CBRE’s UK revenue was up by 20% in the third quarter despite a market slowdown.

The real estate advisory giant said that although sales volumes had fallen, the UK property market was fundamentally strong. It pointed to the recent leasing of Battersea Power Station, SW8, to Apple, on which CBRE advised, as evidence.

The results reflect CBRE’s ongoing repositioning of its UK business towards asset management.

Revenues were bolstered by CBRE’s acquisition of Global Workplace Solutions in December 2015. Excluding that part of its business, UK revenues were still up by 8% from the third quarter of 2015 – a turnaround from last quarter, when they were down 2%.

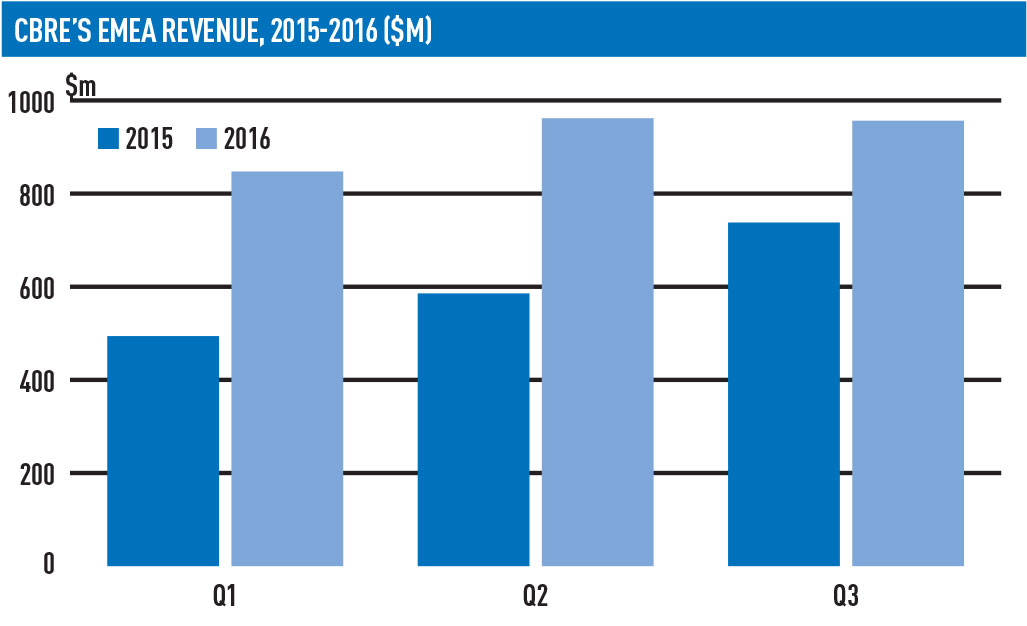

Its EMEA revenue was up by 30% on a quarterly basis to $956m, a rise the company attributed to growth in France, the Netherlands and Switzerland, offsetting falling deal volumes in the UK.

CBRE posted worldwide revenues of $3.2bn in Q3, up by 18% from the year before, with fee revenues up by 9% to $2.1bn. EBITDA fell by 13% to $284.6m. Property sales activity decreased by 7%.

• CBRE Global Investment Management’s assets under management grew by 6% to $87.9m during the period.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette