The Bank of England announced no change in its 0.5% base rate on Thursday afternoon, defying expectations in the property market.

Analysts were surprised by the 8:1 vote by bank governors to hold rates, but saw it as a sign of governor Mark Carney still taking stock of the economy following the EU referendum last month.

Shane Canavan, a director at JC Rathbone, said: “The market is still expecting a rate cut, probably in the next meeting. This meeting probably came just a little too soon following the referendum. The Bank of England only has so much powder, and it probably thought using it today was a bit early.”

Immediately following the decision, the pound jumped from £1.325 to £1.338 against the dollar and the five-year swap rate rose by 5bps.

However, the effect on real estate was expected to be subdued.

Lucian Cook, director of Savills residential research, said that if the decision led to increased lending margins it could squeeze affordability, although any effects would be marginal.

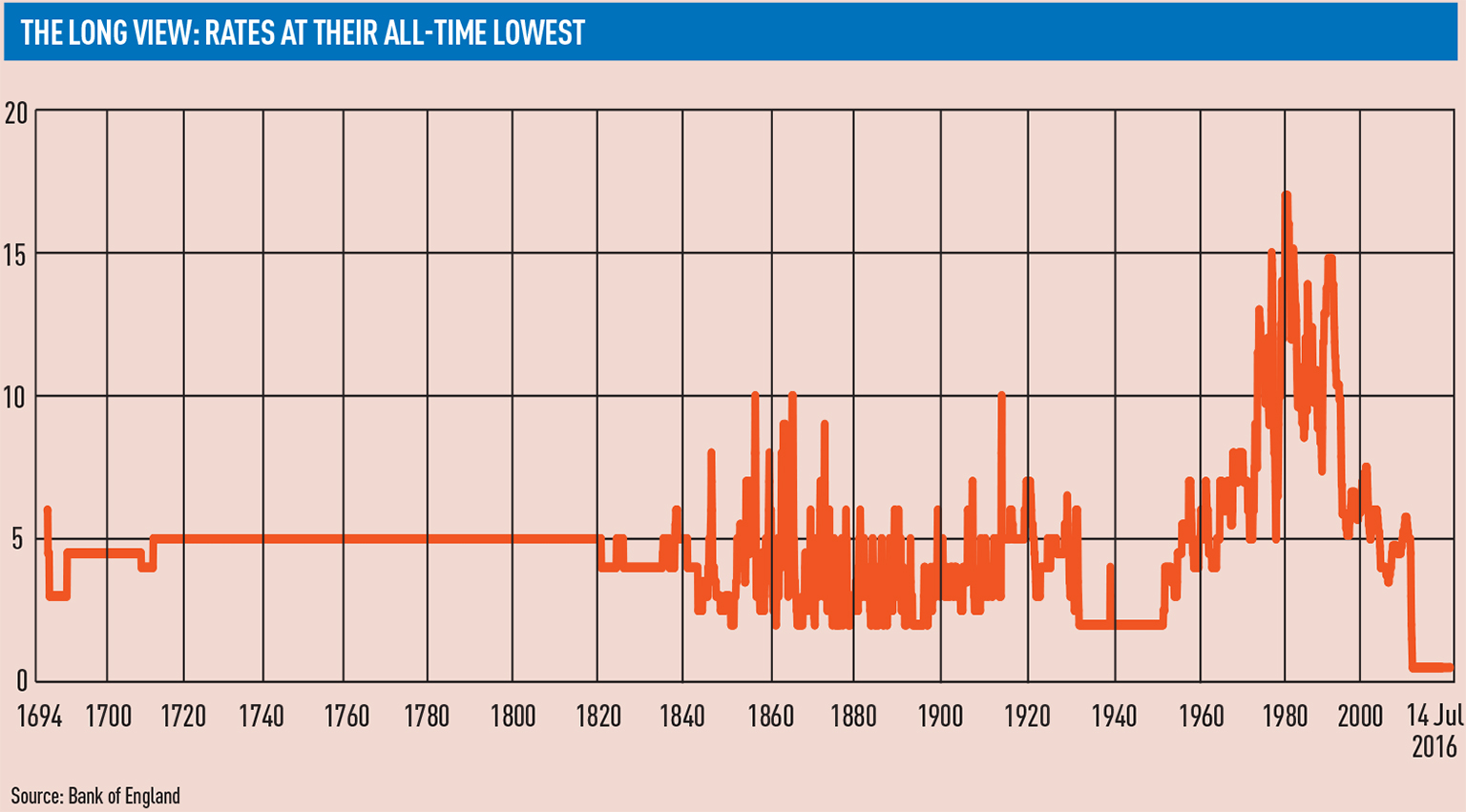

He added: “On the residential front, it will not detract from the fact we continue to have a period of low interest rates.”

Mat Oakley, director of commercial research at Savills, said: “Interest rate movements on commercial property, unless they are dramatic, are relatively irrelevant. What borrowing takes place is done off the Libor rate.”

He added: “Commercial property lending volumes are likely to be relatively muted for a while as both the banks and the borrowers are taking

stock.”

However, Miles Gibson, head of research at CBRE, said: “With sterling-priced assets still looking attractive to overseas investors, whose cost of capital is not driven by UK debt markets, London and the UK most definitely remain a strong investment opportunity.”

• To send feedback, e-mail karl.tomusk@estatesgazette.com or tweet @ktomusk or @estatesgazette