It’s coming – you can feel it in the air. Every up must have its down, every silver lining its cloud. Before long the London property market will start to slow, and perhaps go into reverse.

It’s coming – you can feel it in the air. Every up must have its down, every silver lining its cloud. Before long the London property market will start to slow, and perhaps go into reverse.

George Osborne is already preparing the markets for turbulence ahead. But who needs the chancellor to warn them? Global shocks from China, a possible Brexit and the eurozone simply add to the risks of a UK economy already too fragile for the Bank of England to risk raising rock-bottom interest rates.

UK growth rates are slowing (GDP up 1.9% in 2015 compared with 2.9% in 2014) and it is a similar story in the US. Property weathervanes like Nick Leslau have already called the top of the market.

So what do you do? How can London property people protect and survive?

The answer depends how close you think the storm is – and how severe it will be. A minority forecast calm weather for years ahead and, when the time comes, expect a mild correction. Not so much a hurricane, more a wet weekend (see box). Others take a more urgent view on trigger and timing.

One of the latter is Sam Sananes, manager of UBS Global Real Estate’s Central London Office Value Added Fund, which has been the best-performing UK real estate fund over the past five years.

Sananes says we are already in the slowdown and to watch out for shocks next year. “It feels like London is already on a downward trajectory, sentiment has weakened a little, and it feels like 2017 will see negative trends with supply and demand for office space out of balance, so rental growth will slow,” he says. “And when London turns down, it comes as a shock, usually because there is a collapse in demand for floorspace.

“Severity? If the last crash in 2009 was a 10, then I am looking at an eight, because London has been increasingly reliant on overseas money and we have yet to see what happens when that tap gets turned off. But it is always bad. We never have soft landings.”

The City of London – still reliant on exposed sectors such as tech and financial services – gives Sananes pause for thought. “The market will be strong this year, but may shrivel next, and that is the market most prone to slowing demand and over-supply of office space,” he says.

Sananes is also being careful with the City fringes. “I am much more comfortable holding Shoreditch than I am with Aldgate,” he says. “The City fringe markets that will be sustainable will be those with the most infrastructure investment.”

Other preparations include reducing the portfolio weighting on London – and increasing it elsewhere – while focusing on defensive core assets with the prospect of income growth. Refurbishment – often tipped as a relatively low-risk development play – is also off Sananes’ agenda. “Been there, done that,” he says. The time for refurbs was last year.

“My preparation includes looking to the next recovery, with the aim of timing re-entry to be slightly ahead of it,” he says.

“My preparation includes looking to the next recovery, with the aim of timing re-entry to be slightly ahead of it,” he says.

James Roberts, chief economist at Knight Frank, must have received the same downbeat memo as Sananes. He too expects trouble, and relatively soon.

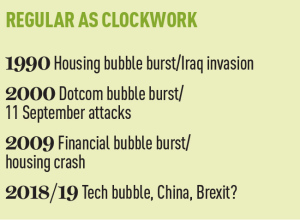

“Uncertainty grows beyond 2018,” he says. “And we are often on a 10-year economic cycle. We had 1990, 2000, then 2009, so we are getting to the end of a nice long run, and the further you go out the more risks there are.

“When it happens, it will be serious. On a scale of 1 to 10, where 10 is as bad as 2008-9, it will be seven or upwards, because I have never seen a light downturn.”

Roberts offers classic advice: prelets are good, refurbishments are less risky than new-build, but the focus of his concern is the tech sector, and those London locations and developers most exposed to it. Top of his list of collateral damage is the serviced/co-operative workspace sector.

“New technology has always been at risk of boom and bust. The market is very prone to correction and a potential source of trouble,” he says. “The serviced and collaborative workspace sector has mushroomed in London in the past 12 months and inevitably it is full of tech start-ups, sole traders, media, advertising, recruitment – all sectors vulnerable early in a downturn.”

Roberts’ conclusion is that the City’s more balanced occupier base may not protect it from the worst of whatever economic storm lies ahead. Heavily tech-dominated neighbourhoods could face trouble.

For developers, a downturn poses real problems. While everyone agrees that, as things stand, there is no over-supply in the office market, that could easily change if demand collapses. In the meantime, capital values are already taking a modest tumble, says Simon Durkin, head of research at BNP Paribas Real Estate.

“We are forecasting a significant drop in capital value growth in 2016 – down 2-2.5% – but income will still be good, so total returns will hover around 7%,” he says.

Durkin is by no means predicting a fierce economic storm – “mild drizzle” is his bet, a mere market correction – but he nonetheless says changed circumstances will mean the big players must adapt.

“We will see a slowdown in Far Eastern investment in London, probably those associated with the tech sector will be hit, and for investors the lesson is don’t simply chase returns. Maybe instead focus on core assets, and don’t get involved in speculative development in secondary markets.”

Harry Badham, head of UK development at AXA Investment Management – Real Assets and a man who wagered £2bn on London property in 2015, does not disagree. Watching progress on the new 1.4m sq ft tower on the former Pinnacle site at 22 Bishopsgate, EC2, Badham has every reason to be careful. Construction work is timed to complete in 2019 – the year most pundits suggest the market will reach its nadir.

“We are looking for long-term value, which means business occupiers paying rents. We are focused on income returns, because our capital is in this for the long-term,” he says. “This is not just about knocking it up and letting it quickly.”

A single economic cycle is something Badham will take in his stride. There will be no panic at AXA.

The world is not about to end. London will still be the capital city of one of the world’s richest countries. But sensible people are fixing the roof while the sun is still shining. And that means rethinking investment strategies and facing some hard truths.

Crisis, what crisis?

Not everyone is convinced that London’s property market has peaked, and the capital’s relatively modest office development pipeline is often the reason given.

Savills is leader of this bullish group, saying it does not predict anything that looks like a downturn for the next five years.

Mat Oakley, head of commercial research, says the office development pipeline is strictly limited and although knowable demand-side issues could be troublesome, they will not cause “seismic” shocks.

“There are warning signs; we have seen three or four years of rental growth, which is a warning sign, and in the third and fourth years of the next five-year period we have above average development volumes – another warning sign. But I cannot hand-on-heart say a trigger for trouble is visible. We are not modelling a demand-side shock, not at the moment,” he says.

Data from Deloitte Real Estate’s winter 2015 Crane Survey perhaps points the same way. It says 38% of the 11.1m sq ft of city office space under construction is already prelet. Further preletting activity this year will make the pipeline even more digestible.