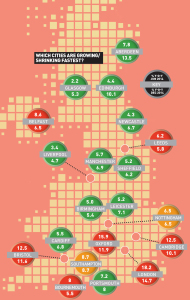

The brakes went on in seven out of the top 20 housing markets last year as the rate of growth in some of the hottest residential markets started to slip into the red.

The growth reduced the quickest in London and Oxford, slipping by 3.5 percentage points, between June and December last year after affordability pressures started to bite, according to data from Hometrack.

The two markets still represent some of the highest levels of growth in the UK, with house price inflation in both rising above the 10% mark. In absolute terms, London’s house price inflation, at nearly 15%, was the highest in the country, followed by Aberdeen and Bristol.

The slowest annual growth was seen in Liverpool, which in the year to the end of December 2014 saw prices grow by 4.7%.

Only Southampton and Nottingham maintained growth, with all 20 cities seeing price growth at or above 5% a year. “House prices are now very much a tale of two cities – high-growth locations that are slowing as affordability pressures bite, and those where prices are rising off a low base,” explains Richard Donnell, research and insight director at Hometrack.

The growing gap represents what could be a potential opportunity for investors,

says Donnell, who adds: “Relative value in

the regional cities, together with the prospect for further political change, creates opportunities for the major centres. The relative value of housing could be used as one of the levers to attract inward investment into the largest cities, such as Birmingham.”