MIPIM UK 2015: Only a few firms, operating in certain London locations, are making PRS investment viable, while risk-averse institutions wait in the wings

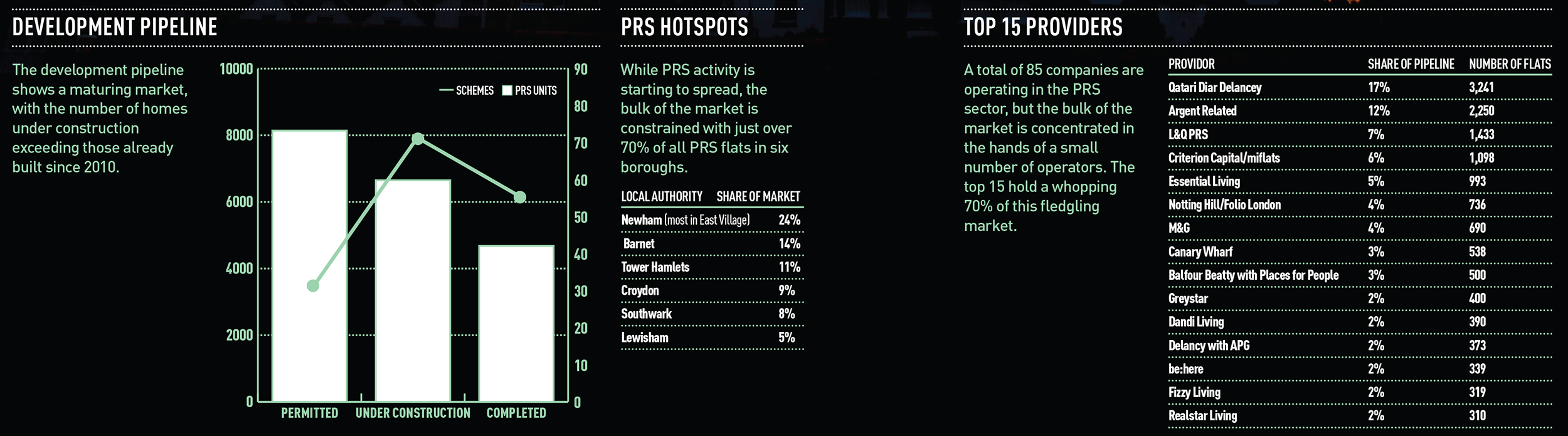

For all of the talk about London’s rental revolution, large-scale institutional investment in the PRS sector has been slow to materialise, with the bulk of the market concentrated geographically in just a few boroughs and in the hands of a small number of operators.

The key reason is viability, says Adrian Owen, BNP Paribas Real Estate’s head of residential.

He says investors and developers require a return of between 10% and 12.5% on PRS currently, due to their assessment of development risk. “We believe it is the operators that hold the key to unlocking this investment,” says Owen.

“North American businesses such as Lone Star and Greystar, which manage 400,000 homes in the US and have earmarked £2bn for investment into London, have the expertise and the appetite to build and manage at the required scale, stabilise their investment and then exit after five or six years, selling the income stream to an institution while retaining management of the asset.

This removes the development risk and the challenge of managing thousands of tenancies efficiently from the institutional investor.”

Click here for all the news, views and analysis from MIPIM UK .

.