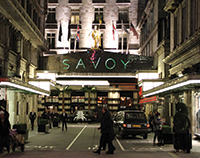

Deutsche Bank is lined up to provide £300m of fresh debt to refinance London’s Savoy Hotel.

The German lender is in final negotiations over the structure of the facility, which is expected to comprise two tranches taking it to a loan-to-value of 70%.

It is understood that the owners, a joint venture between Prince Alwaleed bin Talal and Lloyds Banking Group, want an existing piece of mezzanine debt to stay in place, which adds to the hotel’s total leverage.

The mandate attracted term sheets from a number of investment banks including Citi and Goldman Sachs, with debt funds and mezzanine providers also considering the deal.

However, the high loan-to-value level of the capital structure and the stable – but potentially not improving – underlying cashflow deterred a number of lenders.

The search for fresh finance comes a year after the partners’ vehicle, Breezeroad, completed an extensive debt-and-equity restructure resulting in the asset’s current £458m multi-tranched capital stack.

The new loan will refinance a five-year, £200m senior ?facility provided equally by Credit Agricole and DekaBank. It has a margin of between 380 and 400 basis points over three-month Libor.

The remaining debt comprises seven junior debt-and-equity positions. This is split between £143m provided by Lloyds and £115m by the Saudi billionaire’s Kingdom Holdings Investments. All eight facilities mature in March 2018.

Lloyds and Prince Alwaleed’s KHI each have a 50:50 joint stake in Breezeroad, which bought the hotel in 2005.

Eastdil Secured is advising.

All parties declined to comment.

bridget.o’connell@estatesgazette.com