It has been a year of mega-mergers for fund managers as AUM continue to grow. Sophia Furber reports on this year’s PFR rankings

The past year has been an eventful one in terms of high-profile mergers and acquisitions in the world of property funds. In the big league, BlackRock has swallowed MGPA, Aberdeen Asset Management has taken out Scottish rival SWIP, and Henderson has teamed up with US giant TIAA CREF.

So it is surprising that, according to exclusive data compiled by Property Funds Research for Estates Gazette, the league of top 10 managers ranked by UK assets under management has been disrupted by only one new entrant – Aberdeen Asset Management – in the 12 months to June 2014.

The fund manager has risen from 14th position last year to rank 6th in this year’s survey, with almost £10bn under management as a result of its Scottish Widows takeover, which formally completed in April this year. It would have entered the top five, had it not reclassified £3bn of SWIP assets as alternatives.

But apart from this, there has been very little movement. The question is why?

Global reach

One reason is likely to be the global ambitions behind many recent deals: many funds have sought to bring together a patchwork of global coverage under one worldwide umbrella. While these have involved headline-grabbing figures on an international scale, the impact on UK AUM has not reflected the activity.

Henderson’s £13bn “global alliance” with US giant TIAA-CREF, which completed on 1 April this year and led to the creation of TIAA Henderson Real Estate, was largely motivated by ambitions to boost exposure to Asian property markets.

Under the deal, Henderson merged its £10.5bn of European and £500m of Asian real estate assets under management with TIAA-CREF’s £2bn in Europe.

The deal added only around £500m to the newly minted TH Real Estate’s UK holdings. However, the firm’s UK AUM rose by £1.9bn over the course of the year, owing to a surge of asset purchases that accounted for around £1.4bn, according to James Darkins, the company’s chief executive.

“We have seen considerable capital value appreciation over the past year, but not across the board,” Darkins says. “Acquisitions have been the real driver of growth for us. Our major clients have been increasing their allocation to real estate relative to other asset classes over the past year because they simply haven’t been getting the returns from their bond and equity portfolios. Investment consultants are looking favourably at real estate.”

Flush with cash to spend, TIAA Henderson made a number of big-ticket transactions in the year to 30 June, including a £270m, 50% stake in thecentre:mk, a 1.3m sq ft shopping centre in Milton Keynes. The deal was made on behalf of long-standing segregated account client AusSuper, and represented

the A$70bn (£38bn) Australian pension giant’s first direct investment in real estate.

Similarly, BlackRock’s acquisition of private equity real estate company MGPA, which completed in May, led to the creation of a $23.5bn (£14.6bn) global real estate company – but had a muted impact on UK AUM. The deal was driven by BlackRock’s desire to build up exposure to property in continental Europe and Asia, and led to only around £370m of assets being added to its UK portfolio.

No big change… for now

So the old guard hang on to the top five spots, led for the 11th consecutive year by Aviva Investors – albeit with a narrowing gap between it and second-placed M&G Real Estate as its AUM fell by £759m.

Ben Stirling, managing director of European real estate at Aviva, credits this to a wave of disposals over the past year: “We have a number of closed-ended funds of the 2005-6 vintage that are coming to the end of their lives in the next year or two, so we have been in sell-down mode on a number of strategies.”

While there has been little movement over the past 12 months, particularly among the top five fund managers, the rankings will be shaken up next year at the very upper echelons, following Standard Life’s takeover of Ignis Asset Management, which completed just after the period for this year’s league.

Overarching trends

Overall, the year has been positive one for the fund management industry, with inflows into real estate generally rising across the board. A total of 48 managers participated in this year’s survey – up from 43 last year – giving a combined total AUM of £177.6bn, illustrating a steady climb back towards the £216bn recorded at the peak of the market in 2007.

This shows a 9.1% rise on last year’s figure – albeit with five more participants on paper – just shy of the 10.3% capital value appreciation record over the 12 months to 30 June 2014, according to IPD.

Despite fluctuating participant numbers, names disappearing through takeovers and £3bn of assets dropping out through reclassification, the broad direction of travel is clear: only six of the 48 saw a decline in UK AUM.

One of the notable fallers was Lend Lease Investment Management, which tumbled 11 places to 32, with AUM falling from £2.2bn to £802.6m. Part of this was the result of the sale of a £696m stake in Bluewater shopping centre in Kent, which completed in June. Additionally, a number of assets have been moved off balance sheet, according to a Lend Lease spokesman.

The wave of consolidation that many property-watchers predicted would happen in 2014, with mid-sized fund managers increasingly being swallowed by larger players, has, for the most part, failed to materialise.

“A lot of fund managers are interested in buying up businesses, but finding the right fit is very difficult – it’s like a jigsaw,” says Justin Brown, managing director at BlackRock. “Another factor is that a lot of the middle-sized investors that might have struggled otherwise have benefited from a rising market and are now looking more expensive for competitors to buy than they would have done at the end of 2012.”

This is not for want of trying. Official sales processes have completed or are in train for Orchard Street, Highcross, Valad and Pradera – reportedly being looked at by Cordea Savills – with more informal processes surrounding Catalyst Capital and rumours circling Rockspring early in the year.

The fund management sector is firmly back in growth mode, thanks to a vote of confidence from investment consultants, the gatekeepers of the investment management world, and an exceptional rise in capital values over the past year. While the rankings of fund managers have remained relatively undisturbed by the slew of corporate activity over the year, this could yet change in 2015 if much-vaunted buy-outs of mid-sized players become a reality.

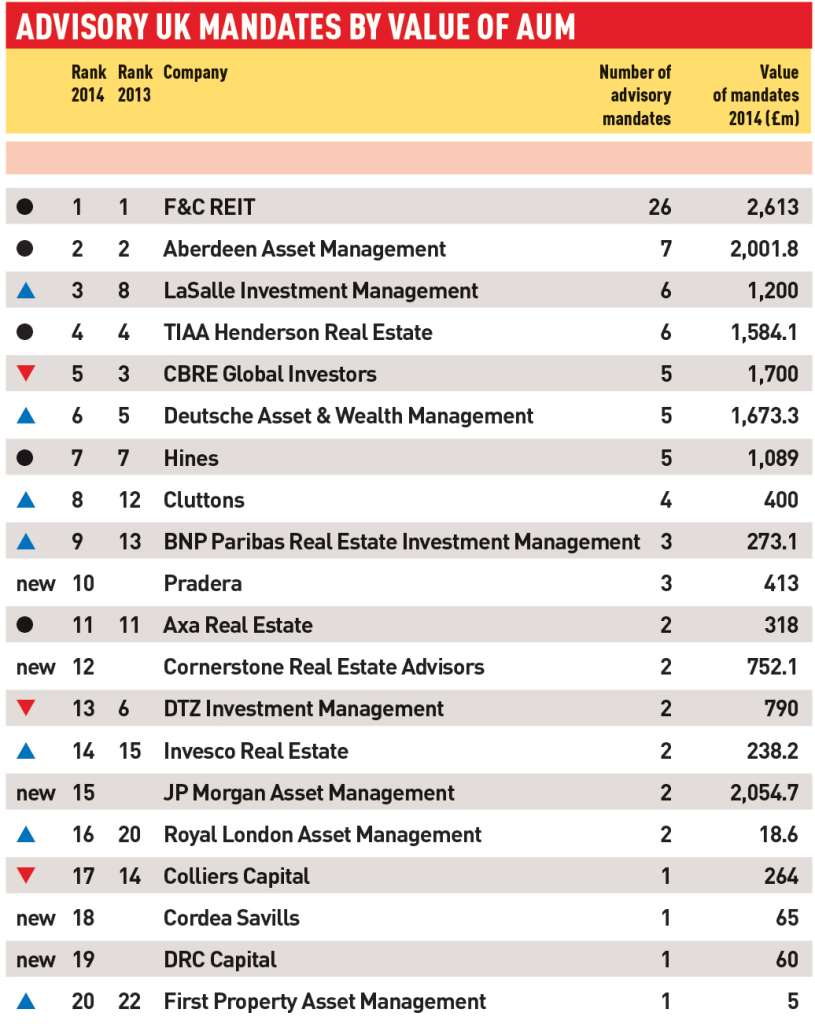

Advisory mandates: LaSalle is major mover

LaSalle Investment Management was the major mover in the rankings of managers by advisory mandate. It climbed from eighth to third place after more than doubling the size of its advisory business from £580m last year to £1.2bn by mid-2014. “This is partly due to our win of the £250m Alaska Permanent investment mandate in March,” said managing director Alan Tripp. The $50bn (£31bn) Alaska Permanent fund invests income earned from natural resources in the oil-rich US state. The mandate is its first move into European property. F&C REIT held top spot for the third year in a row with 26 advisory mandates, far outstripping its closest rival.

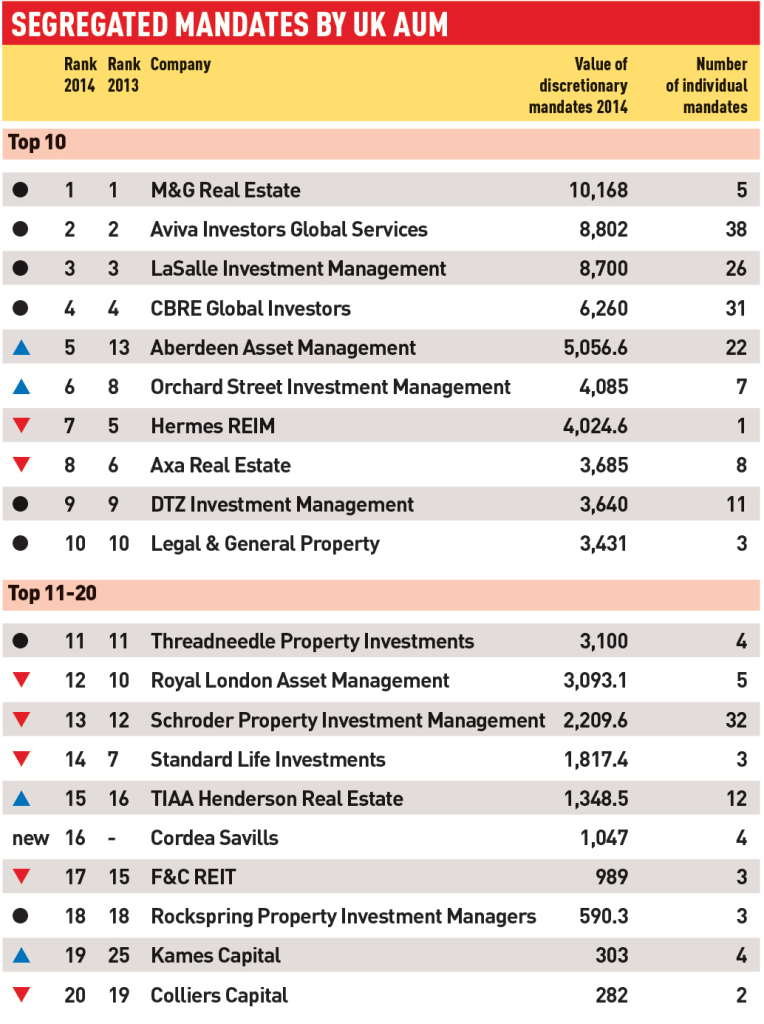

Segregated mandates: AUM jumps 10%

The total AUM in segregated accounts rose by 9.9% this year to £73.3bn, with the number of mandates remaining steady (225 in 2014, compared with 227 last year).

“Segregated account mandates are very popular with institutional investors at the moment, especially local authority pension funds,” says Andrew Creighton, managing director of UK property fund management at Aberdeen Asset Management. “However, this trend won’t necessarily continue into next year. We may see a shift back towards pooled vehicles as there is a tendency for new fund structure to be less rigid.”

M&G retained its lead as the number one manager of segregated account mandates by AUM for the third consecutive year, despite the total amount falling by £1.1bn to £10.2bn under management.

Aberdeen Asset Management saw the most dramatic increase in segregated account assets under management, rising 15 places thanks to mandates it inherited from SWIP.

Mergers

Several major mergers took place in the 12 months to 30 June and more are expected to follow

£5.8bn Aberdeen Asset Management entered into a £660m deal to acquire Scottish Widows in November last year, adding around £5.8bn of UK real estate to Aberdeen’s AUM.

£370m BlackRock bought private equity real estate investor MGPA in a $12bn deal in May. The transaction added only £370m to UK AUM.

£500m Henderson Global Investors merged with TIAA-CREF in a deal that completed in June to create TIAA Henderson Real Estate Investors, a £13bn business, which added around £500m to UK AUM.

£744m Paris-based investment group La Francaise and UK-based private equity firm Forum Partners announced plans to buy Cushman & Wakefield Investors in February. Following completion of the deal, La Francaise and Forum added $1.2bn (£744m) of separate account funds to their business.

£2.9bn Standard Life’s £390m purchase of Ignis Asset Management, which completed in July, added £2.9bn to its UK AUM. This will feed into next year’s rankings, jostling the top five positions.

£12bn Cordea Savills was in advanced talks to buy SEB Asset Management at the time of writing. The German-based property arm of Swedish bank SEB has around €12bn of European AUM.