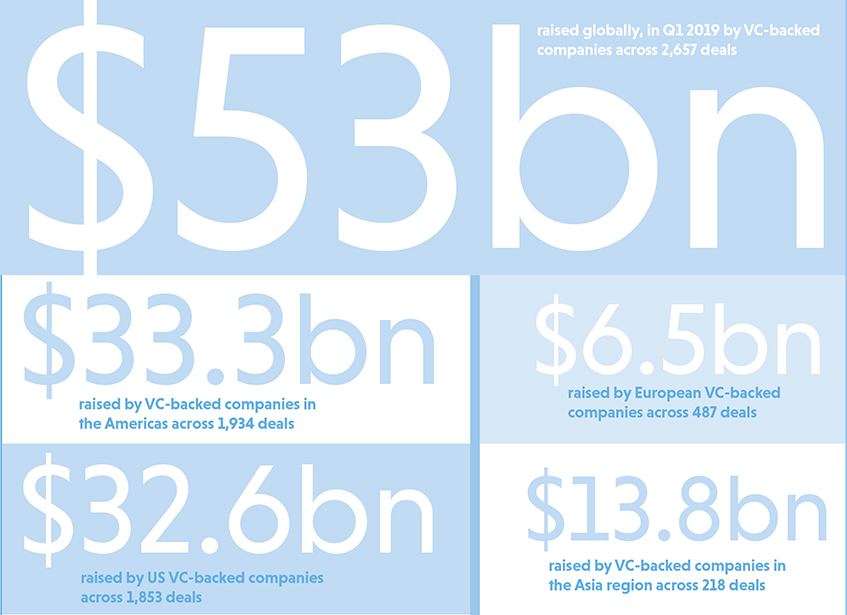

After a record-breaking 2018, global venture capital investment was relatively low in Q1 2019. But a strong US market and a much-anticipated crop of unicorn IPOs offer hope for Q2.

After a record-shattering level of venture capital investment in 2018, the global VC market got off to a relatively weak start in Q1 2019, particularly in China. The US continued to see very strong VC investment, including a $5bn (£3.8bn) investment from SoftBank into The We Company (formerly WeWork) and a $1bn raise by freight logistics company Flexport.

A shortage of $1bn+ megadeals is likely to have contributed to the decline in VC investment in Asia quarter-over-quarter. In Europe, meanwhile, VC investment remained relatively steady despite the challenge of Brexit in the UK. Strong activity in other European markets is likely to have helped buoy investment numbers in the region.

Late-stage deals continued to attract the bulk of international VC investments as economic uncertainties around the globe resonated across a number of markets. While US public markets rebounded in January following the fluctuations seen at the end of 2018, other uncertainties remained high on the radar of investors, including trade wars between the US and China, Brexit, and a weakening Chinese economy.

Following a record year of unicorn initial public offering exits in 2018, 2019 is looking to extend the trend with a number of highly anticipated companies already heading to the gate.

Ride-hailing firm Lyft made the first big wave of 2019. Additional planned exits are setting the stage for an exciting second quarter, while others are also contemplating IPOs. The performance of these companies could have ramifications on the IPO market through the rest of the year.

In the UK, more than £1.19bn was invested in the first three months of the year, around the same level as seen in the first three months of last year. However, this was raised across 161 deals which was down 57% on the same period in 2018.

Spend Watch: VC investment trends round-up

US drives VC investment with public markets rebound

The US continued to drive a significant amount of VC investment in Q1 2019. The public markets rebounded nicely following the fluctuations at the end of 2018, proving that the economy in the US remains strong. There was a lot of liquidity in the market and no significant signs of US based VC investors preparing for a downturn. The increase in IPO activity in the US, if sustained, could also help inject new capital into the earlier deal stages in the near future.

Diversity key to VC market buoyancy in Europe

In Europe, the diversity of VC investments across individual jurisdictions helped to maintain the robustness of the VC market despite local uncertainties like Brexit in the UK. The region saw an exciting mix of $100m+ megadeals during Q1 2019, including challenger bank N26 in Germany, electric vehicle charging technology company Ovo Energy in the UK, biotech company Arvelle Therapeutics in Switzerland and farming start-up Ynsect in France.

Southeast Asia an exception as Asia VC investment slows

VC investment in Asia was down quarter-over-quarter, primarily driven by slower activity than usual in China, where only Chehaoduo Group raised a $1bn+ funding round. Southeast Asia was one of the bright spots in the region, with Singapore-based companies Grab and Zilingo raising $4.5bn and $226m respectively. Thailand-based Lalamove also raised $300m during the quarter. India also saw solid VC activity in Q1 2019, including a $413m raise by Delhivery and a $300m raise by ride-hailing platform Ola.

IPO market ramping up for big 2019 second quarter

Despite some turbulence late in 2018, stock exchanges in the US, Europe and Asia have performed strongly during Q1 2019. Chinese equities, in particular, have been experiencing a bullish market, even with heightening concerns over a trade war with the US and lower GDP forecasts. The global IPO market also gained strength in Q1 2019 as numerous companies filed plans to go public, or began to discuss their options. Ride-hailing company Lyft was first out the gate in the US, although other unicorns are expected to be close behind. In Canada, Lightspeed held one of the largest tech IPOs in TSX history in Q1 2019, showing that the US is not the only viable location for a successful IPO exit. While the IPO markets in other regions of the world were quieter during Q1 2019, should the line-up of IPOs in the US be successful in Q2 and Q3 2019, more mature companies in other jurisdictions might rethink their own available exit strategies.

Another large crop of unicorns birthed in Q1 2019

Q1 2019 saw the birth of 23 unicorn companies globally across a wide range of verticals. The US accounted for the most unicorn births, including Nuro and Aurora in the automotive space, Flexport in logistics and Health Catalyst and 10x Genomics in health and biotech. And, of course, later in the year, VTS joined the unicorn club in May. China also saw several new unicorns, including Danke Apartment, Horizon Robotics, logistics company Yimidida, and 360 Enterprise Security Group. The unicorn club of Q1 2019 reached beyond the US and China, however: new unicorns also included Australia-based Airwallex, India-based Delhivery, France-based Doctolib, and Germany’s N26. Of the unicorns birthed in Q1 2019, fintech companies accounted for four, including Airwallex, Marqeta, Chime and N26. The growing number of fintech unicorns highlights the rapid maturation of the fintech sector, both in the US and globally. With a large crop of mature unicorns expected to exit in 2019, VC investors are now beginning to look for the next crop. Whereas many to-date have succeeded based on digitizing existing business models, it is expected that the next generation will be driven by new business models or offerings that merge different industries into something new.

Digital banks gain ground as more mature firms eye growth

Digital banking was a big winner of VC investment globally, with Chime in the US raising $200m, Germany-based N26 raising $300m and UK banks Oak North and Starling Bank raising $440m and just under $100m respectively. A number of these digital and challenger banks are now well-established in their home markets and are eyeing opportunities to grow both regionally and internationally. The US is a big target of many of the European challenger banks, with the likes of Revolut, N26 and Oak North looking at expanding into the North American market.

Emerging markets coming into the spotlight

As developed markets begin to see saturation in more established areas of VC investment, such as payments and lending, ride-hailing, bike sharing, and food delivery, investors and corporates have begun looking to less mature markets for new opportunities. In 2018, VC investment in developing countries was well above $8bn, substantially more than the year previous. It is expected that 2019 will see an increase in the amount of VC funding being deployed in developing markets. Latin America is well positioned to see strong increase in investment in the coming quarters, driven in part by a SoftBank’s Q1 2019 announcement of the launch of a $5bn fund focused on Latin American start-ups. This investment could spur other VC funds to increase their presence in Latin America. Fintech is expected to continue to be one of the most attractive areas of investment in emerging markets, particularly in countries with high populations who are underbanked and unbanked.

Trends to watch for globally

Artificial intelligence is poised to be the hottest investment trend globally through the remainder of 2019. The applicability of AI is almost limitless from an industry perspective, with solutions ranging from healthcare and financial services to retail and manufacturing. Fintech is also well positioned for growth, particularly as more established fintechs in individual regions begin to stretch their wings and expand globally. This could result in some mergers and acquisitions activity as fintechs look to consolidate their market positions and win market share.

Tim Kay is director, innovative startups, at KPMG