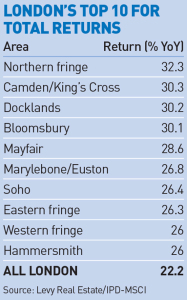

London delivered a 22.2% total property return in 2014 thanks to 7.8% rental growth coupled with 60bps of yield compression.

London delivered a 22.2% total property return in 2014 thanks to 7.8% rental growth coupled with 60bps of yield compression.

The tech heartlands of the northern fringe remained the top submarket, according to the London Markets Analysis report, posting a 32.3% return for the year, thanks to 21.7% rental growth.

The research, by Levy Real Estate and IPD-MSCI, found that even Paddington, which was the worst-performing submarket, delivered a total return of 16.2%.

Levy investment partner Simon Heilpern said: “If you take the worst-performing market with a return of 16% and compare that to current interest rates and bond yields, that is a staggeringly good return.

“When you get up to 20% or even 30% returns you are talking about an incredibly strong performance,” he added.

Transport and public realm improvement helped drive returns in several markets, with King’s Cross the second-best performing submarket, with a 30.3% total return, up from 18.5% last year.

Docklands saw the strongest improvement on 2013, achieving a 30.2% total return, which was more than double the 14.3% it returned in 2013.

The increase – which saw equivalent yields tighten from 8.5% to 6.5% – put it third in the submarket standings, up from 15th last year. The improvement came as the Qatar Investment Authority and Brookfield closed in on a takeover of the dominant landlord in the area, Canary Wharf Group, albeit with the IPD sample weighted to property outside the wharf.

The overall London return was 14.2% in 2013.

London’s overall equivalent yield now stands at 5.2%, down from 5.8% last year.

With bond yields at close to zero, Heilpern predicted further yield compression over the next year, while forecasts from Real Estate Strategies suggest rental growth will continue at around 5% pa.

On this basis the capital could be set for at least another two years of strong returns, following which Crossrail will come online, generating further growth, Heilpern added.