Residential land values fell further in the second quarter as May’s general election, build-cost inflation and a focus on margin over volume depressed housebuilders’ appetite for new sites.

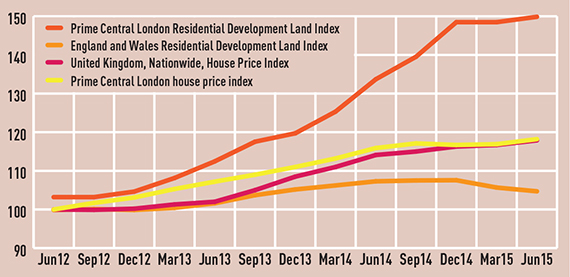

Knight Frank’s residential development land index found that greenfield land values dipped by 0.9% from April to June this year, taking the total fall for 2015 to 2.7%.

Knight Frank UK head of regional land David Fenton said housebuilders had become more selective about sites, having had access to higher levels of consented land in the past few years through the introduction of the National Planning Policy Framework.

Many had also reined back on land purchases in the face of rapid construction cost inflation, which risked eating into profit margins, he said.

Fenton warned that prices may face further downward pressure from the government’s shock u-turn in the July budget, when it announced that social housing providers would be forced to cut rents by 1% per year over the next four years.

“We are already seeing the change in rent policy for housing associations having a significant impact on the land market,” he said.

However, the index revealed that prices for land in prime central London continue to rise.

jack.sidders@estatesgazette.com