Buyers of central London prime residential property will need years to turn a profit in the slowing market, according to analysis of the costs incurred with residential transactions.

Buyers of central London prime residential property will need years to turn a profit in the slowing market, according to analysis of the costs incurred with residential transactions.

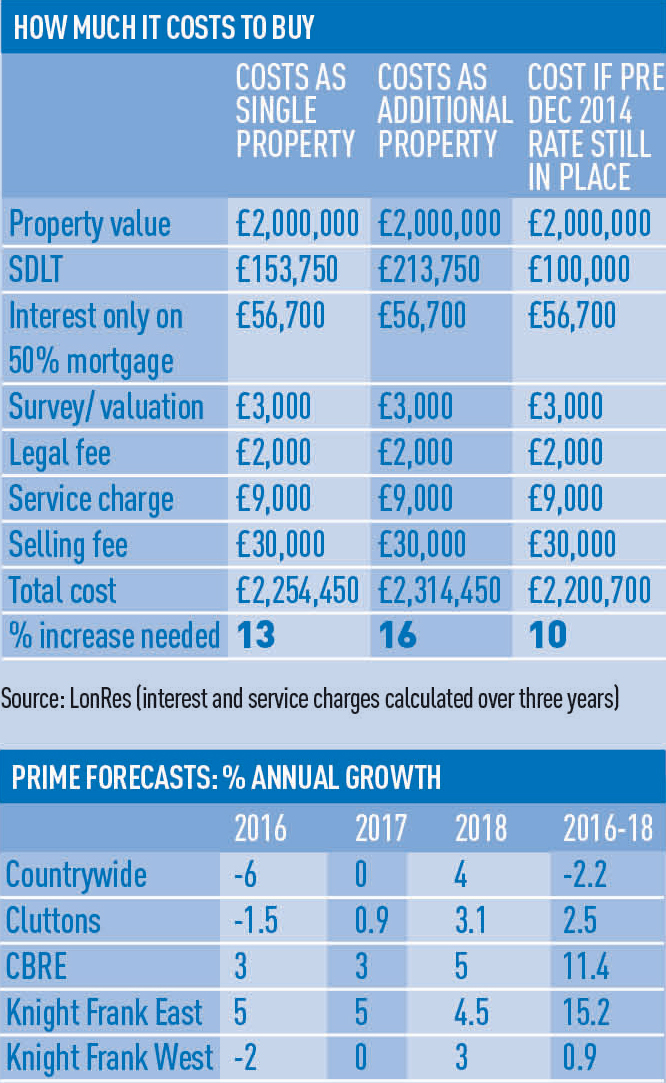

Research from LonRes, which calculates the costs associated with buying an asset in central London, says prices need to rise by 13% for a buyer to break even.

The owner of a second home would need a 16% rise owing to additional taxes introduced in April. Even before the various stamp duty changes launched in 2014, a 10% increase was needed.

Combined with current agency forecasts for the prime central London market, this means buyers could have to hold assets for longer than three years before breaking even, let alone making a profit.

Marcus Dixon, head of research at LonRes, says: “Having enjoyed significant increases in prices in recent years, expectations for growth in prime London are more subdued in the short to medium term.

“Whereas in recent years buying costs could be recouped in as little as 12 months, forecasts suggest that it could take longer. Indeed, for those relocating to London for a short period, renting could well prove a more financially astute move.”

Demand for London prime residential tailed off long before the UK’s vote to leave the European Union, with taxation changes, peak pricing and global instability all taking their toll on pricing. Increases to stamp duty from December 2014 onwards were generally considered to have had the most impact.

However, much will depend on how the prime market reacts to Britain’s EU exit negotiations: while the risk of investment may still seem high to some, a clearer direction in policy would allay fears.

Dixon adds: “It is still a little early to assess the impact of the referendum on the prime markets. Transactions remain subdued, and prices have fallen slightly since the vote. However, July and August have historically been quiet months in prime London, so the autumn market will tell us more about the impact of the vote to leave on activity and prices in prime areas of the capital.”

While the referendum has added to uncertainty, the devaluation of the pound has made the market more competitive.

LonRes’s data suggests that a US dollar investor has seen an 18% reduction in price over the past year, while a euro investor will have had a 17.4% decline.

It says the prices in Q2 2016 had fallen to levels equivalent to 2013, and this could have a significant impact on the cost of prime property in the coming months.

However, while the cost of buying has declined, this does not have any relevance to future price growth.

How stamp duty hit the market

A massive rise in transactions and instructions before the 1 April stamp duty increase was more than matched by a decrease after it, according to LonRes data. The question now is whether the downward trajectory will reverse after June’s EU vote.

• To send feedback, e-mail alex.peace@estatesgazette.com or tweet @EGAlexPeace or @estatesgazette