Welcome to the latest edition of Sustainability Matters, a regular wrap of all things ESG from EG to make sure that you and your business are up to date with the latest news, views and opinion about all that is important in the world of ESG in the built environment.

Having to report a £1.2bn writedown on your portfolio could prompt you to tighten the purse strings on ESG, but that was not the case for British Land this week. After beating its 2020 sustainability targets by an impressive amount – the REIT has set a 55% carbon intensity reduction target and achieved a 73% reduction – it has unveiled a new set of goals for 2030.

For chief financial officer Simon Carter it is an imperative, regardless of the economic environment.

“We are seeing more and more evidence that sustainable buildings generate higher rents and lease quicker than other prime space,” he said. “And, with more of our customers explicitly committed to reducing their emissions, we think this approach really enhances our offer. Already we are seeing the benefit of that in the conversations we are having.

“Sustainability is a key part of our offer and our strategy. It’s what our customers want, and that means it goes hand-in-hand with delivering value for our shareholders.”

One key component of BL’s new strategy is that every new development will reach a net zero embodied carbon standard.

It’s a view on development that is being shared and progressed by its peers across the real estate sector.

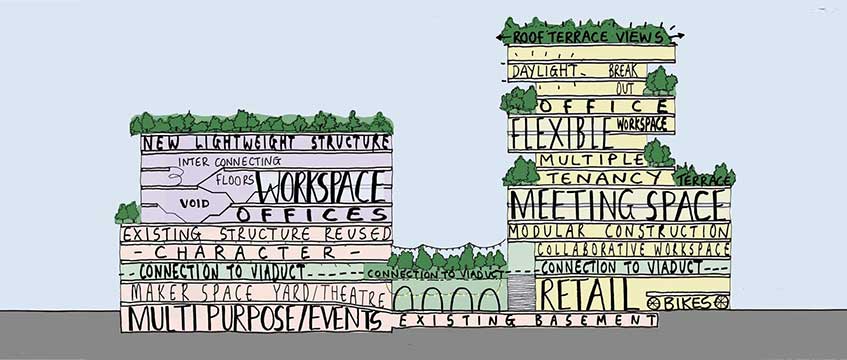

This week Landsec unveiled fresh images of its redevelopment plans for 25 Lavington Street in Southwark. The net-zero-carbon development will use an innovative hybrid steel frame with CLT floor slabs, reducing the amount of embodied CO₂ in the building to about half that of a typical London office building.

And Tritax Symmetry is going green with its logistics developments too. It has secured planning consent for a 60,000 sq ft parcel distribution facility for DPD, which will be built with net zero carbon in construction. DPD wants to become the “greenest delivery company in the UK”. It has more than 600 electric vehicles, representing 10% of its fleet.

Tom Leeming, development director at Tritax Symmetry, said: “DPD’s commitment to become the UK’s most sustainable delivery company is aligned to our own sustainability policy. As a business, we are factoring in environmental considerations into every aspect of our development plans, from electric vehicle charging facilities and energy centres to photo voltaic generation and other energy saving initiatives.”

And it’s not just in development where real estate is going green. It is increasingly looking towards green financing initiatives.

Dublin-based IPUT has just secured a new (and bigger) revolving credit facility with Wells Fargo.

Some €200m of the €300m facility will be used to finance projects that meet a defined set of sustainability criteria under IPUT’s Green Finance Framework, including a minimum LEED Gold equivalent rating for environmental efficiency, a defined improvement in a building’s BER rating, and a range of other renewable and energy efficiency metrics.

Chief executive Niall Gaffney said: “The long-term winners in real estate will be those who place sustainability and the occupier experience at the centre of their investment decisions – attributes we believe are now more important than ever before.”

Hungry for more information? Keep up with all things ESG by visiting EG’s Sustainability Hub

To send feedback, e-mail samantha.mcclary@egi.co.uk or tweet @samanthamcclary or @estatesgazette