Whether it’s the lure of cheaper homes and commercial space, or demographic trends favouring its underpopulated status, east London is hot property

Has the sun finally risen on east London’s regeneration?

Has the sun finally risen on east London’s regeneration?

If it has, it has been a long time coming. The first big regeneration push – the one that led eventually to Canary Wharf – began in 1981. For most of the past 35 years progress has been either slow or fitful, and only occasionally rapid. So what has changed to make east London such hot property today? And does the change mark a permanent rebalancing of London?

Two competing theories explain the rise of the east: cost-push and demographic-pull.

The cost-push argument says east London is popular because both homes and commercial space are cheaper than in central or western locations. With West End rents regularly hitting £125 per sq ft (to peak at or over £180 per sq ft), it is easy to see the appeal of lower-rented Clerkenwell at £65 per sq ft, Canary Wharf at £45-£50 per sq ft and other Docklands floorspace a bargain at £35 per sq ft.

According to Colliers International, the 2017 rating revaluation will widen the cost gulf between the east and the west even more sharply. It predicts that total occupational costs per sq ft will be £143 in Soho, around £114 in the City, but just £102 in Shoreditch, with Aldgate at £93. No wonder occupiers are heading east, the latest being rum-maker Bacardi, which migrated from Paddington to 9,600 sq ft at TH Real Estate’s 75,000 sq ft Steward Building, E1.

Michael Pain, a partner at Carter Jonas specialising in occupier advisory, says: “The appeal of east London is that it is good value. That is the overriding reason for looking at the east.

“But if demand for City floorspace wanes at a time when we know a lot of new supply is coming on to the market in 2018-19, rents in the City may fall to a point where occupiers decide to stay put. Any macro-economic shock could sap demand for the east, too. I don’t think that means a collapse in demand for the east, but…”

Matt Glenny, associate director at JLL’s London Unlimited, is also looking at east London from the occupiers’ point of view. He says that in the long-term cost-push is less important than demographic-pull for explaining the rebalancing of London geography.

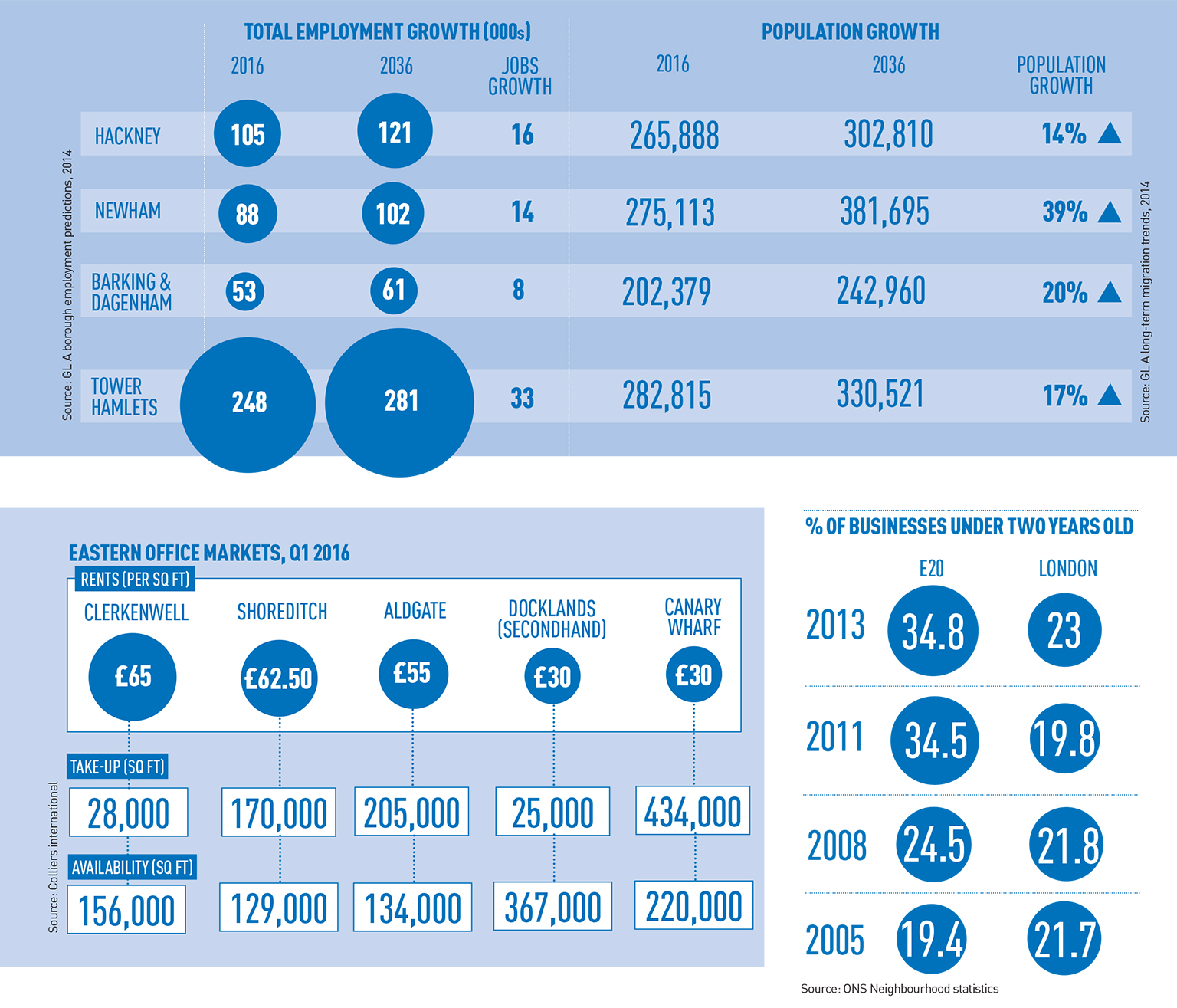

Figures from the Greater London Authority suggest London’s population will exceed 10m by 2036, rising by between 800,000 and 1m

people each decade. The east London boroughs, all of which have land and

are relatively underpopulated, will grow the fastest – in some cases by as much as 39% (Newham, by 2036).

Glenny explains: “The rise of the east is about long-term demographic change, which is going to bring huge swathes of residential and commercial development along with it. It is driven by the growing population of the capital – there are 120,000 extra Londoners every year, and the city needs to grow.

“I can’t see the east reverting to what it was like, because people need places to live and work. This is not a trend manufactured by the property sector, it is the general desire of young people to be in the east, it’s a real long-term shift.”

Silvertown and the latest phases at Canary Wharf – both of which assertively mix residential and commercial – are cases in point.

Crossrail, the Docklands Light Railway and an improved Overground have helped to reconnect the east to the rest and have made this demographic shift possible – and sustainable – says Glenny.

The four key east London boroughs will see 78,000 new jobs by 2026, according to the GLA. Many of those jobs will be home-grown, not relocations. Detailed analysis of the area around Westfield Stratford City, E20, proves the point: deep mining of official data shows the rate of new business formation in the area is now easily outpacing the rate for London as a whole. Before 2005 the area was firmly behind the London trend (see stats, below).

Many of the new businesses are in the tech sector. JLL says that for every technology and media company that moved out of Aldgate, Clerkenwell and Shoreditch over the past three years, two moved in, reflecting the rapid consolidation of TMT business in the east.

Glenny says that tech and media staff are disproportionately moving to the east to be near their jobs and cut commuting time. “It is all feeding into one broader eastward movement,” he says. The risk of east London pricing itself out of growth is – for now – small, he insists.

“As for rents, it is quite early in the story yet. After 20 years, Canary Wharf is at a prime rent of £50 per sq ft, less elsewhere in Docklands, but as the east becomes a more coherent part of London, rents across the city will even out. That may take as long as 25 years.”

Are London’s local authorities equipped to handle the enormous population and economic growth heading their way?

Iain Painting, senior planning partner in Barton Willmore’s London office, is working on Barking Riverside, the London & Quadrant-led 11,000-home scheme in Barking and Dagenham. There will also be 650,000 sq ft of commercial and community space. He says the GLA’s City in the East document adds to a useful portfolio of workable plans – a stark contrast with the past.

“Back in the 1980s we had a surplus of paper and lots of coloured plans with land allocations marked on – and not much else, certainly not much thought on delivery issues, particularly transport. These days we have lighter planning documents like the London Riverside Opportunity Area Planning Framework. Instead of 400 pages of planning policy, which is inevitably out of date the moment it is completed, we have 25 pages of useful spatial strategy,” he says.

If anything could spoil the party, it is a failure to continue to invest in infrastructure, say those with some skin in the game.

Alan Holland, London regional director at SEGRO, says: “We have something like three river crossings east of Tower Bridge and 26 west of Tower Bridge, and Sadiq Khan, the new mayor, needs to get on with resolving that. We could also see the DLR extended beyond Beckton, but this is all big-ticket stuff.”

However, the big picture is not the whole story. Look closely and the mighty eastward migration London is now experiencing is composed of lots of much smaller micro-moves as each business reassesses its property needs.

James Neville, City partner at Allsop, has been watching the micro-trends. He says: “Today we are seeing a movement east from Shoreditch to Whitechapel, but of course that is pushing rents up in Whitechapel – from £35-£37 per sq ft two years ago to £55-£56 today, a massive jump.

“The City fringe is no longer the fringe – the fringe has moved out. And it will keep on moving in the next three to five years. If I had the money, I would buy in Hackney Wick, or Mile End Road, or Whitechapel, even New Cross.”

The east has a lot more growing to do before it’s done.

Silvertown

Silvertown

The 62-acre Silvertown development will take live-work to a new dimension in east London. As much as 7m sq ft of development will bring 21,000 new jobs to the area, starting with the 500,000 sq ft Millennium Mills building. Around 100,000 sq ft of prelets are expected to be announced soon, ahead of the autumn 2017 completion of rebuilding.

Barry Jessup, director at developer First Base, says: “We are building the flagship of the new demographic. Silvertown is in keeping with the way millennials want to live and work, particularly in east London. We want to tap into that excitement.”

Office rents are likely to start at around £40 per sq ft.

New frontiers – Hackney Wick

Hackney Wick, E9, has yet to enjoy the same uplift as Shoreditch, but it could come, says Mark Bolton, head of commercial agency at Strettons.

“We are seeing more businesses undeterred by untested locations, even not particularly well-connected areas,” he says, pointing to a media firm looking at a 9,000 sq ft Hackney Wick industrial building. “It is isolated from other parts of the same business in Shoreditch, and it needs some work doing on it, and this is being driven by budget and the atmosphere of the building.”

Hackney Wick office rents are between £12.50 and £20 per sq ft. “But there we might get to the mid-£30s in the next 18 months,” says Bolton.

East london to 2036…?

“Why can’t we just keep going east?” asks Barton Willmore’s Iain Painting. “For instance, why is Purfleet less valued than Woking, when it has as many infrastructure advantages, plus land, and you can’t grow much more in Woking?”

It is a rhetorical question as London’s developers begin to place bets on an eastward movement down the Fenchurch Street railway line in the next 20 years. Purfleet is inside the M25 and close to junction 31 of the M25.

SEGRO is among the first to wager that Purfleet will grow – last year it bought a 20-acre prime development site in the area from Savills IM. A single shed of 400,000 sq ft is planned.

In the meantime, SEGRO is focusing on the 86-acre East Plus portfolio of GLA sites in Newham, Barking and Dagenham, and Havering. Immediate plans include 330,000 sq ft of new industrial space, and eventually more than 1.4m sq ft. Half a dozen larger sites at Beam Reach (pictured), near Rainham station and close to the A13, are hotly tipped.

SEGRO regional director Alan Holland says: “Developers like us want to get into east London before it gets super popular and super expensive.”

Inshoring vs the rise of the east

Will east London’s growth be balanced by inshoring losses? There is already some evidence that the east is losing out to the inshoring trend: HSBC is transferring 1,000 staff from 8 Canada Square, E14, to Birmingham, while shipping line Maersk will soon move staff from Aldgate to 40,000 sq ft in Maidenhead, Berkshire.

Balancing the inshoring losses by attracting inward relocations – as opposed to the growth of indigenous businesses – could be risky for east London. Savills calculates that the median Greater London relocation is just 804 metres – about half a mile.