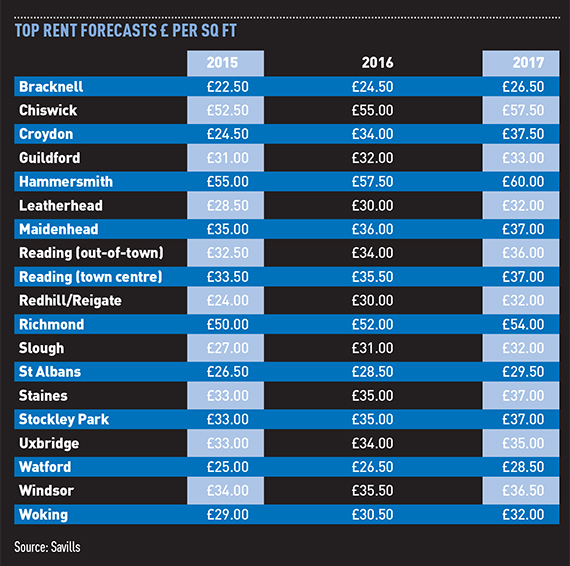

As we approach the end of 2015, Savills has considered the outlook for a selection of key office markets within the Greater M25 region, illustrating the varying rental performance levels that are anticipating growth.

Its in-house forecasts for the next couple of years show significant variation in the expected levels of growth.

Tom Mellows, director of South East office agency at Savills, says: “Some markets have seen higher levels of rental growth in the past few years and, therefore, will post more conservative growth rates during the next 24 months. However, it is clear that a large degree of repricing in some office markets will occur in the next couple of years as new office stock is delivered to meet occupier demand, where previously supply has been limited.”

Analysis shows corporate moves are relatively localised, and this will support the levels of rental growth presented in these areas.

Steven Lang, director of commercial research adds: “With rent levels broadly similar in the majority of M25 office markets, there is a willingness to stay within the area and accept slightly higher rental growth. By choosing to move much further away, businesses risk losing their most valuable asset, their employees.”

Investment facts

£70bn

Figures from Carter Jonas (CHCK) , show investment in UK commercial property is set to exceed £70bn in 2015, making it the highest so far.

£20bn

Nearly £50bn of deals had been completed in the first three quarters, and Q4 volumes are predicted to exceed £20bn, based on deals already in the pipeline.

13%

Investment in offices over the first three quarters has risen by 13% against the same period in 2014.

Source: Carter Jonas