Prime London house prices have fallen in both central and outer prime locations over the past quarter, according to latest Savills quarterly prime London Index.

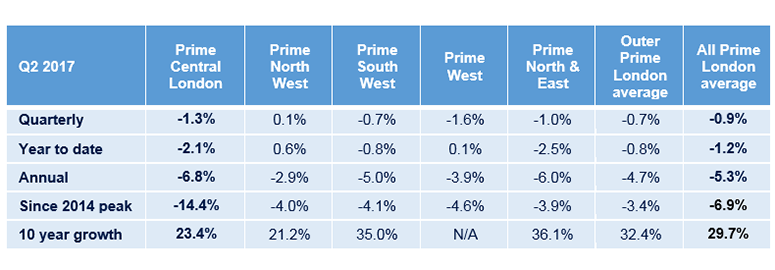

Average prime London values slipped by 0.9% in Q2, leaving them 5.3% down year on year and 6.9% below their mid-2014 peak.

Ten years on from the credit crunch, this puts total gains at almost 30%, albeit this is down from the mid 2014 peak of the market, when post-2007 gains stood at 37%.

Lucian Cook, head of residential research at Savills, said: “Ahead of the vote to leave the EU, there were signs of a market bottoming following the adjustment triggered by the December 2014 stamp duty reform, and some locations had started to show price growth, but increased political and economic uncertainty has weakened fragile buyer sentiment.”

To send feedback, e-mail alex.peace@egi.co.uk or tweet @egalexpeace or @estatesgazette