Occupiers could face the greatest risks when the government lifts restrictions, new research shows.

Traditional real estate tenants have been ranked as businesses that have been heavily impacted as a result of lockdown measures, as well as those that face the greatest challenges in returning to the workplace, research by Aviva Investors shows.

Financial services and media occupiers, as well and retail and leisure tenants, are ranked as businesses for which “the benefits to society of these sites reopening is low in the short term”.

This is because people can choose to shop online or staff can operate remotely. Serviced offices also fall within this category.

Open for business?

Source: Aviva Investors, May 2020

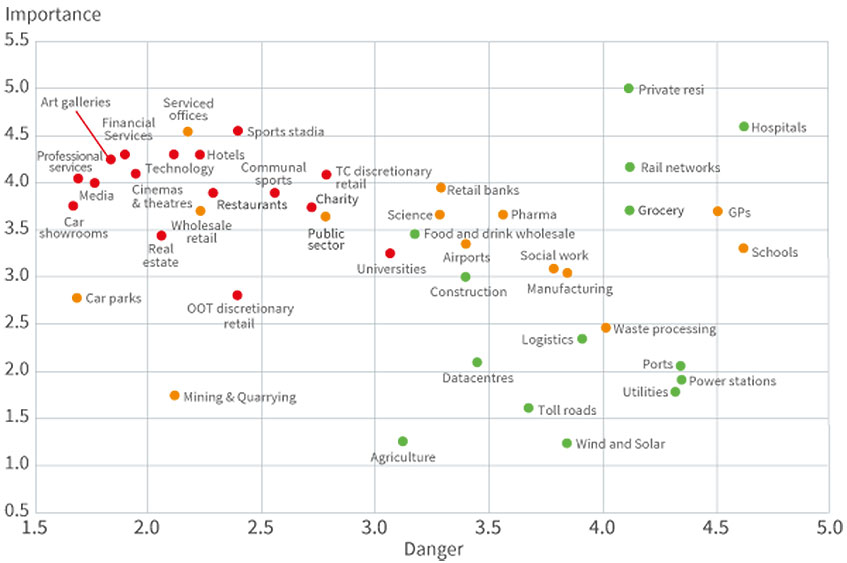

The chart above ranks industry sectors relevant to European real assets investors by the benefits of returning to their usual workplace against the risks of doing so.

It shows that there are greater benefits to being open for “utility-like” sectors favoured by infrastructure and long-income real estate investors – such as power, hospitals and schools – while the relative risks are lower.

Consequently, many of these sectors have remained open throughout the crisis (shown by the green dots). Aviva Investors expects other assets in these areas that have closed to reopen first.

To send feedback, e-mail lucy.alderson@egi.co.uk or tweet @LucyAJourno or @estatesgazette