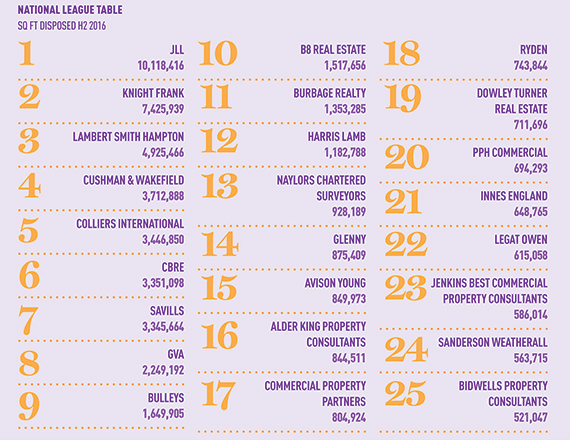

A bumper half-year for JLL saw the national agent tighten its grip on EG’s top industrial agent in the second half of 2016.

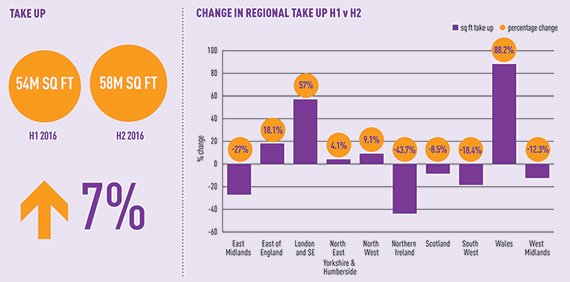

At more than 10m sq ft, the company transacted the most industrial space, almost doubling its 5.8m sq ft quota from H1 as market confidence grew after what can only be described as a hesitant first half. Compared to the first six months of the year, overall space taken increased by 7% to 58m sq ft.

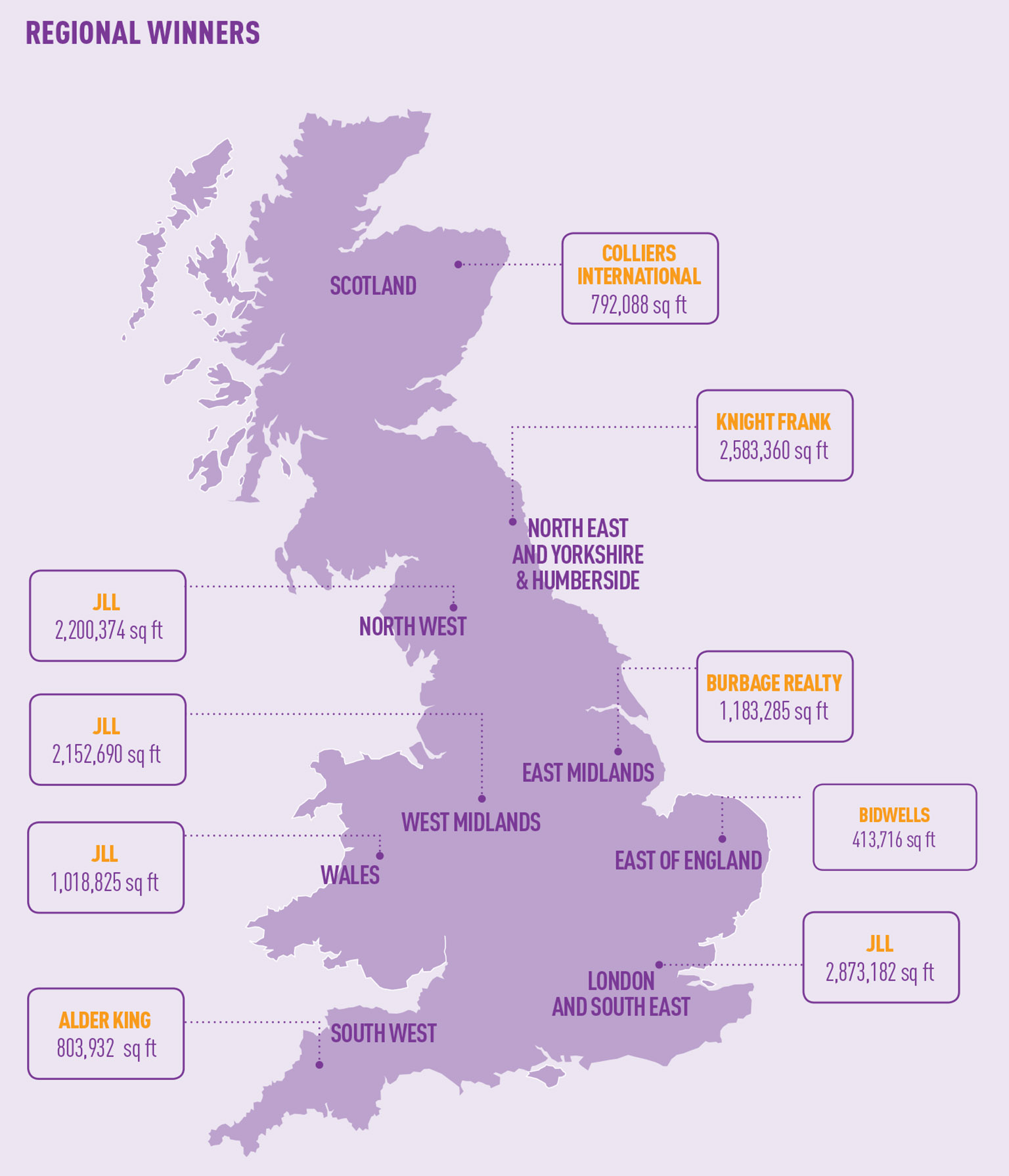

JLL was involved in four of the largest five deals in the last six months of 2016, with notable transactions completed in Lichfield, Wolverhampton, Swansea and Chesterfield. From a deals perspective, it was also the most active for agents, with a total of 336 transactions.

The only new entrant this half was Colliers at the expense of CBRE, which saw space transacted drop by nearly 40% and slip out of the top five from second place in H1.

Elsewhere in the top five, there was little movement with just a slight rejig of the order.

Knight Frank climbed to second place acting on more than 2m sq ft more in comparison to H1, taking its total to nearly 7.5m sq ft.

The entirety of this rise was due to its involvement in the Amazon-London Distribution Park prelet in July which, at 2.2m sq ft, is Europe’s largest logistics prelet.

Lambert Smith Hampton and Cushman & Wakefield climbed one place each to third and fourth respectively, despite shifting an almost identical amount of space compared to H1.

Five out of the 10 regions saw falls in the amount of space transacted in H2 compared to H1. However, the totals were held up by performances in other markets.

Wales was the regional winner for take-up, with a 48% increase for space shifted in H2 compared to H1. London and the South East also fared well, seeing an increase of more than 32%.

Average rents remain consistent half-on-half with just a 0.1% decrease. However, the biggest increase came in Scotland with average rents up by 0.5%.

London and the South East saw the biggest drops with falls of almost 0.6%. The Midlands and the North West – the industrial heartlands of the UK – continue to hover around the £5 per sq ft mark.

London and South East retains its position as having the longest average lease lengths (although an average fall by a whole year was recorded in H2 compared to H1, showcasing the demand for shorter leases from online retailers in and around the capital).

Northern Ireland bucked this trend, however, with average lease lengths increasing by more than a year.