As buy-to-let landlords find themselves handing more and more cash to the taxman, many are choosing to diversify. In fact, private investors bought more commercial property at auction last year than at any time in the past decade. Here, investors and advisors explain the attractions,

as well as the potential pitfalls.

“We started looking at commercial about six months ago, and we are steering away from anything residential,” says private investor David Wainwright.

His company, Network Investment Services, has a portfolio of 26 residential properties, but has been finding it increasingly difficult to secure finance to buy more. As well as facing tougher affordability checks on buy-to-let mortgages, investors like him are being hit by the government’s 3% stamp duty hike on residential investments and the phased reduction in tax relief on mortgage interest payments.

The Lancashire-based investor is now considering moving his residential properties from a partnership into a limited company to improve his tax position.

But while he chews over the costs of doing that, Wainwright is busy buying his first commercial investment: a convenience store let to Co-op on a 15-year lease in Kirton, Lincolnshire, for £830,000, a 6.5% yield. The money is coming from the firm’s pension fund, which has a cash reserve, but he expects to secure borrowing against it at 4% once the deal goes through, making the return even more attractive.

A growing army

He is not alone: Wainwright is part of a growing army of private investors making the switch into commercial and using auctions to buy the sub-£4m investments that are the bread and butter of the auction room sales – and which can be difficult to track down in the private treaty market for those new to the sector.

In Wainwright’s case, the Co-op investment was sourced by Harrow-based Prideview Group, which specialises in buying commercial investments at auction for private investors. He sought the firm’s advice after making some unsuccessful telephone bids at auctions held by Allsop, the largest commercial auction house, and says he intends to use auctions to source more stock like the Co-op investment, let to good covenants on long leases.

Duncan Moir, partner and auctioneer at Allsop, says a quarter of the buyers now coming to his firm’s commercial sales are new to the commercial market. “There is clear evidence of new buyers coming into the market who have been concentrating on buy-to-let investments,” he says. Most people are now cash buyers, and there is a lot of unspent money in the market, he adds.

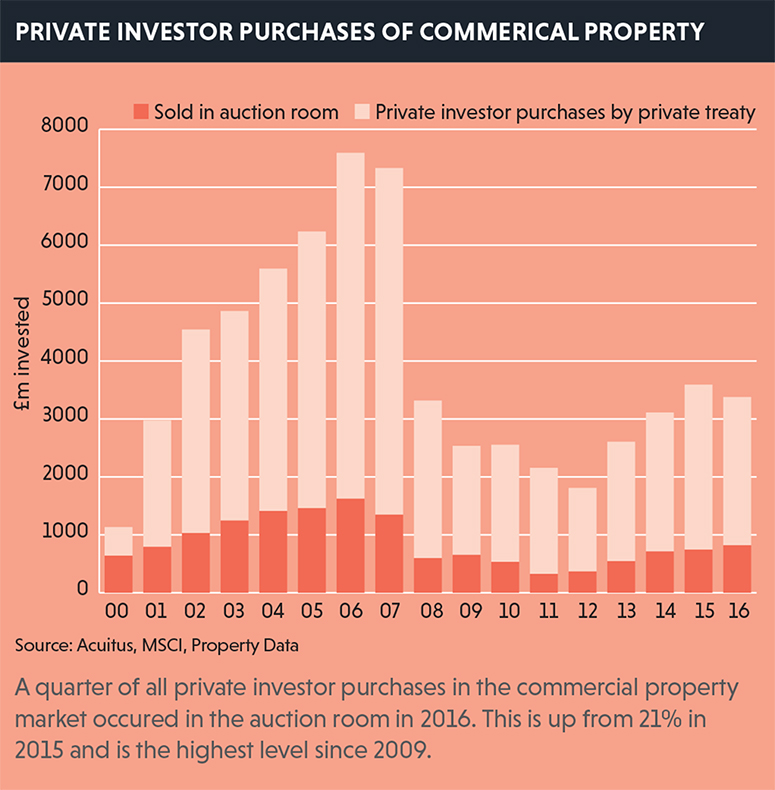

In fact, private investors are now buying more commercial property at auction than at any time since this part of the property market peaked in 2006, according to research commissioned by commercial auctioneer Acuitus. Last year, auctions were the conduit for £820m of commercial property buying by private investors, up from £745m in 2015 (see graph). What’s more, this part of the market grew last year despite the overall value of private investor transactions in commercial property shrinking slightly, from £3.6bn in 2015 to £3.4bn in 2016.

Yields have historically been higher for residential investments: over the past ten years, it has delivered a return of 9%, versus 5.7% for commercial property, according to Countrywide. And regardless of the rising costs of residential investment, long-term house price growth continues to trend upwards – meaning that it remains a worthwhile long-term investment play for those seeking to boost their pension nest egg.

Longevity of income

However, the longevity of commercial income is a major draw when compared with residential tenancies, which typically are for 12 months.

“For a pension fund commercial is much safer as a long-term investment, with a guaranteed income,” Moir says.

Philip Waterfield, auctions director at Strettons, says he expects the shift from residential to commercial to increase now that would-be investors can draw down a lump sum at 55 from their pension. “I have a lot of clients in residential and they are slowly moving into commercial, where you can buy with a long lease and forget about it,” he says.

Another convert is Veeral Sanghrajka, a director with glasses wholesaler Hilton International Eyewear. He buys commercial properties as investments for a SIPP (self-invested personal pension) scheme.

Another convert is Veeral Sanghrajka, a director with glasses wholesaler Hilton International Eyewear. He buys commercial properties as investments for a SIPP (self-invested personal pension) scheme.

“It is a good additional business to have – it is very attractive to us,” he says. Sanghrajka, who is also a client of Prideview, says he has looked increasingly at commercial investments over the past five to 10 years and sees their many advantages, starting with the price.

“Commercial is much more affordable. A one-bed flat in London could be £500,000, but you can pick up a Barclays Bank with a 15-year lease for £250,000,” he says.

“We take the long-term view and we feel it is recession-proof,” he adds.

He finds commercial tenants are usually easier to deal with and more reliable, with more of the repairs burden falling on them than with a residential property. “A long-term lease with a residential tenant is a year, but you could have 10 years with Barclays,” he says.

Interest in UK commercial property has also come from overseas, according to Prideview director Jesal Patel. “We are getting enquiries all the time from buyers who are switching from residential to commercial,” he says. “Many of the interested people are abroad and want to exploit the weak pound.”

Patel says investors who are new to the commercial market sometimes lack confidence initially, but when they see that a commercial property needs less management, they grow into it.

Another draw to the commercial auction room is that investors can find mixed-use investments such as shops with flats above and avoid the higher rates of stamp duty applied to pure residential investments.

“The value of shops around the M25 area is in the upstairs,” says Patel. But he adds that competition for such lots tends to be fierce from investors seeking out diverse sources of rental income or looking to realise a profit by splitting the property up and selling the parts off separately.

Surge in interest

Andrew Parker, auctioneer and managing director of Midlands and North West auctioneer SDL Auctions, says his firm is seeing a “surge” in interest in mixed-use lots in response to the tax changes on buy-to-let.

“Retail units with an apartment above have risen in popularity, as buyers pick them up at auction and then seek to get planning permission for a change of use of the shop to residential,” he said.

Richard Auterac, chairman of Acuitus, the UK’s second-largest commercial auctioneer, says there are often development angles to exploit for more experienced investors.

“There are huge areas of upper floors that are mothballed. In some areas the residential market is still very weak, but in town centres where people want to live, the upper floors of retail are attractive,” he says.

“This has changed dramatically in the past 10 years. Previously, the value was in the shop, and the upstairs space was ancillary or used for storage.”

Hugh St Pier, a dealer and developer specialising in reversionary property in London and the South, says these kinds of opportunities can work well for investors who have cut their teeth on pure residential – provided they find a lender happy to provide mortgages on flats above shops, as many will not.

But he also believes that the “traditional” buy-to-let market is far from over: “The average buy-to-let landlord looking to avoid stamp duty will look at the rest of the market and where they can put their money. They should, however, be able to negotiate 3% off to secure the right product in the right location,” he says.

David Callaghan

Landlords throttle back on buy-to-lets

Allsop’s spring issue of the Rent Check report, which covers England and Wales, found that the percentage of existing landlords intending to purchase one or more properties in the next 12 months was just 16%. This is the lowest level since the report began in autumn 2012. Around four-fifths (83%) of landlords reported that obtaining buy-to-let finance had become more difficult in the past six months.

The report, compiled with market research consultancy BDRC Continental, tracks the experience of more than 1,500 members of the National Landlord Association, covering 11,595 properties.

Despite the worsening tax position, it forecasts a positive picture for buy-to-let returns over the long term and found that 37% of landlords anticipated rental growth over the first half of this year.

Pros and cons of commercial

Pros and cons of commercial

The increasingly penal tax regime for residential investment property has been well documented, writes Barry Shaw, real estate partner at Wallace LLP.

The raised stamp duty rates and 3% surcharge and the less-favourable tax relief available on mortgage repayments have dampened the demand for residential buy-to-let investments. The housing market generally has shown a big fall in transaction volume – the number of houses for sale was recently reported to be close to a record low.

As a result, some investors have been considering the possibility of investing in commercial property for the first time.

So what are the advantages and pitfalls associated with commercial lots compared with residential buy-to-lets?

Stamp duty

The rates of SDLT are lower for a commercial property and the 3% surcharge will not apply. Furthermore, the non-residential rates also apply to mixed-use properties, so an investor could purchase a building with, say, retail units on the ground floor and flats above and still pay the non-residential rate of SDLT.

To give an example, purchasing a building for £750,000 would incur the following SDLT rates, assuming the 3% surcharge applies:

• Residential: SDLT is £50,000.

• Non-residential (including mixed-use): SDLT is £27,000.

Length of lease

An assured shorthold tenancy is usually for 12 months and it continues until either side serves a notice to terminate – and may be renewed. A commercial lease is often for a much longer term – such as two, three, five or 10 years. While the lease may contain a break clause, the longer term nevertheless provides greater certainty for the landlord, which enhances the value of the investment and assists in obtaining finance, because a regular income stream can be demonstrated to a lender.

Rental income

Rent under an AST is usually paid monthly in advance. Under commercial leases, although sometimes a tenant may negotiate monthly rental payments, usually rents are

paid quarterly in advance, which can greatly assist the landlord’s cash flow.

Commercial leases that are for five years or more usually have rent reviews built in (either based on the open market rent at the time or on RPI increases), which enhances not only the rental value of the property but also the capital value when the rent increases, providing greater capital growth and better yields.

An investor will usually buy a residential property with vacant possession and may have to refurbish it before letting it out, so there can be quite a time lag and some expense before any rent is received. Conversely, a commercial property is often purchased with a lease in place and with the benefit of a tenant already in occupation, so the rental income is immediate.

Tenant

Although references are usually taken up prior to granting an AST, for a commercial lease far more detailed due diligence is carried out on the credit-worthiness and covenant strength of the tenant (such as looking at trading history). Additional security can also be taken, such as a guarantor or a rent deposit, to fall back on if the tenant defaults. Unlike a residential buy-to-let, the covenant strength of a commercial tenant can add to the value of the property, especially if it is a well-known name, such as a retail chain.

Also, if a tenant wishes to dispose of the premises during the term of the lease, it may assign it with the landlord’s consent, which will also be subject to approval of the proposed assignee’s financial standing. Conversely, ASTs are usually non-assignable, so that when a residential tenant leaves, a new AST has to be entered into and there may be a void between the two tenancies.

Landlord’s responsibilities

An AST tenant usually has to pay council tax and utility bills, but all other costs of maintaining and repairing the premises fall on the landlord. With commercial premises, often an “FRI lease” is granted – which means a full repairing and insuring lease, whereby the tenant pays for all repairs (either carrying the repairs out itself or paying through a service charge) and the tenant also reimburses the cost of insuring the premises. A commercial landlord seeks what is known as a “clear lease”, which means the landlord just collects the rent and all other expenses relating to the property fall to the tenant.

Furthermore, the landlord has far less responsibility to repair the premises, as this will be the responsibility of the tenant under the repair covenant. In the case of a lease of whole, the tenant may have to repair the whole building. In a multi-let building, the tenant will repair its part and the landlord the common parts and structure. Overall, the landlord will have far fewer responsibilities and does not get called out every time the boiler breaks down.

Pitfalls

Although during the lease term there usually will not be a void, when commercial premises do fall vacant, it often takes longer to find a new tenant than with residential premises.

Also, if the commercial tenant becomes insolvent or disappears, the landlord is more likely to be exposed to greater rental arrears and it may take longer and be more costly to remove the tenant and/or forfeit the lease.

The documentation for a commercial lease is more complex, involving lengthier provisions relating to assignment, alterations, restrictions on use, rent review and other matters – and it therefore usually takes much longer between agreeing heads of terms and the new lease being completed and the tenant taking occupation.

As a result, the landlord may incur significant legal costs in making sure that the documents are in good order.

Often (depending on market conditions), when the landlord is granting a lease to a new tenant, the tenant will negotiate a rent-free period, creating a delay before the landlord receives any rental income.

It is far more important to ascertain that a commercial property has the correct planning title to ensure it is authorised to be used for its purpose, as there is a great variety of planning uses – such as retail, offices, restaurant, bar, industrial. Planning permissions and planning history need to be checked carefully.

This article appears in the latest edition of EG’s Property Auction buyer’s guide, available in newsagents from 20 May. For full and free digital access to the guide, please click here