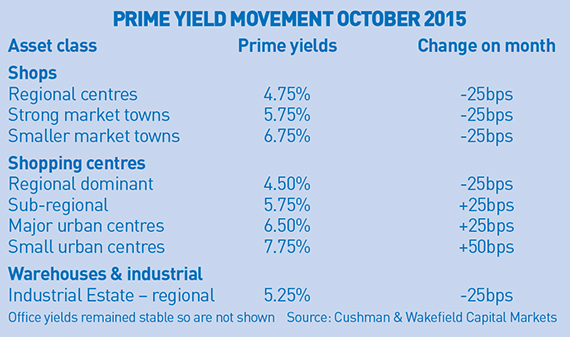

Prime yields for riskier commercial property assets moved out by as much as 50bps in October as the impact of a late summer “slowdown” took hold.

Cushman & Wakefield’s prime yields data shows small urban shopping centres were the hardest hit, followed by major urban centres and sub-regional malls.

International director and head of investment agency UK and Ireland, Jason Winfield, said: “The UK market has definitely experienced something of a slowdown in the past 12 months. There is still plenty of activity under way but there is more caution over where we go from here.”

Prime office yields remained stable in October despite fears the core City market would

be most vulnerable to the emerging market slowdown.

City core yields remain at 4% while West End office yields are 3.25%, according to C&W.

Yields tightened by 25bps for shops in regional centres, market towns and for regionally dominant shopping centres.