There was a lot of circling the ring for the property market in the lead up to the referendum. Uncertainty over which way the vote would go meant fewer deals were landed, the question now is how quickly the market can get back into the fight.

“We haven’t seen a referendum bounce so far, but the brakes have certainly been released,” is how Keith Dobson, director in Savills’ Edinburgh office, phrases it. If that sounds more circumspect than whooping for joy, this is exactly the message feeding through from all corners of the property industry.

Perhaps it is simply the understandable reluctance to have egg on their faces for calling an uptick too early, but there is also a genuine concern that the ripples of the referendum result may take some time to show themselves.

It is, however, difficult – although not impossible – to find a local property professional who does not believe that activity in the third quarter is up on the previous three months, even though only one-sixth of Q3 took place after the referendum.

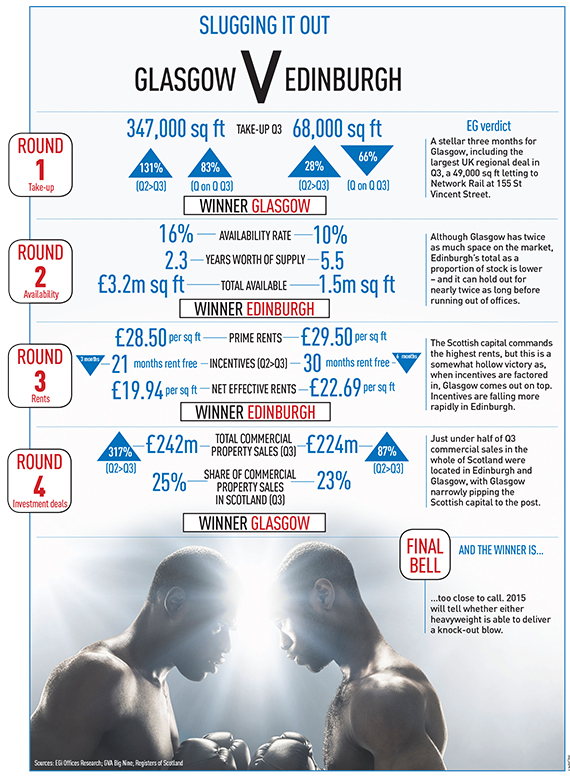

The statistics support the sentiment (see graphic, below), although the real proof is likely to be visible only when the results from Q4 emerge early in 2015.

Privately, agents point out that many transactions were oven-ready by 18 September, and were just awaiting a confirmation of a no-vote. Alan Stewart, partner at legal firm Maclay Murray & Spens, voices the unspoken view of many: “What happens when all of those have gone through though? That’s one of my concerns.”

The good news on the occupational side is that new stock is in the pipeline. More by coincidence than design, Edinburgh and Glasgow each have three major office schemes due to complete in the next couple of years, which will boost supply by 327,000 sq ft and 463,000 sq ft respectively.

Agents insist that it will be schemes, rather than cities, competing with each other to attract tenants. CBRE director Stewart Taylor explains: “In 30 years it has been very rare that an occupier will potentially go to both places – usually the choice of city is fixed.”

In Edinburgh, a city not known for large prelets, all eyes are on which big scheme will sign a tenant first. “If there was a market prelets could be achieved in, this is it,” reckons Savills’ Dobson.

More new supply is on the way. Chris Stewart Group is expecting to submit a planning application by February 2015 for a 130,000 sq ft mixed-use development at 42 St Andrew Square, including 60,000 sq ft of offices, which could complete in summer 2017. “We acquired the site pre-referendum as we didn’t see that materially affecting us, as we are due to complete at a time of plenty of lease events,” says CSG owner Chris Stewart.

Ewan Cameron, partner in Ryden’s Glasgow office, believes that the majority of space available in the major schemes in the city will have been taken by this time next year, but would like to see more refurbishment on the blocks.

“I’m surprised that we haven’t seen more smaller refurbs [up to 25,000 sq ft] coming through now the referendum isn’t in the way,” he adds.

A hiatus in development is expected to push up rents, although Mark Glatman, chief executive of St Vincent Plaza developer Abstract Securities, believes that the differential costs between new-build and secondhand have been overplayed: “It’s a complete fallacy to say it’s cheaper to renew a lease on an older building at anything over £10 per sq ft.”

Agents in both Edinburgh and Glasgow are not expecting a rush of transactions in 2015. Ryden’s Cameron concludes: “We’re seeing a slowing down of decisions – but, crucially, decisions are still being made.”

Transport turmoil

Long before the turmoil caused by the referendum, Edinburgh’s office market was disrupted by the works to reinstate a tram line in the Scottish capital.

Originally planned to run between Leith and Edinburgh airport, the £1bn project was more stop than start for several years as it jolted from funding shortfalls to contractual disputes.

At one point, after the trams had been ordered, it looked as though the whole scheme would be cancelled. Eventually, a truncated route, covering nearly nine miles between the city centre, the out-of-town offices at Gyle and the airport, was agreed, still leaving the city with a surplus of tram vehicles.

Now the nightmare of roadworks that clogged central Edinburgh for so long are a distant memory. The trams officially started gliding along Princes Street this summer, causing much rejoicing among local property folk. The trams now whizz into the city from the airport in around 40 minutes.

“The tram really helps from a perception point of view,” affirms CBRE director Stewart Taylor, “and we’re glad it’s all done now”.

Well, maybe not quite… Edinburgh council is reviewing plans this autumn for an eastern extension. So trams may make it to Leith after all.

Office occupiers in Glasgow can only look at their Edinburgh peers in envy as detailed plans for a rail link to the airport there hit the buffers in 2009, even though new trains had already been ordered. However, one of the no-vote bonuses was a promised £1.1bn infrastructure fund for the city, which could see the project back on the rails.