Deal sizes have fallen by more than a third in London over the past decade as occupiers seek fewer and smaller offices.

Deal sizes have fallen by more than a third in London over the past decade as occupiers seek fewer and smaller offices.

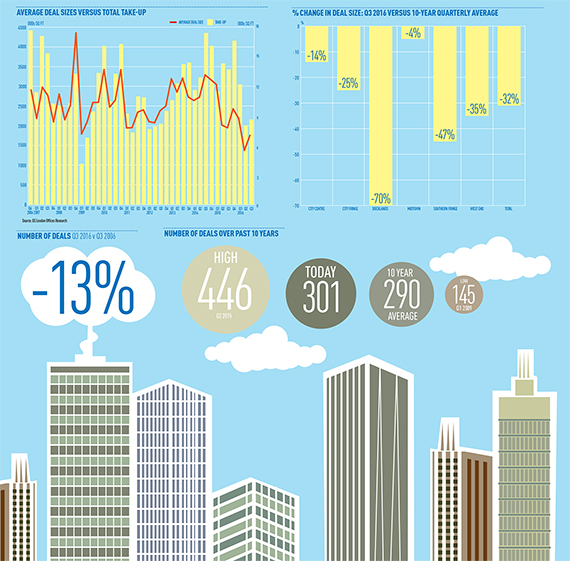

According to EG’s London Offices Research, the average deal size in the first three quarters of 2016 was 7,000 sq ft compared to nearly 11,000 sq ft in 2006. The amount of space taken by the average occupier is now at a record low, below the 10-year quarterly average of 10,300 sq ft and only just over a third of the size of the average deal size in Q4 2008 – the peak of the market at 17,500 sq ft. That quarter was boosted by JP Morgan’s record acquisition of 1.9m sq ft at Riverside South, E14.

Excluding the notoriously lumpy Docklands market, deal sizes have dropped most dramatically in the southern fringe and West End.