Overseas investment into New York City real estate over the last five years has been dominated by Asian and European money, while Canadian funds have made their mark in some of the riskier outer boroughs.

Overseas investment into New York City real estate over the last five years has been dominated by Asian and European money, while Canadian funds have made their mark in some of the riskier outer boroughs.

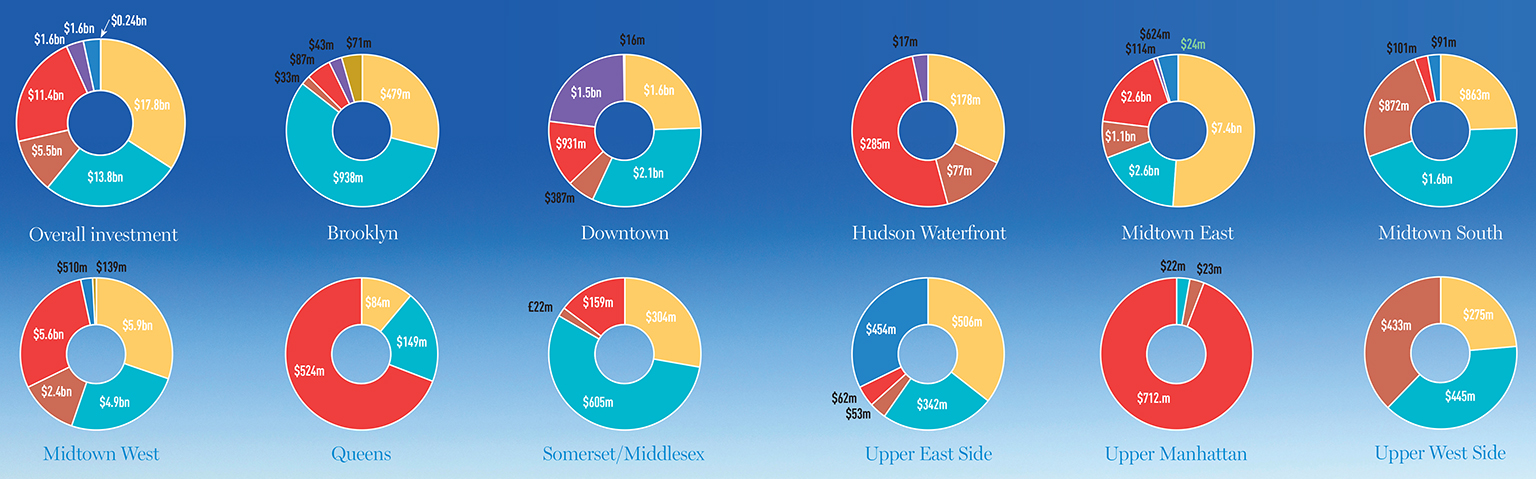

Research by Real Capital Analytics shows that Asian investment has hit nearly $18bn since 2010, followed by European money – a large chunk of which is made up of investment from the Norwegian fund Norges – coming in at $13.8bn and Canada the third most active, having spent $11.4bn.

But despite a close split, Savills Studley’s head of US capital markets, Borja Sierra, says that Asia is the one to watch. “Asians have been, by far, the largest foreign investor in New York,” he says. “Even more so, as it appears by looking at the data because so much of the European money comes from the Norwegians. The other thing we have noticed is that for every three Asian investors doing deals here there are another 10 who are most probably just screening the market to see how it works and to learn how we assemble deals and finance them.”

The biggest trend by submarket breakdown was that the newer the investors are to the market, the more likely they are to stick to safe, inner boroughs – hence the larger mix of money in central submarkets such as Downtown and Midtown.

The further out you go, the bigger the dominance of Canadian money. “Upper Manhattan is basically Harlem,” says Real Capital Analytics senior vice president Jim Costello. “This is still a very risky market, so the investors here are likely to be those who understand Manhattan well and who are familiar with the American market. The Canadians are our neighbours. They have the closest relationship and so are the ones more likely to have the confidence to take the bigger risks.”