“Retail continues to change radically, but that doesn’t mean people don’t want the goods that are sold in shops – they just want them quicker. In fact, their spending power is greater than ever.

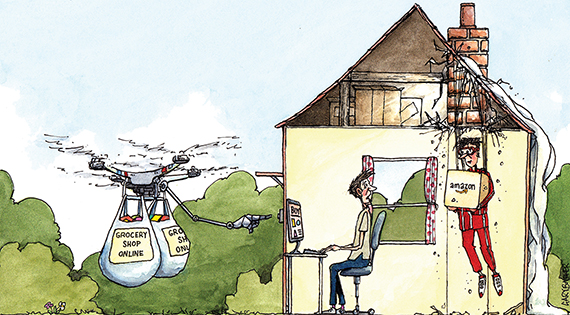

“What has changed is the way people receive those goods. They are now more than likely to purchase online and will soon demand delivery the same day.

“That makes last-mile distribution very interesting, particularly warehouses and delivery and collect points close to the edge of densely populated areas. It’s a profound shift, from which one property asset class will benefit.”

Who said this? Not a dyed‑in-the-wool industrial or logistics veteran, but Nick Leslau, speaking at BDO’s Annual Property Dinner on 21 January. Leslau had been asked where he would invest £100m now if given the choice.

The reason for Leslau and other investors’ enthusiasm is the continuing growth in multi-channel retailing. I believe we are only at the beginning of the process.

While shoppers will continue to go to “must-visit” malls, many other people will simply order their goods online.

Three developments make me think the rush to online shopping – with a healthy knock-on effect on distribution property – will pick up pace this year.

First, online grocery will begin to take off. Ocado is now trading profitably, and the big change the UK is now awaiting is the growth of Amazon’s grocery offer. It is established in the US and, as its second-biggest market, the UK is the obvious next location for Amazon to grow the concept.

Now, with 29 February’s announcement that it has struck a supply deal with Morrisons to supplement its existing small UK fresh food business, Amazon Pantry, with Morrisons’ fresh and frozen goods, it has stepped up a gear over here.

UberRUSH, Uber’s variation on its disruptive taxi service, is our next service to watch in 2016.

The Uber app allows UberRUSH customers to track the progress of their package and share the location of the item with the recipient.

Messengers will pick up and deliver anywhere within Manhattan for $3 as a base charge and then $4 per mile, and to Brooklyn or Queens for a flat rate of $25.

If an organisation such as Uber is dedicating resources to the distribution world, the inevitable result will be further radical change, with a knock-on effect on the property world. With deliveries now being made by bike or even on foot, the onus again will be on warehouses close to town centres.

That’s not to say that big box logistics won’t also continue to benefit as the retail revolution continues to pick up pace.

Our third shopping trend to watch this year is continued reshaping by traditional retailers of their supply chain – again with a beneficial effect on logistics property.

When an investor such as Leslau nails his colours to the mast, people listen.

Yes there will be doubts this year over the European Union referendum, falling commodities prices and weakness in China, but none of these will outweigh the revolution that is picking up pace in the shopping world.

David Sleath is chief executive, SEGRO