see how many deals have been done around Prospect Park and Crown Heights in Brooklyn, for example. Chinese and Scandinavian investors have dominated here, where the focus is very much on high-end apartment block deals in up-and-coming transition areas.”

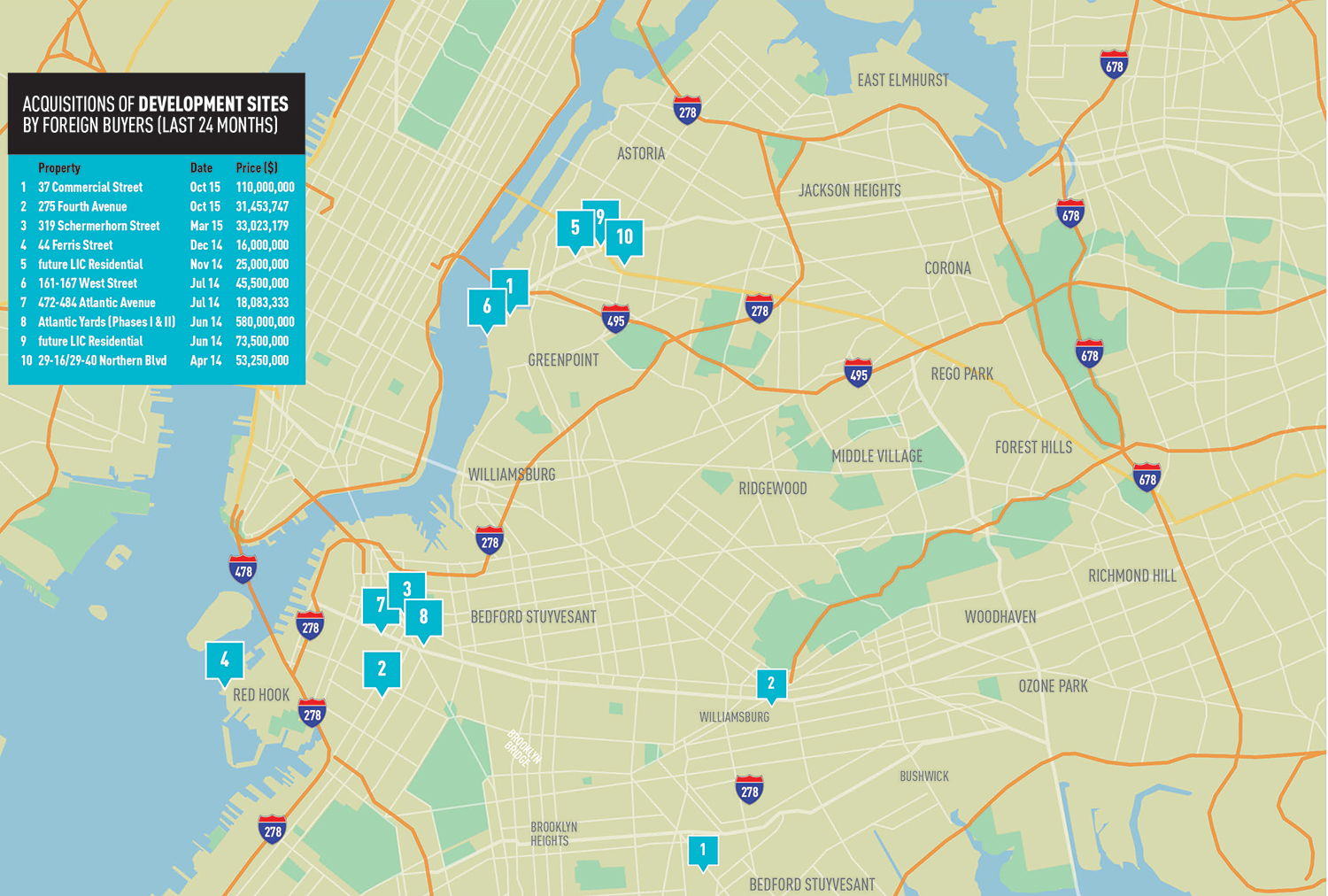

In Queens the focus is more on development sites where, once again, the Chinese have been particularly active over the past two years. “These deals are for the more opportunistic investors,” says Costello. “Whereas the Europeans tend to be focused on current yield, the Chinese often go after risk. They might well consider a deal of less than several million a waste of time and typically target these bigger deals – the ones that are easier to find the further out you go.”

But he adds that while Queens might not be hitting Brooklyn prices yet, it is only a matter of time before the area is on a faster-moving upward trajectory. “If you look at where they are positioned, most of these development sites are on the waterfront and near rail links – these are former warehouse industrial locations – and so I would imagine that most of them will eventually be repurposed into high-end resi,” he says.

So while Manhattan might once have been considered the jewel in New York’s resi crown, it looks set to be the deals in these riskier, outer boroughs that have the potential to deliver the greatest return on investment for savvy overseas buyers. But Costello warns anyone wanting to make decent bang for their buck will have to get in quick.

“When everyone agrees an area is worth investing in, it is at that stage you are probably too late,” he says. “It is always a good backwards indicator of the market.”