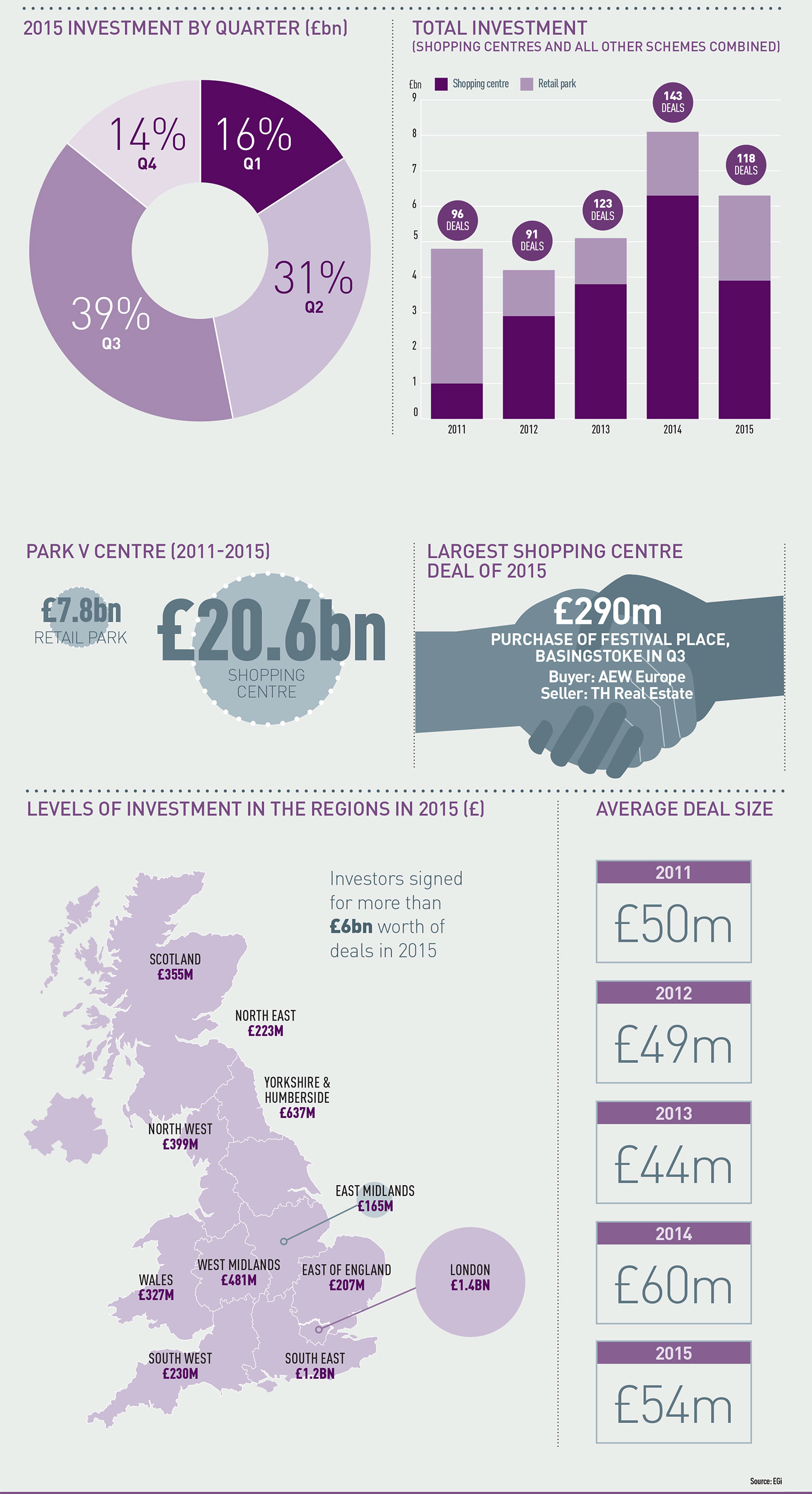

Retail investment fell 23% in 2015 compared to the previous year as 12 high-profile shopping centre deals failed to cross the finishing line.

Investors signed for more than £6bn of deals, but an additional £1.6bn was expected to get over the line in Q4, which would have pushed the year end total to £7.8bn – within a whisker of 2014’s high.

The industry had eagerly anticipated the sale of schemes such as the £250m Project Charlotte Portfolio, a seven-mall investment which went under offer in March, as well as trophy deals such as Grand Central, Birmingham, secured by Hammerson in September 2015 for £310m.

Long lead-in times for joint venture sales were blamed for delays and many are now expected to complete in the first quarter of this year. Demand remains high, though the number of centres coming on to the market stayed low, down to 118 this year compared to 143 in 2014.

“It is interesting that a number of agents have publicised the number of deals being carried out over the last few years as very high, but these are some way off previous peaks, not in terms of capital value but in terms of number of transactions,” said one industry expert.

Retail parks made a comeback, representing nearly 40% of sales – double last year’s share.

Fourth quarter investment fell at the final hurdle, registering the worst performance of the year at £875m and failing to live up to the fast pace set across the rest of the year.