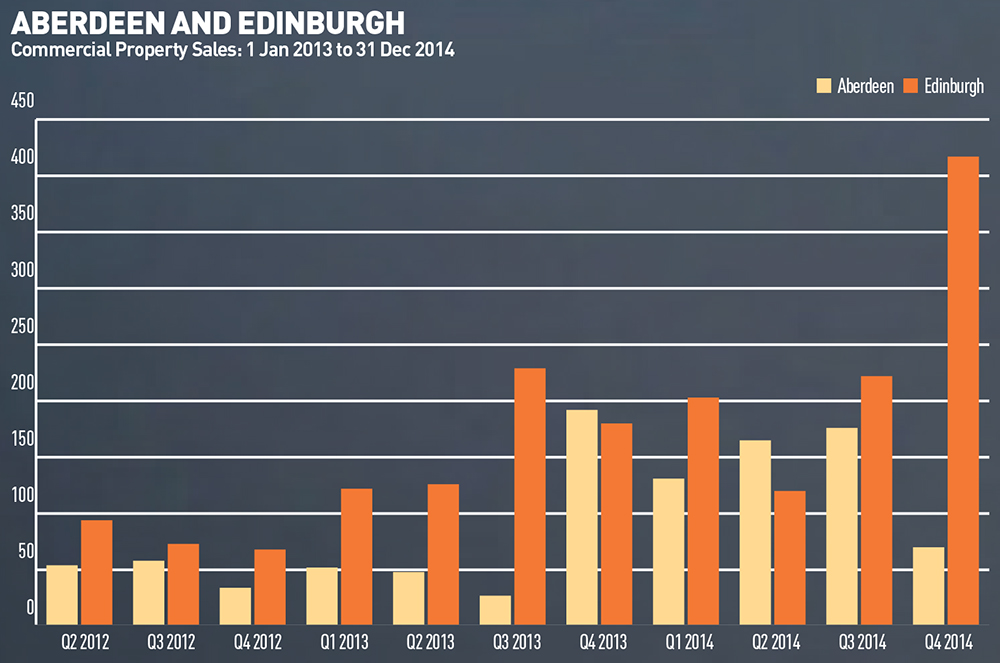

The true extent to which geopolitics buffeted the Scottish commercial property market in the final three months of last year has been laid bare for the first time by the Scottish Property Federation.

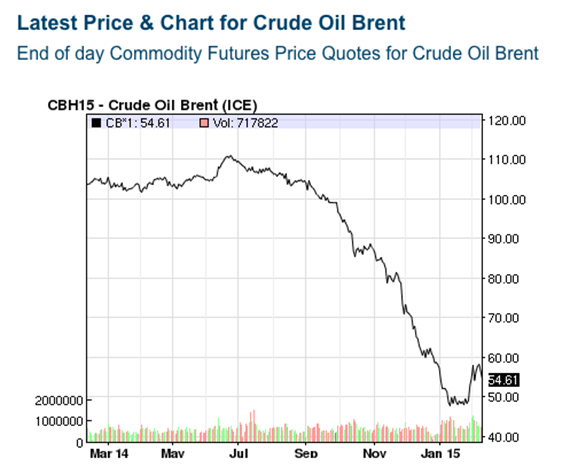

The SPF’s analysis of Registers of Scotland’s Q4 figures highlights the impact of the falling oil price on Aberdeen – commercial investment volumes in the city plummeted by 151% to just £70m, down from a £176m in the previous quarter.

However, the figures also reveal the unprecedented extent of the bounce back in investment in the Edinburgh market following September’s independence referendum. Quarterly sales topped £417m, an increase of 86% on the previous quarter.

SPF director David Melhuish said: “This is the first full quarter reported since the referendum and the stand-out figure is the return for Edinburgh over the quarter with £417m of sales. We attribute this to a post-referendum bounce as sales were concluded following the vote.”