Norges Bank Investment Management, one of the biggest sovereign wealth funds in the world, invested £1.8bn in direct real estate in 2016, according to its extended report on real estate.

The report, which expands on Norges’ annual results published earlier this month, showed that even though the UK returned -16.8%, the purchase of 344-361 Oxford Street, W1, and 73-89 Oxford Street, W1, for nearly £400m made up a fifth of its investments.

Norges’s largest acquisition was the Vendome Saint-Honore property in Paris, bought for €1bn (£880bn).

Karsten Kallevig, chief executive of Norges Bank Real Estate Management, said: “We continue to invest in high-quality assets in a limited number of major cities.”

Karsten Kallevig, chief executive of Norges Bank Real Estate Management, said: “We continue to invest in high-quality assets in a limited number of major cities.”

Last year, speaking to EG, Kallevig reaffirmed his commitment to investing in the UK despite the Brexit vote. “Forecasting the future I think is very difficult, but in itself, based on where we are now, it is not changing our view of London as one of the most important cities in Europe.”

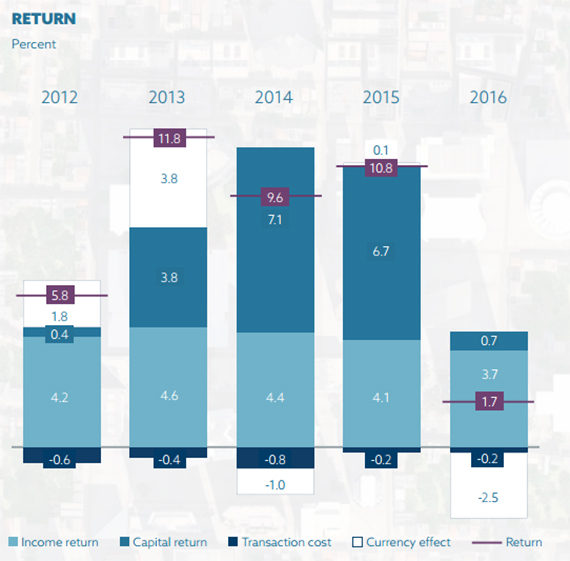

The report released today also revealed more about what led to real estate returning only 1.7% for Norges last year.

Currency

Currency movements were responsible for dragging down Norges’ property returns for only the second time in five years. The currency effect reduced total returns by 2.5 percentage points, which Norges blamed on being overweight in British pounds.

The pound fell by about 18% against the kroner in 2016. Considering UK assets make up 22.9% of Norges’ £18bn in direct property holdings, a fall that big would have devalued the real estate portfolio as a whole by up to 4% before any new investments or asset value uplifts.

Mitigating a UK slowdown with diversity

European investment accounted for 50% but returned -4.2% across office, retail and logistics assets. Investment volumes on the continent were steady, although activity in the UK slumped.

Rents in London fell by 6% in the West End and 2% in Midtown, although they were stable in the rest of the capital. By contrast, Berlin office rent growth was above 15%.

Office and retail, which made up 41% of the real estate portfolio, returned -5.1% through a combination of rent falls and currency devaluations, because its biggest exposure was in London.

A similar story came out Norges’ European logistics portfolio. It returned -0.7% and called the weakening of the pound the main driver in that. However, with a more diversified portfolio where the UK made up only 30% of the assets, the impact was not as profound.

Strong US performance

A slowdown in Europe led by the UK was balanced out with US investments that returned 7.6%. US offices and retail, which made up 37% of the real estate portfolio, returned 6.1%, while logistics returned 11.8%.

With about a 2% fall in the value of the dollar against the Norwegian kroner in 2016, US returns were more reflective of the underlying value of the properties than the ones for Europe.