FINANCE: European real estate loan sales more than doubled year-on-year to reach €80.6bn (£60.3bn) in 2014.

FINANCE: European real estate loan sales more than doubled year-on-year to reach €80.6bn (£60.3bn) in 2014.

The figure for European commercial real estate and real estate-owned transactions last year was more than 2.5 times higher than 2013’s figure.

Cushman & Wakefield’s EMEA corporate finance team said the final quarter of 2014 proved a buoyant one, with €23.9bn sold.

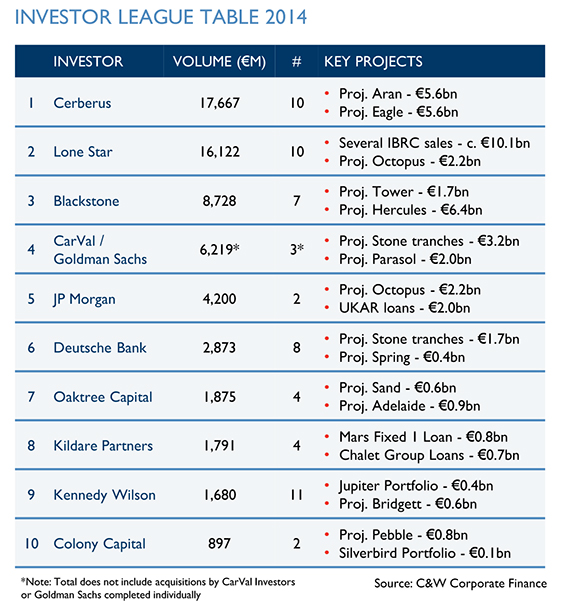

Deals in 2014 included Cerberus buying the €5.6bn Project Aran, an upsized Irish and UK real estate loan portfolio sold by RBS, which is looking to accelerate its disposal of its legacy Ulster Bank loan book.

It is expected to be more difficult to reach the €80bn mark in 2015. With IBRC disposing of almost a quarter of the 2014 total, 2015 will be dependent on the activity of the likes of Nama and SAREB to feed the demand for European opportunities.

Up to €70bn of closed CRE loan and REO transactions are forecast in Europe for 2015, according to the Cushman & Wakefield report.

Federico Montero, Cushman & Wakefield’s head of loan sales, EMEA corporate finance, said: “All records were broken in 2014. The €80.6bn of loan sales recorded highlights the full extent of the troubled assets European lenders have had to deal with since the crash. The figure also illustrates the vast amount of US capital still hungry for distressed opportunities in Europe.”