The new Crossrail station at Tottenham Court Road, which will see more than 100m passengers a year, is to pave the way for a wave of investment and development in the area.

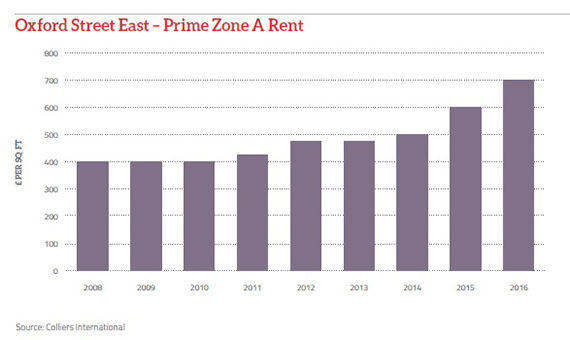

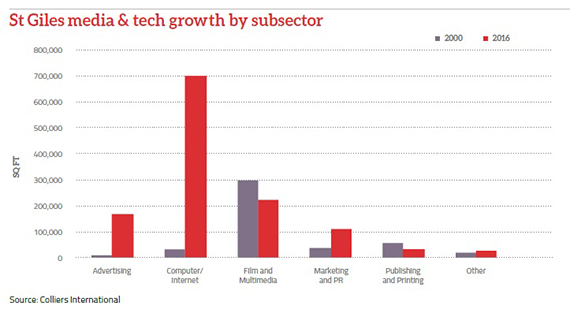

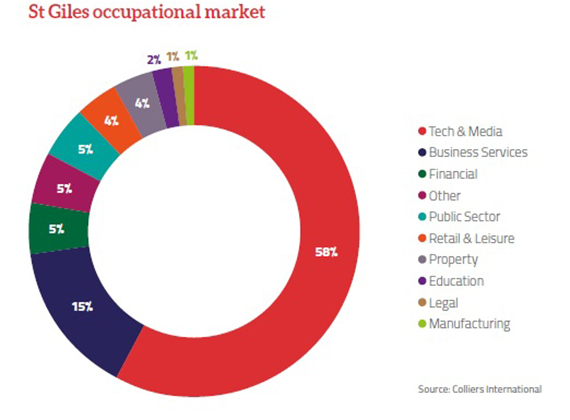

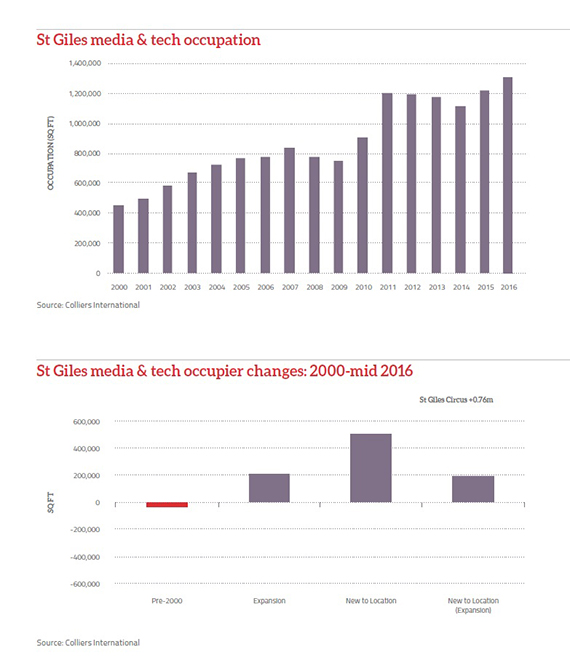

The St Giles report, commissioned by the New West End Company and compiled by Colliers International, has traced the growth of the districts around the station to find a spike in retail and office rents as well as a 286% growth in media and tech companies since 2000.

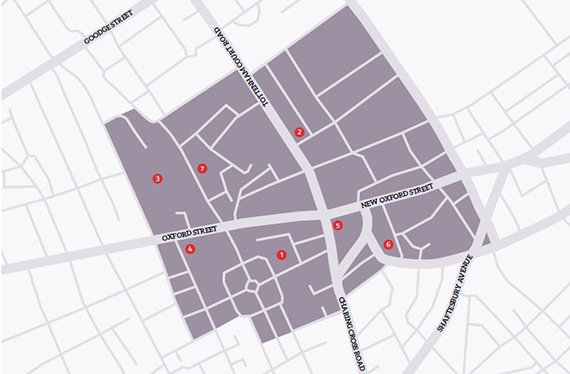

Almacantar, Great Portland Estates, Derwent London, Exemplar, Shaftesbury and Ponte Gadea have all embarked on large scale schemes to change the face of central London.

Retail and leisure

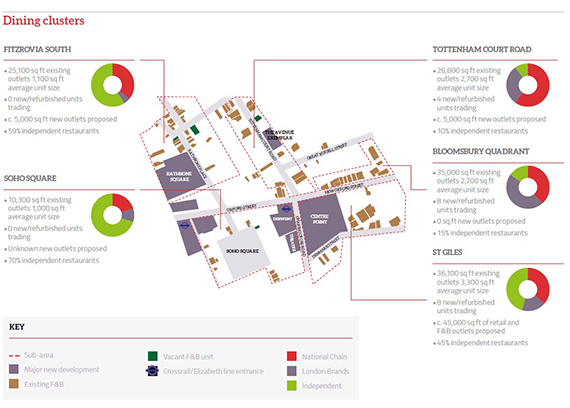

Professional services firm Arup predicts that Tottenham Court Road station could see an increase of 76m exists and entries a year, to hit 108m, an equivalent of 219,000 entries and exits a day. Peak passenger flows will be 3.5 times greater than previous levels. Expected passenger numbers at the station are to rise by 33% to more than 200,000 every day in 2018, which will catalyse retailers to take advantage of the increased footfall. There is an additional 35,000 sq ft of new restaurants and food space in the pipeline in St Giles, Fitzrovia South, Tottenham Court Road, Bloomsbury and Soho.

Offices

Between 2000 and mid-2016 there has been 832,000 sq ft of space taken by media and tech occupiers, anchored by Facebook’s 227,000 sq ft letting of GPE’s Rathbone Square for its new headquarters.

Within the St Giles submarket this equates to a 286% growth and the report predicts this trend will continue upwards with Facebook helping to establish the area as a hub for tech and media businesses.

Development pipeline of offices

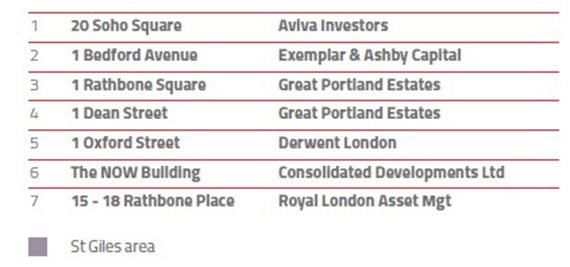

Investment

Investment in the area has changed dramatically since 2014, with appetite from overseas investors set to continue as St Giles takes its place on a global stage. Historically, the report notes that the St Giles investment market has been dominated by UK property companies such as GPE, Derwent London, Lazari Investments and Exemplar, which could see the area’s potential.

In 2012-13, the total investment volume was £183m, with none derived from overseas buyers. But in 2014-15, volumes rose to £446m, with £278m coming from European, North American, Far Eastern and Middle Eastern investors.

Overseas investors dominated the market, accounting for 50% of deals by volume, mirroring the wider trend across the London and West End markets throughout 2015 and this has continued in 2016.

Opportunities in and around St Giles

Opportunities in and around St Giles

Residential and leisure both provide opportunities for growth in St Giles. There are only two residential schemes that provide more than 30 homes, Almacantar’s Centre Point with 82 private apartments and 13 affordable homes, and GPE’s Rathbone Square with 142 affordable apartments and 20 affordable homes.

Additionally there are only four hotels of scale within the confines area: the St Giles Hotel, the Bloomsbury Hotel, Radisson Blu Edwardian and the Kenilworth, which together comprise 1,218 bedrooms. There is little development coming on stream in the wake of Criterion’s Capital’s application for a 166-bedroom hotel on Great Russell Street having been declined. The confirmed pipeline is limited to a 12-room extension at the Rathbone Hotel and a new 14-bedroom hotel at Consolidated Developments’ St Giles scheme.

As the area continues to evolve and benefit from improved infrastructure, there will be potential for further hotel development.

• To send feedback, e-mail shekha.vyas@estatesgazette.com or tweet @ShekhaV or @estatesgazette