New York Climate Week is always an exciting and reinvigorating event in the year’s calendar. Innovators from across the world convene in Manhattan to move the dial on the fight against global climate change. Heads of state, global CEOs, international (governmental and non-governmental) organisations make serious commitments towards the achieving of the UN’s Sustainable Development Goals. So what were the key lessons?

The climate is changing more rapidly than scientists thought

In October last year, the Intergovernmental Panel for Climate Change (IPCC) announced that the target of keeping global warming below two degrees had to be moved to 1.5 degrees to avoid a disastrous climate tipping point. Scientists believe that in a business as usual scenario, temperatures will increase by four to seven degrees, but this needs to be contained to 1.5 degrees to avoid major climate and economic disruption. We now understand what the difference between 2 degrees and 1.5 degrees means. In tangible terms, the difference is the permanent melting of the Greenland ice sheet and reduce premature human deaths from air pollution by 100-200 million over the course of this century.

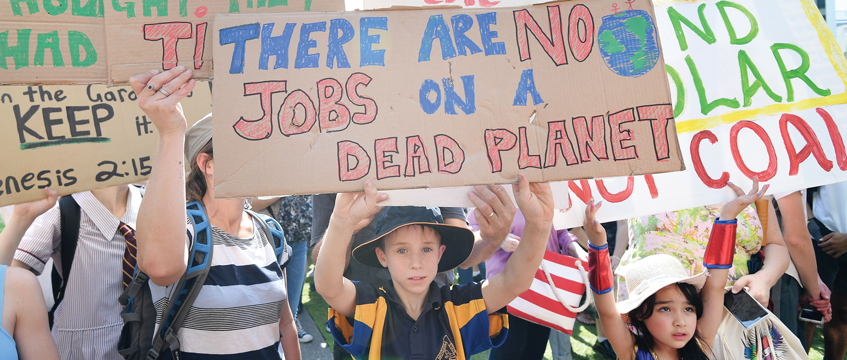

Young people are holding decision makers accountable

Greta Thunberg sparked an explosion of the youth movement, with millions of young people protesting in the streets of the world’s capitals to demand urgent action on climate change. Greta’s main message was clear: younger generations will hold our generation accountable for our actions, and will not forgive us. This movement also led to the mass protests in London this week. The impact of our activities will change the planet as we know it if we do not act.

Net Zero Carbon Building is the new norm

Longevity hosted the Climate Group EP 100 New York Climate Week event at the Harvard Club. More than 70 international (big energy user) companies joined us to talk about ways in which they can commit to zero carbon buildings. Big companies absolutely get the win-win in slashing emissions while boosting their bottom line. Energy efficiency is the cheapest way to reduce carbon emissions and achieve net zero buildings. But it will be difficult to achieve net zero carbon if big business doesn’t embrace the implementation of the latest technologies available on the market, both for the development of new builds and for refurbishments.

Climate change impacts the value of assets

At the Citi Group HQ on Wall Street, 100 institutional investors, hedge funds and banks were asked: do you think that climate change will impact the value of your investments? A huge 86% responded “yes”. None responded “no”. It’s difficult to predict how much climate change will impact investments, as it depends on how quickly we are able to reduce the speed of climate change and adapt to its physical risks. Professor Simon Dietz, London School of Economics and Oxford University, predicts that the annual climate value at risk (VaR) can be anything between $2.5 trillion to $24.2 trillion in a 2.5 degree business as usual scenario.

Occupiers are pushing for better buildings as they double down on ESG commitments

The push for better, more efficient and healthier buildings comes from occupiers as much as investors. Productivity and staff retention are value drivers to business and there is no doubt that better buildings will have the competitive edge. That means improved air quality and comfort levels are more challenging in temperature extremes. Employees’ productivity can increase by 8% to 11% in better buildings, compared with conventional equivalents, a significant topic for occupiers who want to attract the best staff, retain them, and get the best out of them.

More action than talk leads to carbon pricing

Some companies address ESG as simply a box ticking exercise, responding to investors’ demand for corporate responsibility but not actually achieving any real change. The real winners will be companies that dive in headfirst into stewardship to achieve a positive impact on the planet and people. Jeff Bezos, for example, pledged to be carbon neutral by 2040 (10 years before the required deadline), and last month more than 20 member companies of the Better Building Partnerships committed to achieving net zero carbon for their real asset portfolios. Many investors have similar targets for other asset classes. As and when carbon pricing (or other fiscal mechanisms to accelerate the transition to a low carbon economy) emerge, there is no doubt these companies will have a serious lead.