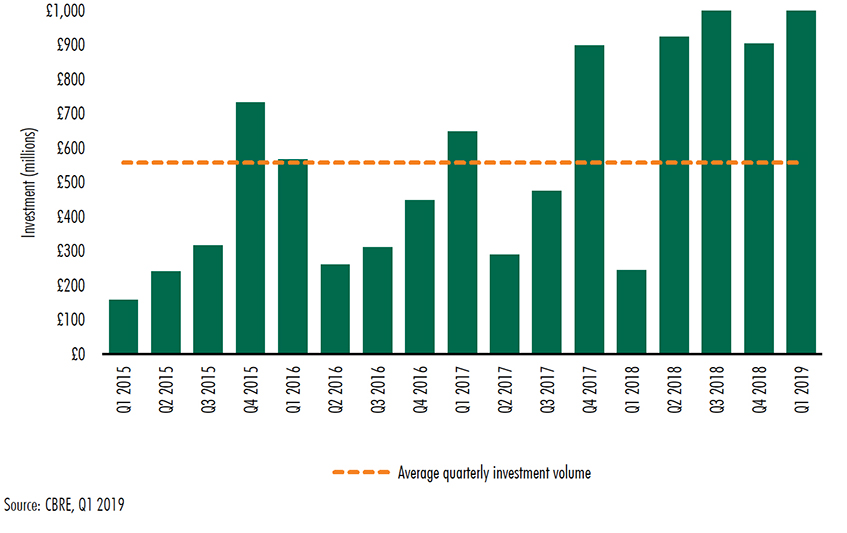

Build-to-rent investment in the UK hit record levels, topping £1bn, in the first quarter of the year, according to CBRE.

Its UK Residential Investment Marketview report clocked £1.04bn of investment – four times higher than the same period a year earlier.

CBRE attributed this to a combination of forward funding deals and direct site acquisitions. London accounted for 82% of the total investment.

Institutional investment volumes into the private rented sector

The bulk of investment came from the £670m Unibail-Rodamco-Westfield Cherry Park Partnership with PSP Investments and QuadReal Property Group. The PRS scheme (pictured above) adjacent to Westfield’s shopping centre in Stratford will see 1,200 rental homes.

Further deals included Realstar’s 161-home scheme in Hackney and Henderson Park and Greystar’s £105.5m forward funding of Telford Homes’ Equipment Works site in Walthamstow.

At the end of the quarter, CBRE recorded a further £779.2m of deals under offer. Some 86% of this was in forward funding deals and 53% of this was focused in London locations.

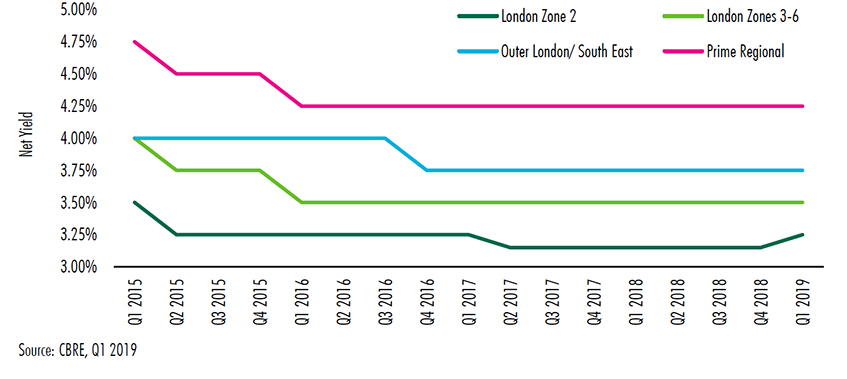

Prime net investment yields remained stable at 3.25% in zone 2, 3.5% in zones 3-6, 3.75% in outer London and 4.25% in prime regional locations.

Prime net investment yields

Alex Davis, senior director for residential capital markets at CBRE UK, said: “Much of this growth has been driven by international investment, with the large North American funds making their mark, particularly in London.”

He added that European investors have been more active across the regions, pointing to L&G’s acquisitions in Glasgow and Chelmsford.

Davis said: “This highlights the growing appetite – particularly amongst UK institutions – to explore ‘new’ markets across the UK’s regional centres and try to grow their portfolios more aggressively.”

To send feedback, e-mail emma.rosser@egi.co.uk or tweet @EmmaARosser or @estatesgazette