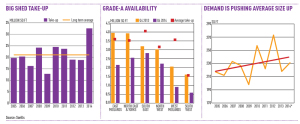

In 2014 take-up within the industrial and logistics sector reached previously unheard levels, rising a staggering 73% from 2013 figures to reach 32.6m sq ft across the UK.

The figure is significantly ahead of the long-term average of 21.5m sq ft. Moreover, while the industry is often synonymous with large, single deals skewing the figures artificially high, 2014 saw the deal count rise above 100 for only the second time since 2006, reflecting a market driven by significant churn and growth in the smaller unit sector.

This being said, there have been a number of extremely large transactions which have ensured the average-sized deal now stands at 232,000 sq ft. Primark and Waitrose have both taken units around the 1m sq ft mark; Primark has let 1.03m sq ft at A14 Central in Kettering and Waitrose has completed a 950,000 sq ft design-and-build deal at Magna Park in Milton Keynes.

This being said, there have been a number of extremely large transactions which have ensured the average-sized deal now stands at 232,000 sq ft. Primark and Waitrose have both taken units around the 1m sq ft mark; Primark has let 1.03m sq ft at A14 Central in Kettering and Waitrose has completed a 950,000 sq ft design-and-build deal at Magna Park in Milton Keynes.

Across the regional markets, nearly every region that Savills records data on has seen take-up surge. The East Midlands alone, driven by almost 2m sq ft of build-to-suit deals, has seen take-up rise by 3.5m sq ft to 6.4m sq ft. The East and West Midlands areas combined accounted for 40% of all take-up in 2014, demonstrating the importance that retailers are placing on being located in the centre of the country.

In terms of which tenants are driving demand, the market is being dominated by the retail industry. This includes both traditional high street retailers and grocers and also online-only retailers such as Amazon and Wiggle. With 47% of space taken directly by retailers the importance of this sector cannot be underestimated to the logistics market. With strong positive drivers for consumer demand set to continue we estimate that 2015 will be another strong year for the logistics market.

It is also worth mentioning the manufacturing and engineering sector, which is often overlooked within the market, as 2014 saw the proportion of take-up rise to account for nearly a quarter of demand. With “Made in Britain” becoming an increasingly important factor for the emerging Asian middle classes, we expect the UK manufacturing sector will play an increasingly important part in the tenant mix.

This surge in demand has had a knock-on effect on current supply levels, delighting landlords and developers but perhaps not occupiers of logistics and industrial space.

This surge in demand has had a knock-on effect on current supply levels, delighting landlords and developers but perhaps not occupiers of logistics and industrial space.

For existing buildings over 100,000 sq ft supply has fallen by 27% year-on-year and now stands at just 22m sq ft. For modern grade-A buildings the figure has fallen to just 10.3m sq ft, down from almost 20m sq ft at the end of 2013. This hasn’t, however, spurred developers into committing to vast amounts of speculative development: at the time of writing Savills is tracking 15 logistics schemes over 100,000 sq ft through the development pipeline, totalling 3.5m sq ft. Of this, 10 units are under construction and due for delivery through 2015. The five remaining schemes have been announced and await detailed planning consent to proceed.

In most cases the development pipeline combined with existing stock remains some way below average take-up levels, meaning that occupiers will struggle to locate large requirements and the balance of the market must shift towards the build-to-suit sector if take-up levels in the market are to continue or indeed even strengthen.