Institutional investors are expecting to target more UK and European real estate even as sentiment toward the industry dips, according to a survey by investment adviser Hodes Weill and Cornell University.

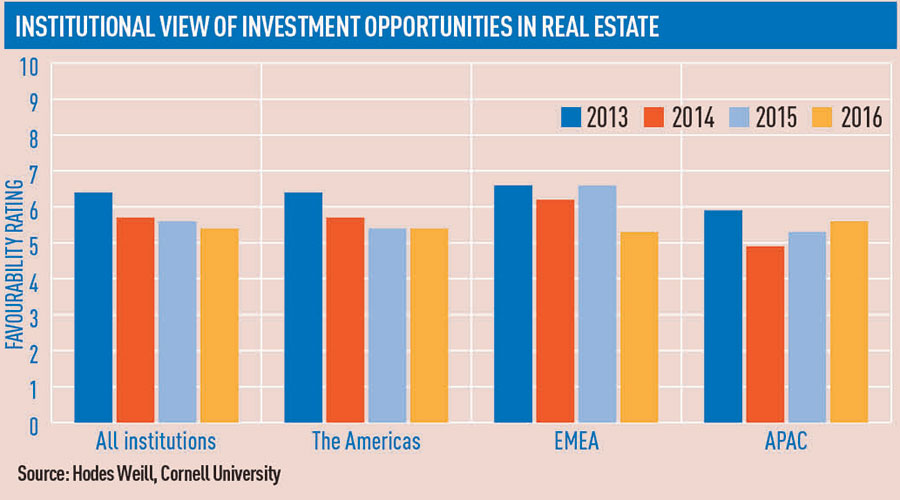

European respondents in the fourth Institutional Real Estate Allocations Monitor rated the industry 5.3 out of 10 in terms of favourability, down from 6.6 last year, while worldwide sentiment toward real estate dipped from 5.6 to 5.4.

However, over the past year the proportion of institutions focusing on European real estate jumped from 56% to 72% as the proportion targeting the UK rose from 51% to 64%.

Will Rowson, a partner at Hodes Weill, said: “With the slowdown of GDPs, Brexit in the middle of the year and some of the geopolitical risk coming up in Europe, this has suddenly brought a dose of reality back to the conviction index.”

However, he added that real estate, particularly UK PRS, has become flavour of the year for investors looking at long-term strategies and consistency through crises, even if short-term prospects were less favourable.

Overall this year, 9.9% of institutions targeted real estate, up by 34bps in the past year, equating to $920bn (£749bn) among the 228 respondents.

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette