The stark fact is that almost any outcome from Thursday’s general election will be bad for this industry.

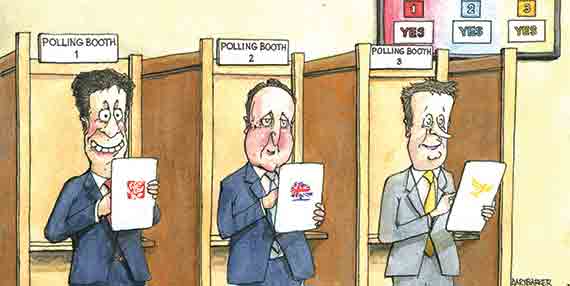

Labour’s plan for intervention in the residential market is the headline concern, according to the REview, our new monthly poll. The fact that David Cameron is less popular than his party doesn’t help the Conservative cause either. But it is his promise of a referendum on Europe that is driving similar levels of anxiety.

This tension rippled through several events this week – dominating discussion at our London Question Time last week and at Thursday’s Movers & Shakers breakfast at The Dorchester.

At these, and at the latest gathering of our Real Estate Leaders Group too, the chief executives of many of the biggest REITs, the heads of some of the most powerful institutions, as well as bankers, private investors and agents, all wrung their hands and shook their heads.

The consensus is that the mere threat of rent controls and mansion taxes is enough to put off investors. But no less damaging would be two years of uncertainty ahead of an EU referendum. Add to that a growing fear that further property taxation is inevitable and property’s political climate looks dicey indeed.

To this you may add the single-issue political parties and the protestors – some with a case, some less so – that are gaining traction and frustrating developers.

And we should expect politics to seep into other areas of real estate. The incoming defence secretary will have to make a decision about a potential £1bn sale of Hyde Park Barracks in prime Knightsbridge. Will it be possible for the government to trigger further prime residential development on MoD land in a climate where the defence budget is under unprecedented scrutiny? It’s controversy squared.

So it is an election whose ultimate outcome may be uncertain but from which there will certainly be negative consequences for the property business.

But, to conflate the off-platform views of a couple of chief execs this week, given that the financial crisis has worsened living standards for so many through no fault of their own, it’s not all about real estate’s financial stability. Social stability matters too.