How will the creation of a raft of new flagship stores on Oxford Street affect one of the world’s top shopping destinations?

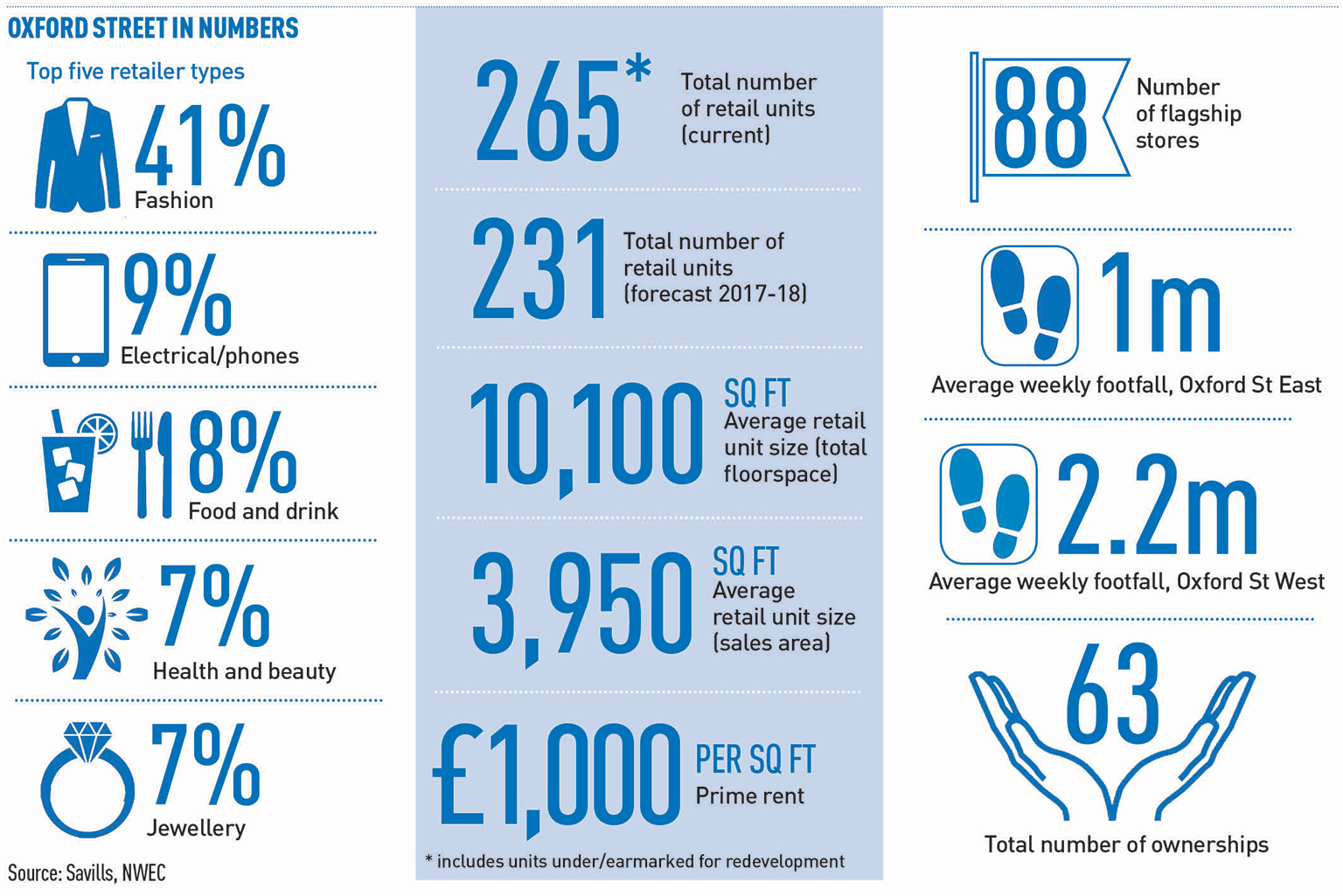

Go stand on Oxford Street, W1,fast forward three years and two things will have happened: Crossrail will be operational and 26 new flagship stores will be open. Half of those flagships, according to Savills, will be created by amalgamating no fewer than 57 existing shops.

Does that mean Oxford Street will become dominated by retail giants? Not necessarily, say retail experts, who point out that much of the store shifting is taking place east of Oxford Circus, on the previously less fashionable part of the street. It is, they say, simply a rebalancing of a road that once tipped heavily towards Marble Arch. And that will mean new shops in all size bands.

“We can’t have the street full of 10,000-15,000 sq ft stores – we need smaller units to provide variety,” says Aron Samra, director at CBRE. And that is exactly what appears to be happening.

“We can’t have the street full of 10,000-15,000 sq ft stores – we need smaller units to provide variety,” says Aron Samra, director at CBRE. And that is exactly what appears to be happening.

Savills director Sam Foyle says: “Smaller retailers, including international players, are now walking the eastern end of Oxford Street and wanting to take two stores.”

So the issue on Oxford Street is less about unit size and more about the retail mix, which has already changed significantly, with the departure of pound shops and tourist gift retailers. In their place, very different types of operators are set to come in.

This is welcomed by many, like Jace Tyrrell, chief executive of the New West End Company, who says: “Creating space for flagship stores is imperative for both retailers and visitors to Oxford Street. Landmark stores attract customers to the area and this increase in visitor numbers ultimately benefits the area as a whole.”

Others are not so sure. Unlike many prime shopping areas in London which have a dominant landlord, typically a landed estate, Oxford Street has a fragmented ownership, making a holistic approach to tenant mix more difficult. One thing the street’s landowners will have in common, says Bilfinger GVA director James Burt, is an eye on the money: “They will put a greater emphasis on covenant strength, leading to Oxford Street becoming the clone of many international shopping streets. This is particularly the case with new developments as landlords will typically agree prelets with established operators.”

The result is that secondary and/or independent brands will find it increasingly difficult to obtain space on Oxford Street. This could lead to a reduction in the variety of the retail mix, as they head to other parts of the capital (see below). “A direct side effect will be an increase in rental costs as those retailers who can afford it pay top dollar for space, pricing many smaller retailers out,” says KPMG Boxwood managing director Paul Martin.

Retail agents report that this is certainly happening east of Oxford Circus as historic rents of £600-£700 per sq ft are shooting up by 30% to the same levels achieved at the other end of the street. Which raises the question of how profitable some of these shops will be. “If executed well, the flagship model won’t be a vanity project or a loss-leader,” says Martin. “If multiple components are all connected seamlessly then the costs of the flagship can be justified, and the transactional store should also be profitable.”

While new flagships are unlikely to face any planning hurdles, they may face some interior design challenges, such as internal columns and needing to punch holes through floors for services, says Jon Tollit, design director at architect Gensler. But he suggests the real issue is outside, with public realm: “Other cities, like Barcelona, have got ahead of the game. Good landscaping, good lighting, a nice place to be – that’s where Oxford Street needs to catch up.”

Where will smaller retailers go?

The extent to which smaller retailers will be displaced from Oxford Street is unclear, but there is broad agreement that some will be forced to look elsewhere. Marylebone High Street, the top ends of Bond Street and Tottenham Court Road, Covent Garden and South Molton Street are all touted as potential destinations for them.

“The street is dominated by multiple brands and department stores, which does not create the right environment for specialist retailers,” says Hannah Grievson, commercial property manager at Sloane Stanley Estate, which spans the King’s Road and Fulham Road – another alternative for niche retailers.

What is a flagship store?

In the context of Oxford Street the term flagship instantly evokes images of Selfridges or perhaps one of the other major department stores west of Oxford Circus. But flagship does not necessarily mean big.

Watchmaker Seiko, for example, is looking for a flagship store no larger than 1,500 sq ft to showcase its premier Grand Seiko range and Timberland’s standalone footwear store at 158 Oxford Street, which opened just after Easter squeezes in to less than 1,000 sq ft.

“We tend to think of flagship as big and shouty, but for retailers it is more often about location and top-of-the-league products. So while flagship must be absolutely prime, it can be boutique and certainly not massive,” says Mike Wimble, retail partner at Knight Frank.

Large units are likely to be more important for international retailers looking to enter the UK for the first time, as the physical space is expected to perform multiple functions, including e-commerce.

Paul Martin, managing director of KPMG Boxwood, explains: “The flagship store is no longer just a transactional space, but also functions as a marketing and brand vehicle for the retailer. With that in mind, the trend is for brands to look at fewer and better stores in tier-one locations, such as Oxford Street, enabling them to create one more aspirational space.”