Have we reached the peak of Jaguar Land Rover? Has the automotive sector done all it can – for now – in the West Midlands industrial property scene?

Have we reached the peak of Jaguar Land Rover? Has the automotive sector done all it can – for now – in the West Midlands industrial property scene?

If you are building or planning to build a warehouse in the region, you had better hope not. The automotive sector in general – Jaguar Land Rover in particular – has been the rocket fuel behind the region’s logistics property business for the past two years.

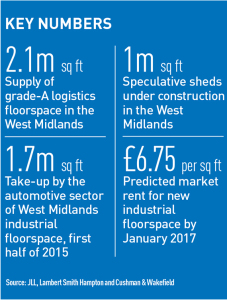

Occupiers led by JLR contributed to 1.7m sq ft of auto-sector take-up in the first half of 2015, according to Lambert Smith Hampton. The second half of 2015 was at least as busy. It marked a sharp rise in auto-sector take-up, soaring from nil in 2008 to 25% of the market in 2012, according to Savills.

Confidence is high, and the automotive sector is linked by rumour to almost all major West Midlands developments. This includes the 650,000 sq ft Imperial Court development at Coventry airport, linked with JLR, and a 170-acre site at Peddimore in Birmingham, linked with Aston Martin. Yet neither site is quite the auto-industry dead certainty it seems. In some quarters the idea that the auto sector is not going to drive the logistics property market for much longer is beginning to gather momentum.

IM Properties is presiding over the Peddimore site, identified for removal from the green belt as part of Birmingham’s urban extension. Close to junction nine of the M42 motorway, it lies either side of the A38 Sutton Coldfield bypass.

“A load of rubbish, sadly,” is how Richard Sykes, planning and development manager at IM Properties, describes the idea that Aston Martin is on its way to Peddimore. The site is a medium-term prospect for 2019 and beyond that could satisfy unmet demand for mega-warehouses of 1m sq ft or more. Planning permission has yet to be obtained for what could be a 2.5m sq ft scheme.

Sykes says the role of the auto sector could be about to shrink. “There is still a core base of JLR requirements, but there comes a point when a business matures, and we should be cautious on JLR growth. Maybe it is at a point in its cycle when the rate of growth slows. Developers will be approaching with caution. After a period of supply-chain growth, that may start softening.”

IM Properties is already at work on 500,000 sq ft in five speculative warehouse units in the West Midlands, at Birch Coppice and the Hub, Birmingham. Sykes says no more are in the immediate pipeline – which perhaps says it all.

Meanwhile, at Coventry airport – where Sir Peter Rigby’s Ostrava Properties is another company rumoured to be courting a 600,000 sq ft JLR requirement – outline planning permission has been granted for 650,000 sq ft, in three units, on the site of the old passenger terminal.

The A46 site is strongly fancied by some observers. You can see the JLR plant at Whitley, it is that close.

Simon Lloyd, director at Cushman & Wakefield, is joint letting agent. “We are finalising plans for B2-B8 – and there is no decision yet on speculative development, but it is possible,” he says.

A reserved matters planning application is expected later this year, and given the shortage of new units, any speculative start would follow a forward sale, and would probably be swiftly followed by prelets. Or so many in the market believe – some adding that a buyer-funder has already put the park under offer, with rental guarantees.

Lloyd, like Sykes, sees a slackening of the pace of auto-sector growth. “The auto sector in general – and JLR in particular – is expanding, so there will be additional requirements. The pace of growth might slow, but it won’t stop, as they digest the next sites they have already taken,” he says.

Lloyd expects a slower pace of rental growth too, with rents rising from £6.50 per sq ft today to £6.75 this time next year.

Prospects at the neighbouring Coventry & Warwickshire Gateway site under the control of Roxhill are more difficult to judge. Last year Roxhill’s 260-acre gateway scheme was rejected by communities secretary Eric Pickles. Roxhill did not respond to EG’s request for clarification, but it is understood that a new planning application is due within 12 months.

David Wilmer, senior director at Bilfinger GVA, rates the site along with Peddimore as “one to watch” in the medium term, meaning from 2018 to 2019.

“Coventry council is supportive of the Roxhill plan, and it is very well located in a market that does not have a lot of opportunities. Timing will be important. If the smaller Rigby scheme prelets – and there is not a lot left at Prologis Ryton – then there is every opportunity for Roxhill to develop speculatively,” he says.

And what of Prologis? The US-owned giant has done well from JLR, with recent deals including the luxury car maker snapping up 312,000 sq ft at DC4 Prologis Park Midpoint, Minworth, and 225,000 sq ft at Prologis Ryton.

There is no sign of Prologis losing faith in demand for space in the area either. Earlier this month it unveiled plans for a 45-acre site at Fradley Park, where 890,000 sq ft is planned. Infrastructure work is now under way in a joint venture with Wittington Investments (Developments).

Andrew Griffiths, managing director of Prologis UK, says: “There are very few industrial sites with planning permission in the West Midlands, so we are already seeing a high level of interest in the new park from companies, each of which could bring hundreds of new jobs to the area.” JLL, Harris Lamb and Savills are advising Prologis and Wittington.

For now, demand for West Midlands warehousing is fuel-injected, the auto sector is still audibly revving, and the gear most market-makers want to select is fifth, with a lot of acceleration. Whether that can continue until 2018-19, when the next tranche of big sites becomes available, is anyone’s guess.

Airport puzzle

A change of government and a new secretary of state are said to have created a more sympathetic background to Roxhill’s 4.5m sq ft development at Coventry & Warwickshire Gateway. The imminent completion of local plans will also help. A new application late 2016 or early 2017 is rumoured.

Mark Sitch, senior partner at planning consultant Barton Willmore, says: “There is a good case to be made. There is a need for green belt review. There is also a need for about 7.5m sq ft of new logistics floorspace in the West Midlands in the next five years.”

Slow progress on local plans does not help and Roxhill may wait until work on the plans in Birmingham, Coventry and Warwick have moved forward before resubmitting.

However, Sitch predicts a more thought-out West Midlands planning regime in the future. “The new West Midlands Combined Authority opens up the possibility of strategic thinking on sites, and hopefully that will deliver a joined-up approach,” he says.

JLR on the move

Jaguar Land Rover’s appetite for land has seemed insatiable. Late last year it was understood to be pondering a bid for the Silverstone racing circuit, the latest in a long line of buys and potential buys including a 62-acre extension to its Coventry site at Whitley. A planning application was expected as EG went to press.