Retail property is a hard game. Reading the property cycles and the effect they have on a portfolio is difficult enough; the ups and downs in consumer spending and the constantly evolving technology and trends in shopping make it even more challenging.

The sophisticated nature of the sector perhaps explains why some listed retail property specialists have struggled compared with their more general real estate peers, and could also explain why the City can sometimes be perceived as wary of piling in.

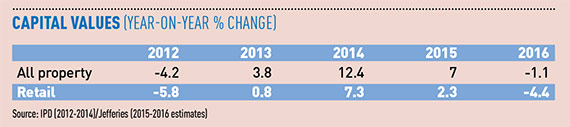

In his bearish forecast calling the top of the property market in August, Mike Prew, managing director and head of real estate research at Jefferies, reserved his most damning projections for those companies with large retail exposures.

Borrowing from the Wall Street Journal, his note said: “We conclude that the equity market will increasingly reward lower retail exposure into 2016 which only serves as insurance against M&A in the sector, which is witnessing the suburban utopia left to rot as online shopping and the resurgence of city centres make malls increasingly irrelevant to young people.”

Less volatility

The counter-argument for retail is that, while it might be slow, it is at least steady, and it provides the strong income that many investors crave.

Timon Drakesmith, Hammerson’s chief financial officer, points out that the company has provided a compounded annual growth rate, in terms of its dividend per share, of 7.1% since 2011.

“Many investors who like retail companies are trying to position themselves in what is generally regarded as a more stable and less volatile market. There is a collection of global investors who are less interested in the wild rides of the likes of the London office market and are more interested in sustainable growth,”

he says.

Retail’s relative poor performance in recent years, says intu chief executive David Fischel, is less to do with the faults of the sector and more to do with offices – in particular, London offices – being buoyant.

“We do accept shopping centres and retail have been out of favour, but in reality that is because of how well offices have performed rather than how badly retail has performed,” he says. “The crash did a lot of damage out in the regions and essentially companies like us and Hammerson don’t have central London assets, so that has been a factor.”

City approval

Being able to provide a strong income growth story is important in order to gain the approval of the City.

Intu has seen income in its five largest out-of-town shopping centres decrease by 1% over the past four years and by 0.1% within its largest in-town shopping centres over the past four years.

However, the company has outperformed the IPD all-retail index consistently since 2009 in terms of its overall capital values.

Capital & Regional had a tumultuous downturn, almost crippled by a mountain of debt and falling income due to retailer administrations. As a result, its share price fell to as low as 17p in 2009, but it has since performed well off a low base.

Chief executive Hugh Scott-Barrett, says that rebasing rents at that time has benefited the company’s share price, as there is seen to be more growth within its portfolio.

“We had to rebase rents in order to try to maintain vibrancy and we took hits on a lot of centres in terms of income. But we can now present a story that people understand in terms of growth and put in place initiatives to reconfigure and refurbish our shopping centres,” he says.

The other retail specialist that has outperformed is NewRiver Retail. After floating six years ago it has specialised in secondary centres where it can gain high-income yields to pay regular dividends to shareholders.

“The performance of retail REIT specialists is, in my view, not impacted by internet retailing but by the quality of management teams, business models and financial performance. The key is dividend yield and earnings growth,” says Allan Lockhart, property director at NewRiver.

“We have deliberately gone after the highest-yielding assets we can with the lowest risk profile and have applied asset management and development strategies that have allowed us to focus on earnings and income.”

Incoming impact

The most important structural trend affecting the sector is online retailing – less bricks and more clicks.

In order to be backed by the City and the market, a company’s retail portfolio has to work incredibly hard.

“Click-and-collect is offered by 70% of our retailers and we have rolled out CollectPlus stations across our portfolio, operated by our people. We have already seen a pattern of people coming in to pick up from retailers not in our centres, and that’s driving spending in our stores,” says Mark Bourgeois, executive director at Capital & Regional.

Whether in or out of fashion, making a strong return on retail is never easy, but perhaps it will have its day in the sun once the boom in the office market has run its course.

Intu’s Fischel says: “To be in the shopping centre business, you need to have a long-term mentality to be successful because the time it takes to get through the planning process, develop a centre and prove performance is between 10 and 15 years.”