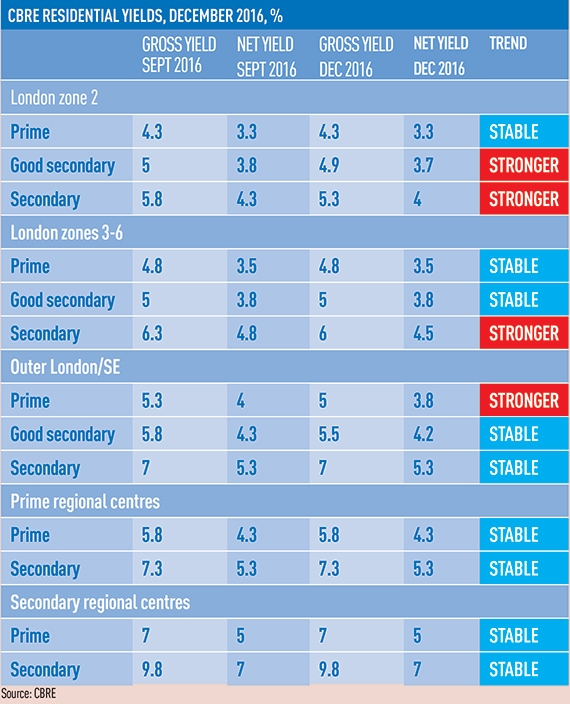

Residential property investment yields have hardened in the last quarter in London and the South East as sentiment regarding the future of PRS improves.

According to the CBRE Residential Yields Index, the end of Q3 and beginning of Q4 saw a flurry of forward-funding deals, with tightening supply in London and the South East leading to yield pressure.

“London remains number one on most investors’ lists,” said Jason Hardman, executive director at CBRE residential valuation and advisory.

“We have seen fewer land trades, and pricing differentials are still a problem, but London remains attractive to investors, owing to the overwhelming supply and demand imbalance.”

The rental market in London has been boosted by the slowing housing-for-sale market, and by mayor Sadiq Khan in the London Supplementary Planning Guidance.

The guidance will allow rental schemes to be treated differently to build-for-sale units in terms of affordable housing provision during the planning process.

Hardman said the new trend was towards aggregation and platform creation on the management side. “We are starting to see jostling from a management perspective. As the pipeline nears completion, we are seeing who the favoured managers are going to be.”

• To send feedback, e-mail alex.peace@estatesgazette.com or tweet @EGAlexPeace or @estatesgazette