Demand for retail parks, retail warehouses and food shops in the UK is forecast to increase by 6% to 11.5m sq ft in 2016.

Demand for retail parks, retail warehouses and food shops in the UK is forecast to increase by 6% to 11.5m sq ft in 2016.

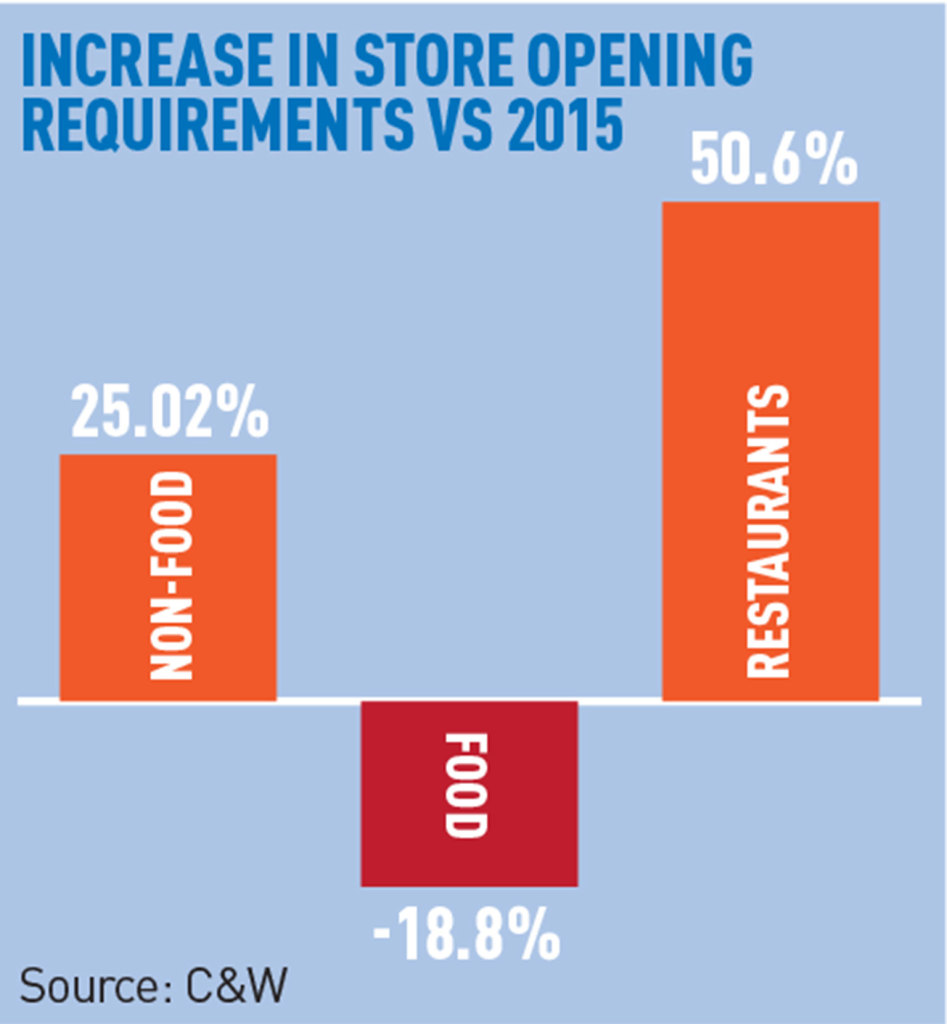

This hike is driven by rising demand from the non-core food sector, which is up by 20% on last year to 7.3m sq ft, according to Cushman & Wakefield.

Aldi, Lidl and B&M are poised to be the most active among a group of 29 retailers and restaurant occupiers which are looking to acquire at least 100,000 sq ft over the next 12 months.

Martin Supple, head of retail warehouse agency at C&W, said: “Foodstore demand is changing fast, with smaller operators such as Aldi, Lidl and Marks & Spencer expanding aggressively and increasingly seeing new opportunities in retail parks.”

Overall occupier demand in the food retailing sector has fallen by 19% to 3.8m sq ft, driven by record low demand for large store formats. This has been partly offset by greater demand for smaller stores from the likes of Aldi and Lidl, which have opening requirements totalling 2.8m sq ft in 2016.

The improving economy has bolstered demand for home furnishing, and total demand for floorspace in this subsector is predicted to jump to 2.4m sq ft in 2016.